UrbanSurvival readers tend to have IQ’s well over 110. If you’re reading us on a regular basis, congrats! You’re probably too smart to be sucked into herd-think.

Lately, our attention has been sliced & diced (“But wait, there’s More!”) by events that all (on close inspection) have a common theme. Money!

Our guiding principle during the Collapse of American Empire is Everything is a Business Model

Today, an explanation of how this LIKELY Big Picture will lead to collapse. with the understanding that it may already be inevitable. Although, working together, we should be able to coach-one-another through it better than single-handing it.

First? Jobs Data

After the stone-cold bummer of Facebooks market cap loss Thursday, many investors were waiting for this morning’s Job Report to drop. ADP you’re remember showed a loss of more than 803 thousand in January. But the Challenger Job Cuts were still low. (Not enough people still working to matter?).

The report that “Offishully Matters” is the one just out from Labor:

“Total nonfarm payroll employment rose by 467,000 in January, and the unemployment rate was little changed at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment growth continued in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing. “

ADP loses 803 thou and government FINDS 467-thou? WTF, homey?

Revised Lies Time

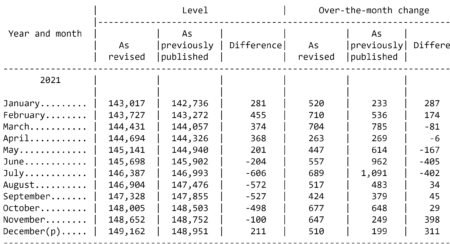

January jobs data is always a mess because annual revisions kick in. The CES Birth-Death model took away 2.8 million jobs today. Worse, a ton of revision from last year really screwed with the reported jobs we were running with:

The ONE number that matters most around here is the Total Number of People Working. By today’s report (skip all the deceit in details) claims 157.174 million were working. This compares with larger employment levels in 2019 and even January of 2020. But who worries, right?

Something about Inconvenient Truths – a democrat engineered approach to population management embraced by the crooked RINOs, too.

I’m already NOT trusting Labor too much. We have many industries still hitting (or on) The Wall due to Supply Chain issues. Yet, with thinning store shelves and employment lower than 2-years back, the bullshit happy-talk Department was touting Thursday how Productivity and Costs, Fourth Quarter and Annual Averages 2021, Preliminary – 2021 Q05 Results (bls.gov). Pass d’ duchy, dudes.

Rising productivity with parts shortages? ViseGrips! Report to my forearm! As we’ve said before, too many statisticians and bureaucrats while note enough data collectors, at Labor.

Another place you see it is in the CES Birth-Death Model which pretends to estimate employment that isn’t otherwise counted. Initially, this was an easy-sell to the sheep. Gig economy, less than full-time work, yada, yada. But now? Anyone with a phone selling shit on eBay or Craigslist could be argued an online merchant, see? Today, that annual revision whacked 2.8 million from estimates.

Moreover, we have no idea what this means:

“CHANGES TO THE NET BIRTH-DEATH MODEL DUE TO THE COVID-19 PANDEMIC

The labor market experienced widespread disruption at the onset of the pandemic, leading to a breakdown in the historical relationship between business openings (births) and closings (deaths). To better reflect the net effect of the contribution of business births and deaths to the estimates during the pandemic, BLS implemented special procedures to the net birth-death model in March 2020. Effective with the release of October 2021 preliminary estimates, BLS determined that adjustments to its birth-death methodology were no longer necessary.”

Is that like saying “We can quit lying now”? (Ure eyes a vodka bottle….)

When government started lying about its money, we got on the “bunny slope” of national decline. When Greedsham got away with hiding M3, the government lying became contagious. When Jerome Powell stopped timely reporting of how much money was in the weekly slosh, the fix was really in. The Fed is using unlimited money to bet against honest citizen-investors. As rigged a casino as you’ll ever find.

The arrival of those helicopters full of cash called-for by that Brookings fellow have been up making drops non-stop ever since.

Which brings us to this cold Friday in February in a land of ice and snow, where the only thing slipperier than the weather is the Double Diamond downhill of Moral Hazard and Slippery Joe in the oval.

Government-Assisted Suicide?

Before we get into our (rather keen) analysis of markets, I’d draw your attention to an overnight comment by an exceptionally clear-thinking retiree out in Hawaii who shared this:

“Follow the money! Insurance companies don’t want to be left holding the bag for Vax injuries & death. They call taking the Vax shot “Suicide” and will not pay out!

Suicide? How Some Life Insurance Companies Are Dealing With Experimental Vaccines Deaths | ZeroHedge

Also, some good info on how unvaxxed ‘natural immunity’ is best if you get covid. The clot shots damage the immune system, leaving one vulnerable for more subsequent infections.”

What really lets the crooked population control out of the bag is the lack of Mainstream coverage of the latest Vitamin D study in four-jab Israel: Israeli study offers strongest proof yet of vitamin D’s power to fight COVID | The Times of Israel.

Elaine and I have remained in the “control group” in part because we shy away from medical procedures where legal recourse is banned.

(As a medical asside (sic): Ever read the legal paperwork around a colonoscopy? “If we kill you, tough shit” isn’t an unfair summary of how one put before me read. Thankfully, non-invasive testing has evolved.)

Fractal Time Vs Elliott & Trends\

Since you may not have time to read our Comments (which tend toward genius) you may have missed this overnight prospect from the Economic Fractalist. Says in part:

“67 week Second Fractal Nonlinearity

A 20 percent crash Friday 4 February 2022 (with trading halts through Monday) will occur following the coal mine canary in asset-debt macroeconomy, Facebook (Meta Platforms) which lost more than 25% in valuation today (Thursday -g).

