AI bubble ending is one thing but the housing situation? Well, gets interesting, doesn’t it?

“YEAR-OVER-YEAR

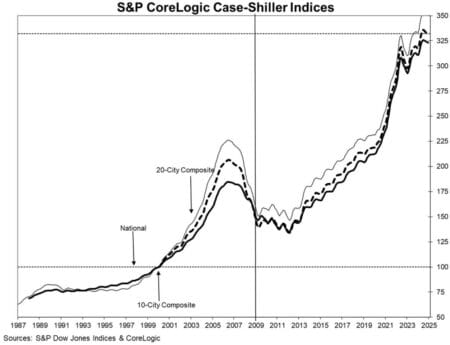

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.9% annual return for December, up from a 3.7% annual gain in the previous month. The 10-City Composite saw an annual increase of 5.1%, up from a 5% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.5%, up from a 4.3% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.2% increase in December, followed by Chicago and Boston with annual increases of 6.6% and 6.3%, respectively. Tampa posted the lowest return, falling 1.1%”

Well, hurricanes will do that. But look at this:

“MONTH-OVER-MONTH

The pre-seasonally adjusted U.S. National and 20-City Composite Indices’ upward trends continued to reverse in December, with both posting a -0.1% drop. The 10-City Composite’s monthly return dropped 0.04%. After seasonal adjustment, the U.S. National, 20-City, and 10-City Composite Indices all posted a month-over-month increase of 0.5%.”

Markets are set to rally so we shall see.

G

“Ai bubble ending is one thing..” da F you talkin bout Willis ?

Ai Wars are just getting started Kemosabe, we are at the very beginning of such battles, that eventually will determine a Winner.

What are you going for the Favor of the “new” Liberal Press entities – trying to get some of that USaid largesse ? Or just looking to become truths newest source for twisted news ?

Why not finish Ure missive with a misdirect ? how about some thing like, “markets are set to rally? – good one Chief, though for the life of me I dont understand WHY you would act like that?????????????????

Thank goodness SPY 385 Puts and QQQ 506 Puts – 3/3 Exp. cant read, otherwise BCN might be in Cover mode this AM..NOT .

BTC, GOLD/Silver looking Cheap. As 4 Dividend payers – ‘I just cant get enough” -https://youtu.be/_6FBfAQ-NDE?si=rZ67j9JK4qlb_7Lv

re: Bezalel visits La Casa Blanca

feat: Arachne’s Hubris

Folks,

Much wants more; black cat alert. Wasn’t there a State Dinner held for the French President by the last Administration? Yesterday’s frightful lack of decorum had Mr. Macron elbowed to a corner of the Resolute Desk by President Donald. Ducking quack observation, “Le Monde” of Paris saw fit to fashionably publish yesterday a dispatch from its Madrid bureau. What canard caused White House Spanish language web pages to be disappeared? Here is a link to Español 404 level at the White House website:

https://web.archive.org/web/20250121211247/https://www.whitehouse.gov/es/

Prior to the undertakings of the Artful Doger, bureaucracy had announced that relics of the outgoing Biden Administration would be assembled at a secure Washington-area federal building in an office of suitable dimension. Imagine my surprise to see that at least one of the Casa Blanca “Archive” webdates renders indication of spider droppings. Perhaps they serve to fuel that ‘pernicious propaganda’ we were forewarned of by J. Jonah Jameson at the “Daily Bugle” in Marvel Universe. As example here is another link on “Archive” to the ‘Casa Blanca’ page:

https://web.archive.org/web/20250101000000*/https://www.whitehouse.gov/es/

Zoom into the 15:02:10 GMT January 7, 2025 snapshot. You might discern the helpful public signpost as follows: “NLIL_2024-25, customcrawlservices, nl_Israel”.

Here is a link to where on “Archive” the signpost can lead to and its deposited terabytes. An onward “about” page offers a graphical depiction of the escalating ascendency of machine inquiry.

https://archive.org/details/nl_israel

The program is running. Shalom.

