“May you live in interesting times.” And, as Robert Kennedy said in a Cape Town speech (1966) “Like it or not we live in interesting times.”

Although Kennedy attributed the quote to a “Chinese curse” there is no support in the literature for such a phrase. We know a few multicultural white hats.

This morning, we will step back from the abyss long enough, to at least get a sense of where History is driving. Think of this little rap as a “birthday weekend” gift from me to you.

Big Picture First

“What Depression? Who Said?”

Data Said. You have been tricked into non-seeing:

In our work, the Global Economy was set and primed to enter a Greater (2nd) Depression in 2019.

Yeah, that’s right: There’s a forensic economics case to be made that we’d be in a financial disaster with cities on fire by now without Covid. Ask yourself this very useful question: “What would the world be doing right now without Covid, the lockdowns and all that?” Likely, we’d have blown up the global economy and in in civil war by now. (Speculation as to how “world would be” without Covid is a great subject for our Comments section…)

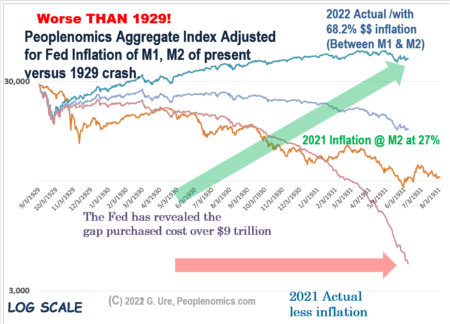

Study the Chart

In the chart above, the blue track is how the run from 1920 to 1929 ran its course. While the black line shows the “Housing Debacle Recovery” from the March 2009 lows to this morning’s estimated values (based on early futures prices which will change as the day unfolds).

Three key takeaways for the armchair investor:

- Long wave economic wave forms are at least somewhat self-similar.

- The speed of advance slows as the rate of information exchange speeds up. This is counter-intuitive, perhaps. But the core concept is that faster communications slows system asymmetries, which – in turn, take longer to hit price targets.

Faster, more responsive steering works for self-driving cars, does it not? Faster, data-driven interventions in markets serve a similar “stay on the road” purpose.

Super Nerd Point:

Study of the OSI model teaches that if the Coms layer speed doubles, even though error correction overhead will also increase for a given path, there will still be a net higher throughput achieved. The trick is to keep net error correction costs low enough to allow some overall increase in speed. (This is like “takes the roulette wheel longer to spin” in the casino…)

This same concept rolls over into economics. Except instead of error rate increasing, we use money supply increasing to pretend everything will be OK.

Which reveals this: The top line here is where $10-trillion (plus or minus a cheeseburger) has tricked you into thinking it’s really where we are. An unadjusted (no intervention track) would have us all wailing in Depression II:

This tickles your retinas in stories like today’s “Minutes show Fed ready to raise rates, shrink balance sheet soon (cnbc.com) and The Fed’s battle to fight inflation could cause more pain than higher prices – CNN.

Sadly, as we have become accustomed to with CNN, the mainstream media have swallowed the “wrong pill.”

At this point in the Long Wave, we are in a hyper-deflation. Which is why Ben Bernanke quite properly called for helicopters full of money drops in here. As it’s the only rational thing to do! Shame on CNN and the other liberal media peddlers, though, for stating it wrong to mislead the public!

Inflation is NOT Prices going UP. That’s the Keynesian Big Lie.

Inflation is more accurately described – with our Fed/Central Bank whoring out our once solid purchasing power – as watering down money.

This is not to say they are wrong from a Public Policy Standpoint. A replay of the Great Depression in less values-based era such as now could be a potential bloodbath.

Besides, we like store shelves that aren’t barren, toilet paper is still useful, and if you have to “crook the money a bit” to get there, just tell me another half decade of hard work will get us back to break-even and I think most people would be onboard. Keep the booze and self-meds available, though.

If this whole “release of virus” and pivoting into “Putin War” against a background of ongoing Trump-hating seems all a bit phony, it’s because it IS!!!

Self-arising System Dynamics alone can’t cope. We are managed.

Bank on Inflation, Food, Idiots

I told you in 2004 to “Buy Silver.” We did when it was around $6.93 with some as high as $7.03. Before that, we said “Buy gold as an ultra-long-term inflation hedge. In 2001 after 9/11 when gold was $274, that was a reasonable call, too, we think (we didn’t suffer). This morning Gold is clawing up towards $1,900 and we shouldn’t be surprised to see it touch $2,200 or higher this year or next. All depends on the Fed’s “watering can on money.”

This is not investment advice (we don’t offer that). It’s just stating the OBVIOUS. Government has to water down your money. It will take more paper to buy the same shit. Don’t buy into the “prices going up swindle” because it will blind you to half the opportunity. It’s really money being cheapened, watered down, whored out to hedge funds and banksters. The Leech Class. They exist to usurp value – tax the poor – steal the assets with sparklies and excess consumption.

The “utility value” of a good steak, toilet paper, and coffee is relatively stable over time. What changes is the made-up “Price” which gets into the long supply and demand charade.