What does second fractal lower low nonlinearity look like? Observe Meta Platforms 2 and 3 February closes.

Markets crash when they are saturated (over invested) and overvalued. Markets self-assemble in simple mathematical growth and decay fractal patterns.

Namely, there are two simple fractal patterns of self-assembly for the global asset-debt macroeconomic system: a four-phase pattern: x/2-2.5x/2-2.5x/1.5-1.6y and a three-phase pattern: y/2-2.5y/1.5 to 2.5y. That’s it; that’s all there is.”

Even in Panic, there is Order:

My favorite economics paper of all time – back when I had just wrapped up the dime-store MBA program – was in Computational Economics, 1998, vol. 12, issue 2, 97-114. “Bubbles and Market Crashes” by Michael Youssefmir, Bernardo A Huberman and Tad Hogg. Pure genius.

The reason? True, all market declines are self-similar. *(In that they all go down.) But each has a unique flavor. A kind of temporal spicing to it. Place a news event too far before a natural peak and you’ll get one kind of peak and decline. Place it after? Another shape emerges (steeper decline).

In the (sometimes delicate) interplay between news and market prices, there is a lot of averaging. While Meta got a beat-down Thursday, other stocks were likely at new highs. There’s a lot of averaging behind the Dow Jones, the S&P, and the NASDAQ. We go another level of averaging in our Peoplenomics Aggregate Index.

As of this morning, we can see how we are LIKELY now in Wave 5 down. And there is a chance that we could rally a bit early today, but Elliott waves always seem to come around in due time.

Refer to the black numbers above, the major trend lines in yellow relate directly to these.

We had a Wave 1 down from the Nov. 8 (20921) high. A Wave 2 rally followed but notice how long it took. This rally could be called “complex.”

Wave 3 down is where we are right now. In this larger down, we count a (1) down, (2) up, (3) down, and we seem to be in (4) – and the count remains there until a new – lower low – than Wave 3 (3) is recorded. That’s when we will (with some confidence) be able to say “Now in 3 (5) having completed the rally portion of 3 (4).

This is NEVER TRADING ADVICE! Just a back-fence economics discussion.

While our doctor of Fractals is correct in his expectations – which reduce to “IF we are already in 5 down, this could be an ass-kicker…”

BUT here’s the problem: Even in a truncated 4 (not complex) we should still see the waves. Since a rally is a counter-trend wave, we’d expect it to be comprised of 3 steps (up, correction, up) rather than 5 steps.

Fractal Ordination

There’s no question that markets are fractal since almost everything in Nature is, as well. However (here’s a Big Math problem for you!) there are other ways o9f divining future price movements. A short list of some favorites.

- Trend Channels

- Regression Channels

- Elliott Waves

- Differential Moving Averages

- Moving Average Convergence/Divergence

- Gann Lines

- Different stochastics

- …and the list goes on for weeks. (I keep tinkering with differential polynomial trend line crossings myself. May show up on Peoplenomics one of these days, lol.)

Care for some readings to orient you to the fractal way of thinking?

- Fractal Conjugate Space & Time: Cause of Negentropy, Gravity and Perception: Conjuring Life: “The Fractal Shape of TIME” Geometric Origins of Biologic Negentropy

- Then much closer to our discussion here, Multiscale Analysis of Complex Time Series: Integration of Chaos and Random Fractal Theory, and Beyond.

- …and then maybe settle it all down a bit to best integrate into your overall thinking with Susie Vrobel’s Fractal Time: Why a Watched Kettle Never Boils (Studies of Nonlinear Phenomena in Life Science).

This whole topic – numerical estimation of future – has broad application to many things in Life. Didier Sornette’s work – essentially drawing a parallel between earthquake prediction and stock market behaviors (Why Stock Markets Crash: Critical Events in Complex Financial Systems) is another classic. Almost like there are keystone events – which might even be relatively small – that set off Event Chains of Future.

Which explains why Peoplenomics this week was focused on Luck. Much maligned, it’s a function of probability distributions in the MWI. A longer topic for another time.

In the Shorts

Which of these matter… I mean really?

Making Up Money – Government style to take on cryptos: Boston Fed, MIT unveil model for electronic cash as policymakers mull whether to launch it.

BTC this morning was $37,885. A rally in cryptos means a bullish cloud is sweeping mass consciousness.

ATR: Yes, Cold

I hadn’t really thought anything about it at the time I cobbled the new vegetable grow room on the side of the music studio out here in the woods. But you know what?

We can now leave the house, go down ice and snow-free stairs, and get on the ground with virtually no risk of falling.

Never thought about that as a senior housing criterion before. Now, having built it, suddenly it makes a huge amount of sense.

Sometimes I just get lucky. (So was selling near the Thursday low.)

Write when you get rich,

George@Ure.net

Having access to something growing in the deepest part of winter is very therapeutic. Enjoy your new grow room. You will soon decide you should have made it bigger. This spring we’ll be recovering the floor of ours with ground cover and dedicating it solely to hydroponics with a space set up for a little sitting area. Wife is already looking for some new patio furniture for it.

My Dr advised yesterday I should consider moving back to town since my progress is not where she thinks it should be. No thanks, I’ll stay at home is all I said. Then she asked when I was getting the jab. I answered after these 4 things happen;

1. Cancel EUA’s, in case my family needs legal recourse.

2. Not mandated, I had enough of that during my military career.

3. No shaming, coercion, threatening, or forced confinement. F%^k You to those who feel that way.

4. Where is Novavax? Everything is a business model, in this case, Monkey business.

Note I didn’t mention when donkeys fly or when bears stop crapping in the woods.