I have been looking for the reason.., can’t find the trigger – but Bitcoin dropped over $8,000 this morning.., taking most of the stock market with it. It is coming back slowly.., now down $7,100., but I am not sure what caused the bitch-slap.[ currently $86,700.]

Is this the point where I say “Yep, no bitcoin for Ure”?

The Conference Board’s Consumer Confidence Index for February came in at a reading of 98.3, a significant drop from January’s revised 105 reading and short of the 102.5 reading expected by economists.

“In February, consumer confidence registered the largest monthly decline since August 2021,” according to The Conference Board. “This is the third consecutive month-on-month decline, bringing the Index to the bottom of the range that has prevailed since 2022.”

The “Present Situation Index,” which measures consumers’ assessment of current business and labor market conditions, fell to 136.5 in February from 139 in January.

The “Expectations Index,” which tracks consumers’ short-term outlook for income, business, and labor market conditions, also fell to 72.9 in February from 82 last month. Historically, a reading below 80 in this index signals a recession in the coming year.

“Comments on the current Administration and its policies dominated the responses.”

* * *

My aggregate index – “Carnac The Magnificent” got bitch-slapped this morning [ wish I could trade that index ! ] It has dropped significantly below the up-trend line., below the 42 day MA., blew past the 85 day MA., and has dropped completely out of the Bollinger Bands. It’s looking really fugly.

Which probably means a small recovery bounce is in the works for a few days.

None of this is trading advice – as I have a very negative bias towards the markets right now.

Ten Year Bond hit a record low for the year.

Even Gold got hammered., down $52.00 – safe haven asset ? Not in todays’ markets.

Oil drops to the lowest levels this year – currently below $69.00 a barrel.

.., and Bitcoin is still down over $7,600 – and I still can’t find what triggered the sell-off., which has been touted as a safe haven from political and economic turmoil .

.

Does all of this smell like the beginning of an economic crash ? Kind of ?

Look at Z Chart – TA

..mind out of the gutter truth, TA stands for Technical Analysis.

BTC just broke down thru its current consolidation channel.

Today breaking down thru 128 DMA, on its way to the 200 DMA. $89k and $87k levels dont hold – down to $73k.

Will be lots of crosses, death crosses and what not in next couple days, BTC is some trouble hear.

MRI says we go significantly lower. MRI does not tell How Far Fall – just the Time – 5-6 more Days of down. Maybe a deadcat bounce into a deathcross…going into $73k into Apr?

Later today though is a MRI Buy opportunity – a small bounce into the low 90’s as DC-bounce.

? A knife catch in the low 80’s ..sub $84k..How Big are Ure Cajones ?

MicroStrategy -looking at Buy in low 80’s as well – LFG!

Trying to nibble on some BTC related stock options like SMLR – but premiums still HIGH – like too rich 4 my blood..

Bitcoin Dominance is surging today at new ATH – as shitcoins get shitted upon some more.

stabnd by for btxc to “rally to zero!!!” It’s what depressions do.

Look to fill the CME futures gap @$78K I mentioned back in Jan before all the hoopla.

Oh and there’s a. CME futures gap @$92K.

I think the odds of CME gaps being filled on BTC is in the ~%99% of the time.

Study the patterns here homegamers.

10 year bond … They were saying even on Bloomberg today that the 10 year interest rates dropped today because the markets now expect Fed interest rate cuts … but since it was simultaneous with the market collapse this AM I am calling BS on that … and calling it a ‘Flight To Safety”.

Take my comments on that fwiw

Bitcoin … the complete collapse of Bitcoin today showed to me that there was a total lack of buyers below those who have been the major institutional buyers. You just don’t basically gap down thousands of dollars in one fell swoop if there is a good market with buying depth under the product.

The charts did show what should have been a strong first bounce area of $92,000 – $93,000 during a Bitcoin decline but Bitcoin just sliced through that this AM as if it didn’t even exist. WOW!

Has every investor who wants to buy Bitcoin now already bought it?

Not sure if accurate but in the back of my mind I have a recollection reading a week or two ago that the AVERAGE price the ETF buyers bought Bitcoin at was $90 /$91,000, “IF” accurate that means the average individual investor is now underwater with their Bitcoin ETF purchase.