The Fed’s so-called “dual mandate” (maximum employment, stable prices) is merely the policy of the Leech Class to keep you from noticing. The real agenda is keep people “on the hook, in debt, and allowing the Leech Class to grow its own power and wealth.” (See why they hide it behind glorious marketing?)

Our “long term” storehouse of value ideas has been reasonable, I think. They didn’t make us poorer, that’s for damn sure. Neither did going short again in markets near the close Wednesday by the look of futures today.

Over half a century of chasing news (off and on, when I wasn’t being a corporate money-whore…which paid very well, thank you!) has taught me:

- Government will over-spend given a chance.

- Patsies, political crooks, and fall-guys (selling free-lunches to the gullible) boost that dynamic.

- Inflation is a money game: Calories, energy, tools, land fully owned, and precious *(limited supply) assets are some meaningful hedges

Uncoupling from the System

Elaine and I bought this place in the sticks in 2003 and moved-in January of 2o04. Six-figure software sales guy had a lot of options; so why did we pick the woods?

- To unplug from the system, you need to dump DEBT.

- To unplug from the system, you need OWNED ASSETS.

- To unplug from the system, you need to CREATE VALUE.

- To REMAIN debt free, owning assets, and continue producing value, you need to continuously LIVE BELOW YOUR MEANS.

A LOT of Americans wake to their Debt Indentures. They are held by comforts and fears. Comfort of living in an anything-on-demand world. And fear of “coloring outside the lines” lest they suffer a loss of “face”, and “social status” as a result.

Look at commercials in media: You’ve been sliced and diced by ad agencies who are agents of pyschographic warfare! They confuse color with status, sex with money, and uninspected, these affronts to logic roll in by the thousands over a lifetime.

Advertising is not your pal.

Now What?

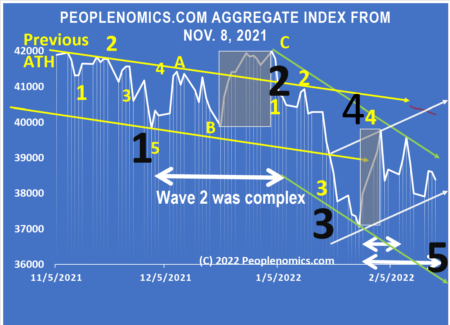

Earlier this morning – ahead of the data – the futures were hinting at where the daily arrows of finance could cluster when the shooting stops at today’s close:

The strategic problem will be coming up with a higher close today.

If that can’t be tabled, then the “failures to hit gains” will become pretty obvious in the chart. Which opens the door to next week working down toward that black “5” ahead. Will the Fed pump or dump?

Our advice, with all the partisanship rolling around, is that you pour yourself a fresh half-cup and set apart from other people. The masses are usually wrong.

Follow your heart and do honest work; the stuff that gives you deep pleasure. Cut the strings and make your own peace with the world.

There’s no greater Gift I can think of offering.

And now for the repetitive parts:

Gunfire to Bullets

Which look of fake surprise do you want? Russia-Ukraine: Pentagon calls reported shelling of village ‘troubling’ | Fox News. Yah think?

But the EU continues waving red flags as Putin. As, for example, European Parliament greenlights EUR 1.2B assistance package to Ukraine (ukrinform.net). Border bullies still shoving.

Second night of Warrior Moon is tonight.

Our best sources are still conflicted, though: “I think [redacted’s] assessment of what Putin would or would not do to suck up to Beijing is, how can I say this, a bit optimistic. ” Versus “I failed to understand why anybody, particularly our so called “Intelligence” agencies, kept pushing their Feb 16th date since Putin would not do ANYTHING to embarrass the one country he needs in his corner if he invades, China, and thus was NOT going to move before Xi and China had their “Day In The Sun” and finished out the Olympics.”

What continues to concern us is neither of these most excellent sources disagrees on the endpoint, by next week, just the specific inception of hostilities.

I hope to lose my fish and chips bet on this.

Data Day

Some num-num’s, eh?

Gee, wasn’t that exciting, kiddies? (F no!)

Well, how’s about:

Housing

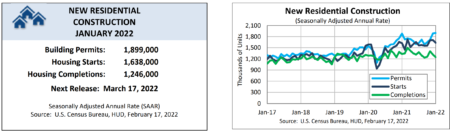

Working on your “Junior Propagandist’s Badge” are you? See now no percentage when Joe Biden’s Housing Push lays a fat one? Try this:

“Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,638,000. This is 4.1 percent (±13.7 percent)* below the revised December estimate of 1,708,000, but is 0.8 percent (±12.5 percent)* above the January 2021 rate of 1,625,000. Single?family housing starts in January were at a rate of 1,116,000; this is 5.6 percent (±12.0 percent)* below the revised December figure of 1,182,000. The January rate for units in buildings with five units or more was 510,000.

Again, Biden aims and shoots his own foot.

Need More “Meh”?