We’re still friends.

Good column this morning, as always.

Money always becomes the loudest voice in the room, eventually, no matter what the event is. These ‘vaccines’ and their nasty side effects are no different. Once the hysteria of the main event passes somebody is going to get the bill. The fact that insurance companies are already trying to avoid having to pay the bill is a good example of this. Classifying voluntary use of the ‘vaccines’ followed by your attributable death as suicide begs the question, if you were coerced or forced to take it against your will and you died would that be considered murder?

If so, Is there a ‘day of the rope’ in the not too distant future for some of our kind and benevolent overlords?

There well should be, Maj. I vote for erecting the gallows on the steps of the Capitol in D.C. First up, Fauci.

George: sorry to read about the Zeus “difficulties” … hopefully this shall pass. My 16.3 yo Tom lived inside for 14 years then we set him free (providing he stays in the front yard). Every trip requires a chaperone, given we have a mated pair of bald eagles and coyotes. The latter I will deal with the former require running with flailing arms. Tell yur cat he’s being a wuss. Mine still insisted on going out at 7am though we are in single digits here!

Now back to the BLS to ponder … BR, Egor

Bad week to have “Zucker” in your name. Synchronicity, or Karma?

Jeff ZUCKER CEO of CNN bites the dust for being a sleazeball and lying for 3 years that the Russians were involved with Trump in rigging the 2016 election. And then CNN refuses to show ANY of the irregularities of the 2020 election.

Mark ZUCKERberg personally loses $31 Billion in stock value yesterday. The sleazeball gave over $419mm to the last election to buy influence which is “slightly” over the legal limit.

Change the “Z” to “F” and you have what both of these slimebuckets really are.

Yep, the news just ZUCK’s this week.

Interesting, very interesting, but twisted in a way that seems short-sighted at first plush. ‘keystone events , that set off event chains” this seems to be solid concept until we turn it around and maybe perceive a different reality. In the line of thinking regards Ure Directorate-69, we could consider how “bad actors” or “good actors”, might RI (Remote Influence) certain players on the global chessboard. Whatwhatwhat remote influence ?!?!?! WTF is that pray tell?!..dam rabbits.

Sometimes U can feel it “coming in from above”..

https://youtu.be/aRlSHG5hRY4

As da caterpillar evolves, grows and metamorphize into magnificent Flutterbyes – so to self realizing Huuman Beings evolve, grow Wisdom and Metamorphize….into ?

What is the Value of above ?, ? ..dont know presactly, bee working on it, still.

Sea a dude riding a white horse, with a blue tinted skin ask him his name – if he replies “Kalki” – he will know all the answers.

You know – like the pain trade is higher.

– thats right folks Inflation is on Fire and it bout 2 bee raised up to a 10-Alarmer dingdingdingdingdingdingdingdingdingding – 10 alarms might not be enough to get Ures all attention.

Inflation killz – ever so slowly but the stress on effects will eventually lead 2 Dis-Ease. $10 gallon gaz is just the beginning.

Wahoo – what an outlook this scheisse getting realer by the day.

– U did see where the the life insurance co’s are fighting Paying-Out Life insurance policies against covert19 vaccination DEATHs.

– the Defense = not accidental DEATH, but SUICIDE. F-ing Suicide – ahahahahaahahah U selfish pricks. Yeah thats some good Thoughts there…

“After the stone-cold bummer of Facebooks market cap loss Thursday,”

hmmm interesting, that is the day i got off Facebook. wonder if i will get an invite back?

i been on it for a while and i uninstalled it then counted how many impulses i had to go back on without thinking, 29, 29 times out of habit to get on facebook, me thinks that is a good number to develop for other habits.

not sure what my que is up to now but it has to be quite a bit round here for- tunes by now. bean at it a while

as per Request, this times 100 on the dial up. play it again! a tsunami of dopamine flow!

I Que

~ Money for nothing ~

https://www.youtube.com/watch?v=wTP2RUD_cL0

No war/crash on Orthodox Ground Hog Day. Orthodox Valentine’s Day is right around the corner.

a skipping record sound effect

https://www.youtube.com/watch?v=wa2Cj5YKJtY

Story time for Ure -readers going into weekend of War possibly breaking out all over. EP’s academy/lancaster6 boyz on the ground in in the craine – working hand-in-hand wit da nasti nazi batallion – Azovs’ .

Altogether now repeat after moi – FALSE FLAG !

These clowns are so creative as to have nothing new in bag o tricks, so we can count on another Gaz attack on innocent Citizens..read Women & Children..alwayz the Women & Children with these guyz..Lets Go Brandon!

-U all know the Azov “gang” – distinguished for the ferocity of its attacks on Russian populations…looooong memory those Spetnaz guyz. Ever try 100 knife strikes in 60 Seconds? One of the quals needed to graduate frm training school. Lets Go Brandon!

Serious Question for Urban Survival population – WHO IS RUNNING THE SHOW in USA ? No really serious inquiry – WHO ? or What?

The narrative for the Ru false flag reads like a script from the now defunct Person of Interest TV show. Maybe the writers got new jobs working for the D’s.

Obama who is controlled by the NWO

WHO. you answered your own question.

You really want to know who’s running (ruining) the country?

https://youtu.be/uwydbZy1nTk

The first part of this video explains it very well.

He’s not very bright. He is an intercom — not one who formulates orders or ideas, but one who passes them through or otherwise delivers them to the next lackey in the chain… In his case, Susan Rice.

“we can count on another Gaz attack on innocent Citizens..”