Be interesting to watch over the next few days but I personally consider Bitcoin as the Canary In The Coal Mine wrt this round of “Speculative Investing since it was the most speculative of all of the speculative stuff out there during the last year. It is now down to $88,000 from $106,000 in December.

(oh … and for those who could care less, Tesla has dropped from the $480 range in mid Dec to $302 today. OUCH. Talk about a “haircut!)

OH … and to add::

Oil: the oil pricing collapse matched up on the clock with the Bitcoin and general market collapse today, and did NOT come back by the close.

The timing aspect of it indicates a classic sign of leverage players selling what they could to raise money to cover their margin calls in other markets. (because of huge commercial demand the oil market would be near impossible to have huge air pockets under it. It should virtually always remain a solvent market in which to execute trades – ie a quick way to raise cash since futures have same day settlement)

OK.., maybe not a “crash”. But did we just fire-up the furnace for a slow rolling melt-down ?

dLynn : I don’t use the “C” word, thinking it a bad message (professional survival in mind). Plus, since I was in the business on Oct 19, 1987 (Black Monday, -22.6% in.a.single.day) well, they just don’t C-word like we used to.

Why? There has been / is a lot of “hot money” which cycled through various markets. The Bigs are quickly soaking up all the foam from the until recently bubbly action. Every rally meets available volume. Large. Like all you can eat.

There is a lot of distribution underway. None of this action is fatal, and we could yet rally (the DJIA has made several runs but?). Still, like you, I am predisposed to see the dark side here. Why buy everyone else’s folly?

Watch the TNX (as you cited). It’s all math versus the crazy momo folks getting handed their hats. All three indices need a solid green close but my belief is there simply aren’t enough buyers (with enough dosh).

Stay tuned

E

ps – of course, none of the ^ above is financial advice. Just piffle

Aluminum producer Alcoa said on Tuesday that U.S. President Donald Trump’s plan to impose a tariff on aluminum imports could cost about 100,000 U.S. jobs and would itself not be enough to entice it to boost production in the country.

Trump earlier this month said he would impose a flat 25% tariff on aluminum imports “without exceptions or exemptions” in a bid to lift U.S. production of the metal used to make automobiles, cans and other products.

The tariff takes effect on March 4.

Bill Oplinger, Alcoa’s CEO, told the BMO Global Metals and Mining Conference in Florida that the tariffs could cost about 20,000 U.S. aluminum industry jobs and further 80,000 jobs in sectors that support it.

The tariffs alone would not be enough to entice Alcoa to restart some of its shuttered U.S. facilities, the CEO said, adding that Trump officials have asked the company to do just that.

U.S. data showed aluminum smelters produced just 670,000 metric tons of the metal last year, compared with 3.7 million in 2000. Plant closures in recent years, including in Kentucky , Washington and Missouri, mainly due to electrical costs, have left the country largely reliant on imports.

Most of the Capacity addition and replacement in the US has been with Combined Cycle Natural Gas units. Of course when FJB attacked gas in the US he made electric costs skyrocket. I live in one of the lowest rate areas in the US and my monthly gas bill for a 4-BR-3-Ba house went from a whopping $49/month to $91/month, and from about $190/month for power to about $240/month now.

The answer will be to not look at things as always being static but to look forward to those gas and electric rates coming back down.

Of course the MSM will never report that as an alternative.

ALL electric rate payers in my state were subsiding our one nice size aluminum smelter … had been doing that since at least the 1970’s, may have actually gone back to the early 1960’s when even coal generation costs started to climb. About 10 years ago the subsidies by the regular rate payers became so large ($2 to $4 per month per household, industrial users were getting hammered – I forget the exact amount of the subsidy was per year but the yearly total was HUGE, in at least the hundreds of millions of $$ for just that one plant) that the state pushed the large smelter to finally close.

Without cheap electricity it makes no sense to run an aluminum smelter in the US anymore since production costs here are WAY ABOVE what the worldwide price of aluminum is. Not sure how Trump is going to handle that issue.