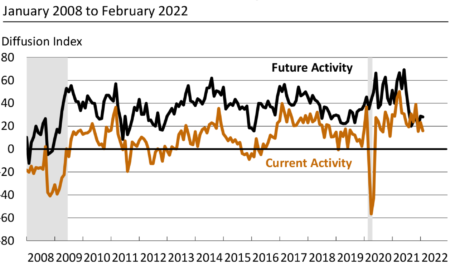

Try the Philly Fed Manufacturing Outlook:

“The diffusion index for current activity decreased 7 points to 16.0 in February, mostly offsetting its increase from last month (see Chart). “

Against this, Dow futures were down 130-ish and the S and Pee was down almost 30. (I don’t wear the Scrooge McDuck suit very often, but we can see a Scene Aesthetic might present a little Beauty in the Breakdown come the close today…)

In the Shorts

A blow job out West: Dangerous winds cause damage, power outages in Las Cruces (yahoo.com).

See Joe toss Kammie under the bus: Harris to go to Munich, as U.S. says there are up to 7,000 more Russian troops at Ukraine border – CBS News Any improvement over her “fix the border” mess would be an upgrade.

Kneel, and look surprised: Video Prince Charles charity under police investigation for corruption – ABC News (go.com)

Our local lab research team (into trans dimensional metals to make UAPs) was just thrilled to read Charge and Spin Density Waves – Scientific American.

More practical, perhaps? Feelin’ dirty: More people shower, change sheets than cuddle immediately after making love – Study Finds (Because if we don’t, we get super-glued to the bed, maybe?)

Or how about Untrained orangutans spontaneously use stones as tools in fascinating experiment – Study Finds. The rest of the sample simply ran for office or became White House staffers…

Write when I get rich,

George@ure.net

Harris going to Ukraine border to yell ,y’all come on in. Isn’t this just like the Mexican border?

I think your “Worse that 1929” chart is a most interesting and unique chart in your chart pack. It provides a different perspective of where we are. Based on the chart the question I have is: what is preventing the Fed from kicking the can “one more time” in the event of a deeper correction?

Or should I say “Ooooonnnneeeee mmmmmooooooorrrrrreeeeee tttttiiiiimmmmmmmeeeeee………”

Dow 65.000

Then waterfall

(Speculation as to how “world would be” without Covid is a great subject for our Comments section…)

what if Q never posted and exposed the evils of the satanists

what if Trump never ran for President

Killdog would be in her 2nd term instead of Biden , right now and we would be burnt toast, worst than Canada is dealing with now, Sorass loving dick tater. New Zealand and Australia and Austria are suffering from them taters. They do not have GUNS

And the lame stream media would not have US calling out their lying bull shit. The sheeple would obediently go to slaughter, led by the NYT and WaPo, etal

Never FEAR, Febr full moon is also the Storm moon, I think Killdog is feeling the storm ala Durham. I feel so positive about the future, I got to wear shades. Yes, the storm will break some trees and there will be the mess to clean up

The deep state[hidden hand] are now the ones, living in fear. What is the penalty for treason? or crimes against humanity? Hemp, brand new ,scratchy, rope. or high velocity lead?

Here comes the sun(little darling), it’s alright

https://www.youtube.com/watch?v=TmBTYK7XZQk Beatles song

Durham will be buried soon.. it took three months to wipe away a pedo ring and less than a month on the hard drive.. this to shall pass..all is well on the beltway..

Onboard with you George, I saw this developing years ago and so since 04 I have been debt free and living way below my means and retired since2016 and I have never looked back. I live remote and can be totally self sustaining when needed, yes practiced that for long enough to know. I have no regrets and am glad i have gone down this road. My concerns now-a-days is only for what happens to this country as it slides over the cliff with so many sheeple in tow.

Some of which will be relatives and friends that just don’t get it. You can take the horse to the trough but you cannot make them drink. LOL

Horticulture?

You can’t lead a what?

Thanks for the link to Bret and Heather. Their eloquence is humbling. I watched several of their takes and interviews. Can’t believe I had missed them. However, their belief in the clock, without SOMEONE who winds it, leaves them hollow.

@MHW, NM: “Ditto”

Wholly Moses G!

War be breaking out in the Donbass, Gold about to be revalued across the world – all that sovereign debt dont cha know. Rolled out of Oil positions and small into Gold – Oil breaking down for another day or two off a MRI Sell signal, Gold looks like it is finally breaking out..we shall sea. Unwound Long side of SPY Strangle, not going well so cut that Loss off.

Farsight Group – Have been looking into future – darkly lately – and it looks rather dicey aftermath – 2024 Elections.

“Aftermath Jan 2024 – Dec 2025”

Contested indeed! as in very contested – physically contested..DC “destroyed” “flattened” “smoking ruins” “whole area destroyed”. Non surface structures involved (no shit!) – inhabitants interviewed/questioned about what was going on surface (DC) and the “thoughts” they used to describe scene below..”betrayal” “family vs family”, brother vs brother”. .

On the Quantum level we know that the act of viewing & bringing back results of future events, changes their probability with time line.