YUP that one was kind of suspicious .. Trump says.. we are going to pull out by friday…. Russia is here to assist Assad with the terrorist factions…. so Assad says.. dam the USA for leaving so soon what can I do to keep them here.. and gasses his own people …

“Serious Question for Urban Survival population – WHO IS RUNNING THE SHOW in USA ? No really serious inquiry – WHO ? or What?”

Serious answer?

Look up this guy:

Franz Joseph I of Austria

and find his family tree,

then research the branches…

I don’t have any opinion on Ray Dalio the man but his reasoning on this subject seems pretty solid IMHO.

https://www.bnnbloomberg.ca/bridgewater-s-ray-dalio-sees-u-s-on-path-to-civil-war-as-political-polarization-rises-1.1718043

Thanks for sharing..

I am not sure if it will get to that point before the globe lights up…. Biden was in a town hall meeting and his opinion was not appreciated and objections to his actions were questioned.. almost instantly you hear and read stories where BLM and Antifa start back in..

On the global front.. we see that the poison pawn trap is closing.. just waiting for the US to make their move..

What was one of the rules of our creator..

THOU shalt not COVET

GU…

Good update.

And IBD/IBW uses distribution days for predicting market trending…

Elliott waves are qualitative saturation trading curves. Lammert fractals are time-based quantitative saturation curves. The models should coincide because both use nadir and peak valuations to determine the wave/fractal groupings.

November 2021 was a peak valuation for the Wilshire composite; the smaller SPX self assmbled to a peak valuation in early January 2022 (4 January 2022 and is following a 5/10/10 of 10-13 day decay fractal from its peak.)

The Wilshire peak represented a x/2.5x/2.5x 1807 36/90/90 year US fractal three phase peak valuation series and occurred at x/2x/2x :: 31/62/62 months from the March 2009 low.

That’s time-based quantitative saturation trading.

Will the Wilshire exceed its November 2021 peak?

The answer is yes, with the necessary inflation via nontraditional post 2009. money printing that will be needed to keep the macroeconomic system with its debt obligations and political-social contract entitlement commitments and defense system afloat.

Look over the Elliot waves’ nadir and peak valuations for the last 100 years. Was there really any political/world/economic/wartime news that affected the saturation curves peaks and valleys to a one percent delta level on a daily/weekly basis?

Did the slight drop in Facebooks’ earning potential cause a nonlinear 1/4 trillion trop over a few hours of trading or was it a 33/67 week :: 2-2.5x second fractal saturation trading nonlinear event?

Did the May 6 2010 flash crash occur because of political/economic news or that it was a x/2-2.5x ratio second fractal nonlinearity saturation trading event from the composite’s March 2009 low?

Interesting concept: quantitative time-based fracatal self-assembly/ self-organization of a complex asset-debt macroecnomic system.

wow! that is some groovy business acumen you have there TEF. good thoughts. don’t worry, the only (Sic) play around urban survival is of course, Music.

nice to meet you. I like him too George. big toothy grin.

hey George, i saw ya moved from number 7 on the google search to number 4 today. good for you.

Ure & IQ

Thanks for handing us out a few IQ points.

If I remember correctly, in my at work days I could simultaneously manage 5 complicated projects.

However, today, I feel pretty proud merely to return from the basement with whatever I wanted.

Here’s the deal. If any of you remaining 2nd Standard Deviation types would like to share 5, 15, 25 IQ points please let me know. I am pretty sure I could use them.

But, hey, if we are all slipping at relatively the same rate, then today’s sorta-stroke of genius will still be seen as a stroke of genius by the others!

;)

On the other hand, there is a benefit of being a bit slo; it implies not comprehending our imploding planet and ergo, times are good. Ignorance is bliss.

Ure, I look forward to your musings everyday.

You inform us, you exercise our brains (what’s left!) challenge us, tease us, teach us and do it with class.

Thank you.

IQ 137. operating IQ speed most days 85 LOL

well, on 02 ~ 2+2 + 20+ 22 you are smarter than the average bear.

the only time I think im the smartest person in the room chris, is when im by myself. hahahahahahahahahahah!

because every one around me teaches me something. great and small. birds and bee’s, flowers and tree’s and the moon up above.

even the everything bagel teaches me something.

there is to much emphasis on IQ today.. in reality IQ doesn’t mean a dam thing.. it is society and the opportunities that pass your by daily and the ability to take advantage of the opportunity when it crosses your path..

All an IQ means is you are a little better at seeing abstract patterns and how they form. in a job situation it is a sheet of paper.. success doesn’t ride on what you have read or know..

I personally believe that EVERYONE is a genius in his or her environment.. a homeless person knows how to survive on the street and in drastic changing.. a horse trainer knows his job training horses.. a tool maker knows his job..

I self-tested at 145 once… was distracted and could have done better. But my mil entrance exams qualified me for Mensa, but I never joined. Eidetic memory also, if I practice.

“entrance exams qualified me for Mensa, but I never joined.”

Don’t Hank….My impression is they are nothing more than a group of self righteous dweebs that think everyone else is below them as a drooling idiot..they are exceptional with understanding of abstracts and have that nice dry humor.. but unfortunately the ones I have known couldn’t see that there is self worth in those around them that the missing element was opportunity and ability to take advantage of the opportunities that passed them by.. a grocery store bagger will only be allowed to excel to a certain level.. He will always be a grocery store bagger..

Yeah, I agree about Mensa. Sitting around doing difficult puzzles to exercise their brains. I just never wanted to be a ‘Registered Egghead’ or wind up on some gov’t list of brainiacs. I enjoyed being the undercover smart guy. I disagree that IQ is not relevant. To my thinking, it is a measure of mental adaptability and ability to learn new things quickly, and coupled with a good memory, the ability to correlate many different things to come to a correct conclusion… faster and better than the average bear. My mental acumen was an asset in TV engineering where I had to learn many things and apply them… usually under stress and time constraints. I regularly pulled miracles out of my technical bag to accomplish nearly impossible assignments in the field… or to build new TV stations from scratch.