“to make automobiles, cans and other products”

Uhm, that’s not why an Administration needs in country production. Sure, good for the Econ but secondary to Defense Co. needs is my guess. But, I’m just a civilian.

Egor

ps – same deal for all the AI hub-bub Bub. I don’t see the use case (yet) but am pretty sure the DoD does

Y’all are starting to catch on…?

Trump is about to make a deal with Zelinsky for half of, more than 1/2 of the known titanium on the planet. I would assume he has already made a deal for the same titanium with Putin. It shouldn’t matter whether Ukraine keeps Donetsk, Russia takes it, or the two provinces Russia “liberated,” and “which wish to become independent nations” (remember that? I didn’t think so — but I did) get to become so. The deal will also be for the nickel, cobalt, lithium, etc., and maybe most-importantly, iron. The Iron in the Donetsk makes the world’s finest quality steel. China wants these resources really badly. They put Ukraine on the hook for $29bln under “belt in mouth,” and was planning on calling the note. I would assume Trump is going to pay off the note, like he did the belt-in-mouth note the ChiComs were holding over Panama.

If we can get some petroleum out of the Donetsk Basin, we will, but the Administration doesn’t care at all, about it. It is not important. The minerals and rare Earth’s is where it’s at.

Look for us to pay off the belt-in-mouth tab in The Congo, before summer’s out…

For answers to the current crop of market volatility questions, I suggest one look at world geopolitics, not finance or economics.

I found this statement by the Consumer Confidence Board rather fascinating:

“Consumers’ expectations of affordable food and gas prices in 2025 were impacted by age, with consumers over 35 years old becoming less confident while those under 35 became more confident.”

We are all looking at the same data – the same facts – the same screen-shots., and hearing the same reports., yet there is a marked ‘age’ division on what those numbers mean.

I wonder why that is.

.

“Math doesn’t lie – people lie about the math.”

Are those under 35 lying to themselves about the economy? Or, is it that they live in mom’s basement and it doesn’t really matter to them?

A Warren Buffett ‘investment rule’ I have always liked.

“Be fearful when others are greedy, and be greedy when others are fearful.”

George,

Tesla’s down 8.8% today with a PE of about 140. With Musk’s great popularity among the Non-Right, the previous principle buyers of T-vehicles, europe’s decided preference of BYD’s and support of Ukraine, and a tariff-enhanced block-buster recession on the horizon, Mr. Market Efficiencies will be the DOGE equivalent for Mr. Musk. He should do as well as owners of crypto’s do. Maybe tomorrow Tesla will decline below its pre-election valuation.

The 27 Oct 2023 55/139/138 day :: x/2.5x/2.5x maximum equity growth fractal series was completed on Friday 21 February 2025. The current initial 3-phase hourly decay fractal model for ACWI is a 12 February 2025 21/43 of 47-48/ 30-47 hours or 3/7 of 8/6-7 days :: y/2-2.5y/2-2.5y . This would be equivalent to the 1929 initial Sept 1929 3 phase 12/29/27 day::

y/2-2.5y/2-2.5y fractal decay series.

Best Regards

I heard somethings strange.

1.) Flag officers arrested inside the Pentagon

2.) CIA agents same for destruction of electronic files

3.) Destruction of files in the FBI

4.) FBI Agents not following orders to relocate to field offices

5.) Agency heads being ‘Froze Out’ by staff

Sounds like totally made up POPPYCOCK

“IF” Flag Officers had been arrested in the Pentagon it would have been splashed all over all the news wires within a couple of hours.

As for the rest a greater chance of possibility but unless people are begging to Go To Jail I doubt any of the it except for the last item … which is normal bureaucratic behavior since the times of Adams /Jefferson (they and their supporters were actively hating on each other for some time so that is when bureaucratic intransigence in the US Govt probably got started)

Kilauea Volcano is fountaining in the crater again tonight. Catch it while you can.

https://www.youtube.com/watch?v=cBiihKsB9Zo

Alan Weiner of WBCQ on restoring an old RX:

https://x.com/AllanWBCQ/status/1894382553999487429

https://youtu.be/j_Iuf-lwEpE?si=0er3zIqhe0sYqVL1

great video on groc 3