What sort of changes would Urban Survival readers/commenters like to see in USA as we stumble blindly around in our slave caves, trying to figure out WTF current REALITY is and means.

What does it say on all our money ? Who are we supposed to trust in? Ever get any Verification ? hahahahahahahahah

We are a severely controlled population = everyday more and more coming out regards all the lies, fabrications, illusions…

https://youtu.be/tRvAqIcW0MQ

“Houston we have a B.F. problem”

Oh boy, oh boy! My mining stocks are finally getting a bid and I just waded in to a penny stock gold miner in Mexico. Hope it’s as good as buying gold and silver was on Ebay back in the 2000s!

Always wary of mid month PM runups – bankerz luv putting on da Spread, only to unwind the Longside soon after putting it on. Caution the paper stocks in PM’s – Phyz is your friend, paper not so much soonly. Personally looking to profit from this practice and buy some Puts on Miner stocks as they con the sheeps one more time during this current runup. F-them and their paper BS! Markets will be turned off – before they us profit too much.. ; )

I hear ya but this move is bigger than anything I’ve seen in these stocks in a long time. They’re either at or above their upper range boundaries whereas they haven’t been close to them for a long while. I’m not trading in and out anyway. Just watching the show with my toe in the water.

O Canada and George Sorass’ influence there. A little history for those that want to know. scroll down for the photo (Jan 20 2016) of Sorass, Trudeau, and Chrystia Freeland

https://www.thegatewaypundit.com/2022/02/exclusive-canadas-deputy-prime-minister-chrystia-freelands-grandfather-nazi-admires-george-soros-no-surprise-labeling-freedom-loving-canadians-terrorists/

Anyone remember Mrs Turdoe and son visiting and taking pictures with ole tricky dick nixon (he liked em young&hetero) ???

Can you also RE-Call when tricky dick said that young justine would the PM of Canadastan some day in future?

go ahead – ANYONE – and tell me your Heros’ arent PICKED for U puny humans ..beforehand.

Hello calling mr musk…is that musky musk I smell or fraudy fraud ?

I can’t help but think the “blown up economy” scenario would have been a better one than what we’re going through now. Most of the reasoning behind today’s overreach by TPTB, the Elites, is a desperate effort to maintain their hegemony and manage their fortunes and influences in a declining Greater Depression – at the expense of everyone else. But, to me, this effort is like suppressing a fever that needs to happen in order to rid the body of an invader. It’s also the reasoning, I’m pretty sure, that the 50 year Jubilee in the Old Testament was instituted. It provided a counter balance to the inevitable imbalances that occur in any human economy and provided a more humane way of starting over. I’m sure Chris could expound much more eloquently on that. One thing to consider, though, is that the happiest of times in a population’s life is when growth is being experienced and the next generation’s security is, seemingly, set in stone. 2nd Turnings are like that and I’m grateful for having lived through that time in America of all places. However, here we are in the middle of a 4th.

The argument can be made that there are simply too many people in the World based on consumption levels and the inevitable UNmanaged die off would be too chaotic, hence, The Jab’s unknown long-term effects on fertility and high rates of spontaneous abortions in military women outside of those it kills outright. Over/excess/conspicuous consumption has been promoted pretty much throughout the last century and certainly since the end of WWII. Such behavior was never going to last forever unless we managed to begin mining the asteroid belt and other planets. It made “The War on Poverty” an irony in itself. How could you bring an entire planet up the standards of the “First World” consumption levels, levels that sustain our higher levels of health as well as wealth, and not destroy all sustainability in the end? Was intelligent living ever a consideration? Even China’s single child per family restriction failed miserably and now they’re taking a long look at America’s Bread Basket. The question is, even though they play the long game, will their circumstances allow them to wait until we destroy ourselves? It seems as if that will be a tight race unless our dumbed-down society wakes up and starts acting like adult humans rather than sheep. Throw in another recurring Pole Flip episode in our future and you have the makings for the next catastrophe movie. (“Don’t Look Down”?) It’s like one old codger I used to know was always saying – “The World is like a cow chip floating down the river with a bunch of piss-ants on it and every one of the little shits think they’re guiding it”.

Investing in gold/silver. From 2002 to now the Dow has increased 5x, property has also increased a huge amount, though with property you have the constant taxes and upkeep, removing wealth from that class. I am all for diversity, though I don’t have a fortress. That means recurring payments for storage at a bank or other 3rd party facility, to secure any amount of physical metals. Almost any investment is of course better then sitting in cash. Buying metals also seems to have a pretty high fees to convert from dollars to metals or back again. If you don’t have the physical metals, you have a lot of trust that some entity actually has those metals to provide if you actually want to hold and secure them locally.

“May you live in interesting times” is falsely attributed as part of a 3 part Chinese curse, the other two segments of which are: “may you be recognized by powerful people”; and “may you get what you wish for.”