“A rally in cryptos means a bullish cloud is sweeping mass consciousness.”

HAVE YOU EVER NOTICED.. That crypto’s have a Unique similarity to CONGRESS. PORN and those COOKING shows..

A congressman will come out and take a look at a pile of papers that he hasn’t even read more than the opening sales pitch paragraph.. and tell you just how wonderful it is.. In Porn.. the illusion of the beautiful woman and the activities you both share.. then the cook…

they make up a delicious meal.. make it look really tasty they take a bite and go yumm yumm..

While with CRYPTO’S you have a number flickering on a screen of a gold coin and someone telling you how wonderful it is.. But in the pinch.. You don’t have a foggie clue what is in the paper unless you actually took time to read the dam thing and digest what it is saying… the beautiful woman is NOT having sex with you.. no touch or feeling of pleasures.. and the food on the fork of a cook is not going to past your taste buds.. it is all FANTASY can’t hold it, taste it, or know it.. it isn’t worth a thing…. the hammer.. if you can’t use it to drive a nail if you don’t have the ability to touch it….

Methinks you need to get Ureself one of those new fangled Smell-A-Vision Sets, but nice try with the ” magic numbers” bullscheisse FUD regards Bitcoin, Loobster.

Real world -yesterday at my local bank branch ( big bank) to do a domestic wire upwards $70k.Usually my fav clerk/teller/banking professional does the international wires (Belize), he was only one on floor – so new manager did the wire transfer for me. As we go thru basic BS regards fastest & cheapest way to transfer the funds to an account that is at same bank. She pops up all excited from computer screen and says “oh I see these funds are coming from Coinbase!”

– F-me running! (internal convo)

The scary part of this was the fact that this bank manager (Female of Indian persuasion) was all over Crypto. She was very sharp, and explained her hubby was IOT engineer/programmer type. Wanted to know any info I could/would share cryptos, and also explained she was familiar with Coinbase.

Every other time over the past 3 years – not one single Manager at the bank would even acknowledge Coinbase/Crypto when working with my financial info. Now a very bright young Indian (gupta) women is publicly concerned with value/stability of US Dollar/money = NO TRUST anymore in anything..just ask a catholic priest rape victim if they still TRUST in god. Its printed on US coinage and bills – like Trust in governments to do right thing., Trust in Hospitals to at least make an effort not try and kill you, Trust in Police not kill you for being black or brown or different, trust in Banks to uphold contract law..on and on it goes till you get to BITCOIN.

There is NO TRUST in BITCOIN – cause all You all Humans cant be Trusted.

– Therefore we have VERIFICATION and that dear Soul is why TPTWere be Phreaking.

Still no BTC 4 G – cause he dont do Verification, no wiggle room(trust) for financial weasle dykes(bankers) and their govmint servants.

I am White, police kill White people every single day. Grow up! Yeah, that’s all I got from your ramble today.

” magic numbers” bullscheisse FUD regards Bitcoin, Loobster.”

LOL LOL LOL numbers are just that.. a number.. take away the internet and electricity and you can count as high as you like.. I would buy yourself a clicker LOL LOL… at least you will have something in your pocket other than lint.

its a bargain at that price to.. you just need a note pad and a pencil to make a mark everytime you go to zero..

https://www.walmart.com/ip/Gogo-Hand-Tally-Counter-Handheld-4-Digit-Track-and-Field-Lap-Counter-Manual-Mechanical-Clicker-for-Row-People-and-Knitting/189772247?wmlspartner=wlpa&selectedSellerId=1573&&adid=22222222227000000000&wl0=&wl1=g&wl2=c&wl3=42423897272&wl4=pla-51320962143&wl5=9020397&wl6=&wl7=&wl8=&wl9=pla&wl10=113137531&wl11=online&wl12=189772247&veh=sem&gclid=EAIaIQobChMIkqjXhPHo9QIVGx-tBh3r3wIUEAQYASABEgJwKvD_BwE&gclsrc=aw.ds

then again.. you could buy a bag of bit coin’s so you can carry them in a pocket or belt pouch..

https://www.amazon.com/Bitcoins-Cryptocurrency-Commemorative-Medallion-Collectible/dp/B09BG6SZX8

way better than a coloring book page.. or just a number floating in your mind once the net goes down..

“TRUST in god. Its printed on US coinage and bills – like Trust in governments to do right thing.”

Hmm I thought they were going to change that to… either… IN SOROS WE TRUST… or IN THE NEW WORLD ORDER WE TRUST…Even with hard money.. internet and no electricity.. stores close banks close.. you don’t see old cash registers anymore it is all internet active and kids don’t know how to use a pencil and paper anymore.. our lives depend on new technology..

“Trust in Police not kill you for being black or brown or different,”

Don’t worry.. they are going to take the police out of the high crime area’s.. those that abused the law and kill someone should face the crimes that they commit.. those that are being questioned.. follow their directions.. don’t fight them.. especially in a high crime area..

a white grandpa was shot and killed because he poked his black pipe cane out the door when he was pulled over.. the incident happened in a high crime area.. and the officer mistook the cane as a gun.. if pulled over.. stay in your car follow the officers directions..

https://youtu.be/uj0mtxXEGE8

Chris Rock.. a smart man..

Suicide by vaccine was a good read. My 40 something old daughter had two doses of M. She has been sick for over four weeks with a cold. Went to the doctor twice and is on antibotics and decongestants but is having a hard time getting rid of this one.