Wikipedia and others attribute the interesting times part (a curse or blessing, depending upon one’s perspective) to possibly Hughe Knatchbull-Hugessen, the British Ambassador to China in 1936 and 1937, or Austen Chamberlain’s father Joseph Chamberlain, British secretary of the state for the colonies from 1895-1903 (part of which was Hong Kong). So either man, as well as other potential candidates, may have birthed the ‘curse,’

I usually don’t pay much attention to Yahoo’s financial videos and articles but this one is good. Mohamed El-Erian is usually good for some great observations and this one is like that –

https://finance.yahoo.com/video/mohamed-el-erian-market-lost-153611376.html

He’s saying as much as he’s allowed to say.

Went down to the sale barn for the first time in several months since my bought with the bug. First time in a long time that I have shown up without a trailer of feeders to sell. I just needed to get out without an air hose for a spell. Normally all the local producers sit bunched up towards the center of the bleachers for the best views while the big dog buyers sit up towards the top. They are the ones wearing the new hats and shiny boots without any sweat and shit stains. If you have never been to a livestock auction you have missed an important lesson in economics.

This day I spoke with a buyer from Iowa who I’ve known for many years. Really nice and knowledgeable fellow who bears an uncanny resemblance to Boss Hogg from The Dukes Of Hazzard right down to the white suit and cigar.

After exchanging pleasantries he asked me if he had gotten any of my stock. I told him no and about what I had been up to the past few months. We went into the little cafe adjoining the barn for coffee where we had a good visit. Last thing he said to me was See you next trip I hope, Folks are going to be paying a hell of a lot more for their Big Macs by then.

Somewhat prophetic I think.

Jim,

How do people make money in livestock?

Get elected and tax the shit out of ’em?

you should ask the dark greenish scaly male reptilian complete with tail in UAV overhead, how ?

Been told the “hostiles” want humanity in constant state of CHAOS. – key word- dont forget – know them by their words..

As long as CHAOS reigns – Humanity will be lost looking for the causes, instead of Who – Planetary Acquisition is the ultimate goal..always has been.

You raise what people pay the most for – and have very little debt on top of that so that you can have a cushion for the lean years – and it may take a couple of generations to achieve that! If you’re over your head in real estate debt you better be raising gold-egg laying geese. We did, finally, after all these years, go in for drought insurance and feed supplement payments a couple of years ago and we’re using the latter this Winter. The problem is those payments are taxable so you have to watch how much it boosts your income.

We used to raise sheep until “AlGore” took away the wool incentive payments that had been in place since, I think, WWII. That meant shearing the stupid things took almost all of the money we made on wool as labor costs went up and I think the last load of wool we sent in to the sale barn stayed there for a year. The only thing left to make money on was the docked and castrated lambs which was OK, but…

We finally sold all the sheep and eventually bought a bunch of all kinds of goats – Boar and Spanish mostly but many other types as well which has made a very hearty goat. We rarely drench them, quit castrating them shortly after we changed over to goats because the price difference was minuscule. The only kind of “maintenance” needed is feeding in the Winter as needed and keeping an eye out for predators and water. What makes goats so profitable is what the county agents call the “Ethnic market” which is the Middle Easterners primarily but others as well. I don’t pretend to understand why because goat meat is danged expensive in the store when I see it but I guess ME people prefer to stick with traditional meats. It’s almost an exotic type of meat in the store whereas, when I was a kid, hardly anyone ate it except for bbq’s and those goats came off of someone’s ranch.

Cattle are another story. The only reason we have any is because the wife kept saying “You aren’t a real rancher if you don’t have any cattle!” (/falsetto) so we bought a small bunch about 7 – 8 years ago. They’re good Angus stock but not registered and they’ve been good producers for as long as we had the bull in with them. (He’s gone now) A friend told me last year that his friend’s REGISTERED Black Angus didn’t sell for much more than our unregistered stock which ticked that person off to no end. Can’t blame him. High prices for cattle usually are the result of very high end stock being sold to other high end producers for breeding or high end meat packers. (Everything is not as it seems on “Yellowstone”) It takes a lot more hands-on maintenance to feed and raise cattle than it does goats so our little heard is going to probably find another home this year and we’ll invest in ranch upkeep or something to offset the income. The only good thing is Angus cattle are so docile I’ve always separated the bull yearlings from the heard to sell while alone and on foot in the corrales. It could be the long-term relationship I’ve had with this bunch but it cuts the need for horses which are a MAJOR money pit even though I miss them terribly.

Livestock profits really don’t present themselves until you have a good volume OR you’re raising $1,000 to $1,200 goats like our neighbor on a smaller patch of ground. I’ll stick with volume and sleep better as long as the coyotes and buzzards don’t eat too many.

I wouldn’t know. Never made much.

Me either…bogged by low wages and medical expenses..

What chances I did have was destroyed when a boss took our money paid in for healthcare insurance and played the stock market.. then had a child fall out of a tree and impaled himself.. bill was a half mil.. I couldn’t get a stick of gum on credit..

Stinky stuff seems to have an affinity toward fans, don’t it?

Or elective office?

Without covid, DJT would have had a 2nd term. CNN, MSNBC, would still have some level of viewership (they have mainly trump haters). Would not have had 4T$+ printed and sent out in the world, mostly enriching giant companies, banks and their friends. Recession/Depression likely 2 years ago, instead of giant money insertion masking that reality. I wouldn’t have known what dis-honest people run the CDC and other US health agencies and how they are all political animals. We wouldn’t know Fauci was funding GOF research. We wouldn’t have known that science is not based in facts and reproducible, but politics. We would not have know government and big tech does not like us discussing science. Wouldn’t have known how many adults want to ruin childhood with fear, unwarranted maybe risky vaccinations, and masks in the false belief that all those things will protect themselves. In the past we would protect children and the adults would take the risks on themselves, certainly not anymore. Hard to imagine 2 years ago, none of our population was going around in fear of seeing another persons face.

Not sure of your exact birthday date G but Happy Birthday from this reader who appreciates your hard work and the forum you provide for a wide variety of opinions.

Have a Canadian Club and Canada Dry at Toddie time tonight and keep the popcorn ready for this weekend in Ottawa.

I’ll do that as soon as I move my truck!

https://www.youtube.com/watch?v=ZzVFfexm9-k

Lighten up your days ;-))

I bought some non-lethal pepper spray. It’s claim is 5,300,000 Scoville units of heat.

Carolina Reaper peppers have around 1,500,000 Scoville units. Carolina Reaper peppers are hot! I had some Reaper seeds still attched to the placenta. I didn’t wash my hands after touching them… and later used the bathroom. Within a minute I was in the shower under cold water. LOL

I’m on the fence about buying a new car. My current car has 241,000 miles. I planned on keeping it to 250,000 miles. The car runs fine but does use oil.

Yesterday I noticed one local $TM dealer has a $2,000 ‘market adjustment increase on new cars. I expect if the war ever starts new cars will be a thing of the past.

The last two ‘force majeure’ instances I can think of was when Coobah went over the falls… and when Russia got busted-up back in ’89.

Did the shorts get paid back in ’89? We know they didn’t when Coobah fell.

My UAL put options DID pay off – and pretty damn well! – in 1987 but that was not under a force majeure- that was plain bat-shit markets and junior algo rangers

Praise the Profits ! and pass the joint – O Doobie Wan Kenobie

Took me almost 10 years to make to finally make as much as We did in 87′

Watched a lot of seasoned Pros” blow out “after the Crash… tried not to take too much advantage of bankrupted traders working out of their positions – they had to wear their colored ID badges upside down – so we could ID them and give em a break..hahahahahahahah.

Like the PHLX options trading test question that 95% of all traders get wrong on purpose: What is main Function of the Market Maker?

The correct answer- to maintain a liquid market/order flow. but most “Traders” chose answer B) To Make Money/profit

That is still my answer after all these yearz- bwahahahaahah

A new car is not a good idea, especially right now. Late model used (couple years) much better. Get some of that depreciation burned by someone else and pay cash. My truck is 2018 bought 2 years back for cash and for the first time in 45+ years I am driving a newer vehicle than my loving wife. She reminds me constantly how old her 2014 Nissan with 46000K miles is. Everything else on the ranch is dirt old and does the job.

After the swirling down the drain coming up no debt will be worth more than gold.

Drop a rebuilt unit from Jasper inside and go another 1/4 million. meanwhile a little motor honey might do wonders.

https://www.jasperengines.com/

You can buy a lot of oil for the monthly payment on a new car.

You can also buy a lot of spare parts.

Our old Honda CRV (2003 with 240,000 miles) was using too much oil, so we decided to upgrade a little. Not new, just new to us. Found a 2017 Hyundai Santa Fe Sport with 98,000 miles that we could squeeze into the budget. We brought it home in the rain, didn’t check the oil until the next day. Zero oil on the stick. Long story shortened, we took it back and pitched a fit. They said they’d put a new engine in it. Three months later, we have a 100,000 mile car with a brand new engine. We are extremely blessed!

re: “…interesting times…”

Here are a couple of RFK speech snippets from the same “interesting times” paragraph:

“…the fourth danger is comfort…”

“…everyone here…judge himself on the effort he has contributed to building

a new world society…”

The following link appears to be the entirety of the speech delivered by RFK at The University of Capetown, South Africa on 6/6/1966.

http://www.rfksafilm.org/html/speeches/unicape.php

Faster….

Reminds me of:

“Fast is fine but accuracy is final.

You must learn to be slow in a hurry.:

Wyatt Earp

The other day it was mentioned sliding back to the 1930’s.

I might be jumping the gun a little but the Magna Carta (1215) is what’s being erased.

The Magna Carta stated that the king must follow law like you, me and the others.

Magna Carta

Magna Carta was issued in June 1215 and was the first document to put into writing the principle that the king and his government was not above the law. It sought to prevent the king from exploiting his power, and placed limits of royal authority by establishing law as a power in itself.