My granddaughter brought it home from school and has had this cold twice in the past 5 weeks. We live together so I finally caught it on Saturday, but I feel better today.

I begged her not to take the vaccine since we all had covid in Jan/Feb 2020. Now she walks away when I talk about negative vaccine effects.

I feel your pain.

https://www.amazon.com/Durvet-Ivermectin-Paste-Equine-Dewormer/dp/B01LXKF2VW/ref=sr_1_1?crid=1SXD1YHI3WYKJ&keywords=durvet+ivermectin&qid=1644158174&sprefix=Durvet%2Caps%2C238&sr=8-1

Works every time for me.

oh george, if you were in twon today, we have Thunderdome playing for 2 days straight at the Tacoma dome, massive EDM, crew will be out there, i will be with my youngest who is most certainly not going to a massive “Rave” at age 15.5.

who runs bartertown?

Masterblaster!

Should be a good time.

Truly, I am Blessed and Highly Foretuneate! it is my hope you are as well.

Aunty Enty runs Bordertown.

named my current dog after Mr Rockatansky..Rocky!

https://youtu.be/Gcm-tOGiva0

Meta Selloff:

Just as many large EQ’s are preceeded by smaller precursor EQ’s (most imo) the Stock Market also gives advance warnings as to the fact that it is on shakey ground and about to have a nasty spell.

Two of my favorite BIG PICTURE views of the market, both of which came about before our current techs which as much as you may hate them ARE economy changing companies, were Joe Granville’s “On Balance Volume” indicator and the divergences between the New Highs/New Lows compared to the peaks in the overall market averages. Both more appropriate to an industrial economy than our current one, but still useful in today’s world imo.

What both of those indicators were showing, or attempting to show, was that the FOUNDATION of the market had become very very shakey underneath the surface.

In the real estate arena (my area of expertise) you see this as the Class A properties continuning to go up as the D’s are collapsing, the C’s are falling hard, and the B’s are in a decline. Finally it gets to where the ONLY thing going up are the Named Trophy properties which are selling for unbelievable sums while even “A’s are having a tough time and every other lesser category is in a serious bear market.

Meta’s collapse yesterday is an earthquake of monumental importance wrt the overall market because here you have a Trophey Property literally just SUDDENLY collapse in value … and while for understandable reasons WHY did NONE of the so called “experts” see it coming … and HOW BROADLY IS the underlying shrinkage in advertising and eyeballs decline actually occuring in the overall high tech consumer field?

Meta’s collapse for me feels like a FORESHOCK of the coming GREAT EARTHQUAKE.

As people who manage money stare into the Abyss they will look around and try to figure out WHERE TO HIDE. While for an individual investor getting totally out of the market is an option for most of the large players THAT IS NOT AN OPTION. The various controlling documents that they operate under REQUIRE them to be invested, invested in something. VOILA … people are now scrambling for their individual Hidy Holes to hide in until the storm they see on the horizon passes.

EUREKA … !! TODAY Bitcoin looks to be the Hidy Hole of choice for some since long term bonds, or intermediate term bonds are about to be creamed!!! Bitcoin … or short term treasuries … may be the ONLY OPTION for some managers, depending upon the controlling documents for the money they manage. (for some managers they are REQUIRED to be 80% or even 100% invested in common stocks – YE GADS!!, but understandable if say the Insurance Company tells it’s investment people, which flows down to an individual manager, that they HAVE to have 20% in common stocks at ALL THE TIME, or if that is the in the Legal Terms of a Mutual Fund Prospectus)

The FIRST crack is not generally the once upon which the collapse happens, it is just the WARNING crack. Consider yourself WARNED!!

Makes sense to me! Just bought S&P May puts this week. I may have made a bad guess on maturation (was tempted to go longer for more money) but S2’s analogy with real estate reinforces my decision.

My timing differs.

You’ll do fine with May puts, but my guess will be close them mid March, then buy May calls. Late April we should see a high and turn no later than May 9. I would reload the put side around April 12 (depending how far it has to go at the time) for 2 batches: one expiring end of December and another for June 2023. Yes, that’s how long I think this can go…

George and group,

Remember truth always comes on the back of a DONKEY.

73’s

Amen

“truth always comes on the back of a DONKEY”

Hmmm.. the peoples party.. interesting thought.. seems to me this is a replay of past societies that thought the very same thing..

https://youtu.be/obtlPomREiY

The only comforting thought is the Peoples choice comes off looking like a Herbert.. what I get out of the end games of the Peoples choices through several societies that have collapsed.. was a collapse of the social classes.. each class has its place.. when the classes collapse and there is basically the haves and the have nots.. gives a reason to stimulate the influx of a leader that will equal up the system again.. Out sourcing industry was the biginning of the collapse.. the bill passed by congress as the millionaire relief act of 1978 was the point where the middle class was tossed under the bus.. instead of equaling the tax base it separated it even more by giving tax breaks for the wealthy..anyway all of that crap is ancient history.. the bail outs etc.. all throwing the laboring class under the bus.. I once read that a major uprising would never happen until there was a 78 percent of the working class in a state of need.. we have passed that.. the only thing keeping it from happening is the hand outs which have recently stopped…. Or noodle nomics.. put a cooked noodle on a table and dump water so it floats.. you can push the noodle all the way around the table.. if you dump to much the noodle will eventually soak up to much water and crumble.. ( cook pasta to long and it gets mushy and breaks apart) don’t put enough and the noodle will pull apart.. ( everyone of the wealthy dump money in accounts.. it doesn’t move.. the velocity of cash in society) the older industrialists realized this took lower wages and put more into their employees.. and their employee needs.. see a company that does that.. they don’t have a huge turn over.. those that pile all the benefits on just a few at the top have a huge turnover rate.. its all about the business model.. those countries that went through societal collapse have almost all ended up with tyrants..

https://youtu.be/JrMiSQAGOS4

https://youtu.be/3rlgFpQlxQg

I gave the book away for xmas one year to all my xmas card list.. it is a great book easy read and fast..

https://youtu.be/pRueZb_gR38

https://odysee.com/@audioboy:7/Manias-Panics-and-Crashes-1:c

Buddy showed up for his scheduled Dr. Appointment at a big medical facility. Tested positive for covid at the door and was told to “go home and quarantine, come back in a week if you can’t breathe.” Didn’t get to see a doctor, no early treatment prescribed (or advised) so no meds for how shitty he felt, as if it will just go away … or when he can’t breath they might make some real money on him. (His appointment was rescheduled for a month from now)

Knowing this and, knowing that treating covid EARLY is most beneficial because A. You get over if faster, and B. That covid can morph into some serious complications … I see the lack of medical ethics.

Of course, any medications that are effective in treating covid early are blocked or highly discredited by the experts who have stumbled over their own data and words. – which is where the true disinformation comes from.

They’ve had DECADES of research on corona-viruses and act like they have no idea what early treatments (might – would – do) work effectively. Yeah, sure they don’t.

While Doctors are threatened with board reviews and loss of license if they do not follow the “recommended” treatment guidelines. When has that ever happened before ???

The Tuskegee experiment, they convinced doctors to lie for them. It’s happened again.

Pretty sad state we’re in with our Healthcare Industry.

Must watch ….

https://youtu.be/5SVO0lc_1_o

Happens more than you know. Check out Lyme Disease, Syphillis’ cousin.

“Tested positive for covid at the door and was told to “go home and quarantine, come back in a week if you can’t breathe.” Didn’t get to see a doctor, no early treatment prescribed (or advised) so no meds for how shitty he felt, as if it will just go away … or when he can’t breath they might make some real money on him. ”

That is what happened to me.. exactly.. Now I will have the cough the rest of my life with the lung damage that came from covid.. what could they do.. very little.. it has to run its course..

Hedonistic Data [Adjustments] and [Correction Factors] are always the mainstay of any good socialist regime. If you ignore it will just go away and fix itself, like the products going away on the store shelves. Try closing your eyes next time you go shopping for supplies.

got to give it to them . pump sheetcoin and hold off the down button . wow as yoda says a greater evil i could not imagine

“Lately, our attention has been sliced & diced (“But wait, there’s More!”) by events that all (on close inspection) have a common theme. Money! Our guiding principle during the Collapse of American Empire is Everything is a Business Model”

‘Why are there wars, Daddy?’

It’s about the Money.

‘Why do They want to make us sick, Daddy?’

They want to make the Money.

‘Why do things cost so much, Daddy?’

They go into business to make Money.

‘Why do some people go into Politics, Daddy?’

They want to be Rich.

‘Why do some people become TV preachers, Daddy?’

They found another way to get Rich.

‘Why did Mommy marry you, Daddy?’

It’s about the Mone… UHHH… I mean, it’s about the MOUNTAINS of fun we knew we would have together!…

‘Hey Daddy… can I PLEASE have my allowance now!’

Sure kid. You’re a quick learner.

‘And by the way… NICE SAVE!’

‘Hey Daddy… can I PLEASE have my allowance now!’

Sure can honey but after bath time…. LOL LOL its all about the business model and politicians fulfilling personal wants..

truly after puting it all together . behold the power of evil . corruption and rigging rule . yep without theatrics the best evil day yet . from 33800 to this . really go jab yourself

We all know by now that the extremists and rino’s blame their perceived enemy for what they’re about to do or have already done in order to deny, deflect, defend until people don’t care about that news cycle story anymore…

Enter US/CIA false flag: https://www.thegatewaypundit.com/2022/02/fireworks-ap-reporter-rips-state-dept-spox-claims-russia-planning-false-flag-pretext-invade-ukraine-alex-jones-territory-getting-video/ It’s going to be up to Putin to save the world by not falling for it the coming US/fake CIA false flag. Maybe this is just another thing our eyes are being opened to? My guess is with Putin at the Olympics he probably won’t be on the hook for starting a war for a couple more weeks.

Keep in mind that MIT has a contract with SEC head Gensler (who was working for Obama in DC and then as a prof at MIT while waiting for Obama to get back in office via Bidet) to work on gov’t blockchain so the article you linked to is likely a test run of what we will end up with: https://www.msn.com/en-us/money/markets/boston-fed-mit-unveil-model-for-electronic-cash-as-policymakers-mull-whether-to-launch-it/ar-AATs01l

Here’s the last paragraph in the article in case a reader’s eyes glazed over before getting to it: “The work follows the release late last month of a paper from the Fed’s Board of Governors weighing the pros and cons of adopting a central bank digital currency. It studiously avoided favoring an outcome. But the Fed appeared to dismiss the possibility of allowing Americans to create consumer banking accounts directly at the central bank, an option touted by some liberals but aggressively opposed by the banking industry.”

Let’s look at sentence in there again “The Fed appeared to dismiss the possibility of allowing Americans to create consumer banking accounts directly at the central bank…”

Hmm, again, don’t they always deny that they’re going to do something before they do it?

Here are today’s fake job numbers from an international accounting auditor’s eyes: https://www.thegatewaypundit.com/2022/02/todays-bogus-job-numbers-bls-never-january-seasonal-adjustment-magnitude/

A war of the people taking out lying and murdering leaders is far from a civil war. There won’t be a civil war…it will be a cleansing of murderers and anyone who stands with them.