In 2015 the Houses of Parliament, along with the people of the UK, will be commemorating 800 years since the sealing of Magna Carta (1215).

https://www.parliament.uk/about/living-heritage/evolutionofparliament/originsofparliament/birthofparliament/overview/magnacarta/

It’s interesting that oil is down when gold is up while a false flag war almost broke out in a huge oil area of the world…hmm, that’s the strength sentiment/emotions (indicators like the rsi, stochastic, macd are examples of sentiment) leading a market…the big money has been getting out of oil for a while. Seems they bought billions at the flu bottom and needed several weeks and the manufactured threat of war to keep it moving upward so they could close their oil trades off without damaging/lowering the price. Hope all the mom and pop traders stayed out, but someone bought it all so people will get hurt again.

Oh, wait, the flu was a manufactured event also…wow, these snakes bought low and sold high off of two manufactured events.

Is it just me or has Biden been goating the Russians to invade the Urkrane. Even the Urkrane people don’t understand what the US is up to. The Russians don’t want a war & are confused with the Biden rhetoric. The Urkrane people see the US as a safety net. But wait trusting folks. IS BIDEN LOOKING FOR A WAR WITH RUSSIA AT YOUR EXPENSE?

War … or NO War?

It is Thursday … and the Sunday “Post Olympics” time frame is coming up fast. I still hold to my comments that Putin will NOT move, if he is going to move, BEFORE those Olympics are over … since he will absolutely NEED Xi and China if he does move and thus will NOT rain on China’s Olympics Parada.

I also feel Putin has not yet made a final decision, but he keeps moving the chess pieces around for a BROADER WAR in the event that he does move and the War expands.

Reliable reporting now says that he has moved the type of bombers and the Mig 31s to both Kaliningrad (which lies between the Baltic states and Poland on the Baltic Sea) and to Syria (on the Med) that can carry Russia’s Hyper Sonic missiles. Those long range Hyper Sonic missiles have also now been spotted at those locations. Those Hyper Sonic missiles are reported to have a 2000km range at 10x the speed of sound along a maneuvering ability so as to try to avoid being shot down. Those weapons are generally considered Ship Killers and can carry conventional warheads OR nuclear warheads but they can also be used against ground targets.

Obviously if a conflict remained contained to just inside Ukraine Putin would NOT need those hypersonic missiles forward deployed, but he has deployed them so one can see he is covering the risks of the conflict expanding.

From being fired from the middle of the Black Sea the Russian Hypersonic Missiles can cover the entire eastern Med from Italy east to Syria and Israel, so obviously the movement of the missiles and aircraft to carry them is further assurance of coverage of the eastern half of the Med along with possibly covering even the entire western half of the Med, depending upon how far west the aircraft operating out of Syria would go before firing the weapon.

“IF” Putin moves I personally believe he will try to contain the entire fight to Ukraine, BUT … if it expands then the Baltic States as well as every Nato airfield within 500 miles of Russia’s borders are going to be PRIME TARGETS.

The Balitics having gone into Nato are a HUGE THORN in Russia’s side. From the border of Estonia it is only 84 miles to the middle of downtown St. Petersburg, and Nato HAS put Nato fighter/bombers into Estonia. That would almost be like the Russia maintaining bombers and fighters just up the Hudson River from New York City at Stewart International (near Newburg NY), the backup airport to NYC’s 3 airports!! We would be PISSED if Russia did that, just as I am sure Russia is PISSED at Nato for ACTUALLY DOING IT!!

Putin does not HAVE to make a decision on an invasion until about 24 hours before Russia would move so such a decision may not yet have been made (I do NOT think it has). HOWEVER … Putin can NOT maintain his forces in the field during winter with little field support and no good accomodations for the troops for too long of a period of time, maybe the ex military people could chime in here, but I would guess 2 to 3 weeks or so is the limit. That will mean that he will HAVE to move by the end of Feb or the units will have have to begin to pull back to more medium term sustainable locations.

Which way will the Putin jump?

I don’t think we will have long to wait to find out since the way I calculate it out he HAS to make a decision sometime before the end of February.

My pessimistic view is that much is due to excess people w/o work for them but to kill each other.

My daughter bought 3 meals at a new chinese type restaurant. It cost $50. Prices of fast food are already mostly out of my budget.

The wife and I used to go to lunch for just under $20 back in the 00’s. Now it’s almost double that for the smallest meals.

Stay short perma till bottom of structure and indicators align

“The Fed’s so-called “dual mandate” (maximum employment, stable prices) is merely the policy of …”

My opinion: The Fed’s (1913) so-called “mandate” was and is to finance wars (in order to cull world’s population!). Notice that it started long before you and I arrived on this planet ;-). There are just too many of US everywhere, who have needs, and make

demands that are NOT “to the liking of mother nature”. Humans tend to plunder and shit on their own nest without regard to the future. End of rant.

How do I know? After the FED was established 1913 they published monthly brochures of their business activities. Those were available to the public at the NYC main library where I had read the majority of them when I still had an interest in such.

Meanwhile, (closer to death than most of you,) I don’t even mind anyone’s opinion. Whatever is said and/or written, IMHO, is mostly entertainment until it goes BOOM. so sorry, or should I ;-)

“…There are just too many of US everywhere, who have needs, and make demands that are NOT “to the liking of mother nature”. Humans tend to plunder and shit on their own nest without regard to the future.”

Yep.

Stay short .

Happy Birthday, George. 73 is a good ham number. Cut back on your writing? I doubt it. Did no one ever tell you that once you are over the hill, you pick up speed? :-) Don’t try to get out of the way… I’m right behind you!

Some pretty dark stuff today. Maybe you’re right about the economy THIS time. But 1929’s been replaying here so many times that the tune is getting difficult to dance to.

A couple of weeks ago, all the smart people here were saying that the new moon would prompt Vlad’s Ukraine gambit. Now, y’all say that the current full-“Warrior”-“Storm”-“Snow” moon is setting the stage for the Russkies to act. Which is it?

Could it all just be a big game of chicken Kiev/Kyiv?

“Vlad’s Ukraine gambit.”

Hmm…is it Vlad’s or one of Brandon’s despirate attempts of misdirection of his failed policies..the way I read it Putin didn’t start building up until.. we did..

Everyone Agreed to do a mutual withdrawal to de-escalate the tense situation. so the first thing we did was send more troops and equipment there..

None of it is good.. no one will win this if it evolves into a war.

Be very careful in gold market . Very careful

Yep, it’s at the Day chart supply area, the Week chart supply area and price is inside the Month chart supply area so it will likely take a breather. Oh, and it’s the end of the week so some traders will get out so they’re flat for the weekend. This tends to bring the price down of the things that have been trending. However, this might be a good weekend to keep paper gold in the portfolio in case crazy happens. But, if it’s physical metals you have, then the price of the paper gold or silver do not matter.

Observe the Shanghai property index over the next several trading days…

If the established vehicle for wealth for the average Chinese citizen nonlinearly evaporates, and the remaining Chinese economy has the tools and people needed for production; what will be produced? (Not more property and not more high speed railroads). The next 54 years of the 1807 US hegemonic 36/90/90/54 year :: x/2.5x/2.5x/1.5x fractal cycle will likely be both inflationary (of necessity) and, unfortuately, destructive.

Going forward from the Wilshire Nov 2021 peak at an 1807 36/90/90 years, the great rub and conundrum for western global central monetary policy makers, who need near zero or negative interest rates to sustain debt obligations and social and (in the hegemonic US) military-industrial contracts, is that the lowering of interest rates to zero or negative, will elevate commodity prices and consumer core inflation. US retired and semi-retired individuals (baby boomers et. al) will respond by reducing/eliminating service-related purchases which will directly impact on the service-related economy and those participating individuals. That essential servce sector represents the primary economy of/for the United States.

Carefully observe the Chinese equity market and in particular, the Shanghai property index, the principle nascent hegemonic coal mine canary of the global asset-debt macroeconomic system.

George, meet your new neighbor.

Catch the part that the special forces guy said.

https://www.youtube.com/watch?v=DXfeOAbZ6qA

Comrades,

Weeks after Russia’s Wagner Group moved into Mali, the EU is packing up 2 year old Operation Takuba that was supporting France’s 7 year old Operation Barkone trying to uproot Islamist rebels across the Sahel G5 (perhaps now G4?). According to the BBC, French forces in turn will now decamp from Mali to neighboring Niger over the next 4 to 6 months as this is not an Afghanistan-type withdrawal.

Speaking of Barkone, perhaps Mr. Putin recently saw fit to send Mr. Macron back to Paris with a juicy bone for his lab dog, Nemo. This following the French president’s diplomatic mission in Moscow to spread “liberté, égalité, fraternité” across the Ukraine Republic. Two confirmed dog lovers like Mssrs. P&M would know, “you scratch my back, I’ll scratch yours”. French presidential elections are in 2 months. Good luck to all!

Happy birthday..

“we shouldn’t be surprised to see it touch $2,200 or higher this year or next.”

If this shizt show doesn’t follow the nostradamus predictions…

https://theageofdesolation.com/nostradamus/2022/02/16/preparing-for-armageddon/

“Putin would not do ANYTHING to embarrass the one country he needs in his corner if he invades, China, and thus was NOT going to move before Xi and China had their “Day In The Sun”

I don’t believe putin wants ti invade.. even though he was asked to help.

There wasn’t a build up until we parked missiles on his border.. then kept trying to cross his boundaries during war games and drills.. what I wonder is what is the real business plan and seriously is it worth whatever the thing they planned to gain?

It’s all very scary and quite frustrating..

I believe putin will wait until nato or the US makes the first move..

Comrades,

Staff at a natural gas construction site were attacked tonight by a group armed with axes according to this RCMP police report from Houston, BC.

https://bc-cb.rcmp-grc.gc.ca/ViewPage.action?siteNodeId=2130&languageId=1&contentId=73532

correction: the event occurred Wednesday night/Thursday morning.

spinning bullsheet yankee !!!! washington day monday !!!!!!!!!!!!!! see putin dancing im a yankee doodle dandy !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!