Apparently Whoopi Goldberg is just another “Karen”. Her real name is Caryn Elaine Johnson.

Got my “free” gov’t covid tests in the mail today. Box said, “Made in Korea.” Three years in and we still are making enough on our own? Of course, most will probably expire unused or be used but to no useful consequence. How many people will actually get early effective treatment if positive? How many will actually self-quarantine? Maybe a few will stay away from grandma and grandpa, but given the example of what people have done with masks, color me skeptical.

Keep those things isolated in a cool dark place. Put in a ziplock. They might be useful for those who are knowledgable and equipped to analyze or experiment with them. Since you probably won’t change your behavior based on those tests, there’ no point in using them, and there’s some suspicion regarding the swab itself. Have fun!

Everything with respect to this covid situation is deceptive and coercive. Entities are not following their own rules, and none are above suspicion.

Gosh, I do dislike long posts that are just logorrheic.

However, such is life, swimming upstream of you just fill in the words. ;-( (Not you George, thank you!)

If you are looking for evidence of the market underpinnings eroding, look at the small cap Russell 2000, which is down more than 20% since early November:

https://www.wsj.com/market-data/quotes/index/RUT/

The Nasdaq Composite is down around 12% in the same time frame.

The bear is back.

I don’t remember who said it.., but every market decline has been preceded by and lead down by Small Cap stocks. I also watch the S&P Midcap 400. It is down 10% from its Nov high.

I certainly have us in the 5th down, following an exceptionally large 62% bounce in the S&P500 to almost 4600. We did a small set of down, then retraced up in 3 to 4538 today. If we’re both right, a long, drawn out 3rd started an hour before the close today. The problem with a 62% 4th is that the 5th goes either 62% or the same length. So we are either going to finish this off at the January low, or down below 4,000. After that, there are several options. Its either down in 3 and goes back to the top, or the first set of waves is complete, we get a 3 wave retrace to May, then start again.

Everyone’s got a system. For me, fractals can’t hold a candle to chicken entrails or a good random walk. Whatever’s winning for ya….

Awaiting my imminent vaccine demise, I’ve asked that my tombstone read “I should’ve believed everything on the Internet”.

Some of us have noticed since the jabs were introduced, HIV interest has popped up after years of quiet. We’ve seen articles in the media here and there and wonder why the new mentions ….

Well, after all these years that HIV has been “HIV” now comes … the Variant.

https://www.science.org/doi/10.1126/science.abk1688

Is it really a more contagious variant or jab induced?

There were some Indian researchers who posted an analysis of the covid RNA genome sequence inclusions early last year as a research paper. I don’t remember their names. They claimed it was obviously an artificial construct since it contained four inclusions from four unrelated viruses, one of which was HIV! It’s easy to imagine that further GOF development could create a more contagious and pathogenic HIV virus, though that’s unlikely in nature. Given time, it should evolve to be less lethal too.

United States ›

Avg. on Feb. 3 14-day change

New cases 356,256 –52%

New deaths 2,632 +30%

NY times report above. Missing: Cause of death?

It always remains the “Principle of the bad apple.”

The “bad apple” never improves the good apples.

We need to identify “bad apples” and eliminate them — then another mouse asked: “Who will volunteer to hang the bell on the cat?”

>10K years has proven to me: IMPOSSIBLE!!!!!!

Further evidence of the ‘Suicide Shots’ mortality…. Long Funeral Homes, Short Insurance:

https://www.zerohedge.com/covid-19/long-funeral-homes-short-life-insurers-ex-blackrock-fund-manager-discovers-some-disturbing

Dramatic increases in mortality among the population that are upsetting the insurance quants.

There are other explanations which fit the data.

First, people who are living from one paycheck to the next who lose their jobs (poor people) are going to have higher mortality rates than people with good jobs and employer-sponsored health insurance. I suspect a lot of the newly minted destitute did not take advantage of low-income Obama-care.

Next, life insurance companies and their lawyer gang helpers specialize in stiffing their customer’s heirs, with or without just cause.

Much of the economic and social mayhem attributed to Covid and vaccines is really a direct result of the lockdowns and rules. With regard to insurance, grifters are as grifters do.

Hahaha, yeah, and those people losing their jobs, cars, homes, apartments, are gonna keep up those insurance payments? Nah, try again!

No Way- Read my post again, this time for comprehension.

Obamacare for poor people can be VERY inexpensive.

Being stiffed by the insurance companies isn’t an issue for people who don’t pay the premiums.

Comrades,

Sombre news from Rotterdam as word that the masts of Jeff Bezos’ newly constructed half billion dollar yacht will not fit underneath the restored, century old Koningshaven Bridge. The shipbuilder is tacking into some headwinds for the bridge to be dismantled.

The mayor of Rotterdam, Mr. Ahmed Aboutaleb, son of a sunni muslim imam, is in Colombia this week with relevant authorities discussing how to stem the tide of cocaine imports via Rotterdam. Apparently they increased from 40 tons in 2019 to 70 tons in 2020. Anyhow, Mr. Aboutaleb suggests that Mr. Bezos should apply for a permit to have the bridge moved out of the way of his boat.

Well, back to the half-pipe competition in Beijing, and Ms. Gu of San Francisco will be competing for the Motherland – China. Signing off with a golden nugget from Tony Bennett!

I left my heart in San Francisco…

“I left my heart in San Francisco…”

DAM JESTER… that really SUCKS…….

The vast majority in SanFran just leave a pile of Shizt on third street or in the produce isle at the local grocery stores…..