Although we don’t offer financial advice, we do nevertheless write and opine on both economics in general, the long waves within economics, and some of our own independent research very specifically.

Thus, we feel somewhat driven to announce this is likely to be the transition into?

Deadly Downside Day

We begin in the general economics area with the release of the Challenger Job Cuts report. Going into this, we expected the Markets had gotten a bit oversold at the close Wednesday. In some swing-trading aspects, a respite (in the form of a short rally) is likely due.

However, the general look of the market is “suckish” at best. The odds of Ukraine prevailing over Russia was always a bad bet from the get-go. And now, some of the early indicators are suggesting that we have entered a period like the 1970s. Where inflation becomes incipient, thus, we see gold (and BTC) trying to reprice higher due to the falling purchasing power of the Dollar.

Yet, the Dollar can’t fall too far – because it is supported by the Fed which we keep hearing is buying our own paper – to keep Titanic America afloat financially. Which must happen until the next “election” event a year off.

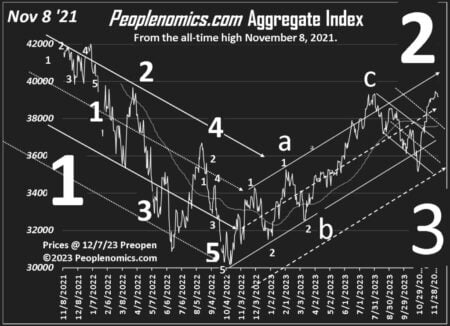

The problem, clearly visible in our meta-index (The Aggregate) based on putting equal resources into major published indexes at a suitable “time between the lies” tells us that we still have not rallied enough to claim higher highs are just ahead.

Sure, it looks that way to True Believers – and even our view expects one more marginal new high in order to fill an Elliott “trading box” a few hundred points up from here.

But the hour is getting late, as we inspect the chart here:

The problem? While this is daily data, as we showed Peoplenomics subscribers Wednesday, the weekly chart makes the double-zigzag “a” of 2 up disappear. As it does so, the zigzag becomes the “a” wave, meaning we have done a “c” of 2 and the market shills are desperately pushing for this to become the “e” wave (which would complete the larger 2) before we collapse in 2024 into a heap. Rather, more correctly, we begin to have “hot flashes”. Hot enough to melt glass.

“Where’s the Deadly Downside?”

Oh yeah, that.

Well, any damn fool can keep track of the S&P 500 average on a daily closing basis. Then (in a derivative work) calculate both a 2-day and a 13-day moving average.

In our limited back-testing, this ain’t a bad way to see which way the market is likely heading next. When the 2-day drops under the 13-day, it’s “Lookout below!” time. Which, in the pre-0pen pricing today was (wait for it…)

NOW.

(Color chart on the subscriber side.)

The underlying dynamics of why this is so useful relate to the difference between STM (short-term memory) and LTM (long-term memory). Short-term memory is running low on “good news and fresh hype” leaving “bad shit we’re trying to forget about” ready to overtake us.

My consigliere and I go over this several times a week. As the market isn’t driven by news events. BUT – this is key – news drives emotional states over time and this is what works into people’s thinking.

One other useful observation: In order to be a “good investor” you can’t overthink things. If you can’t pull the trigger on a $10,000 (or larger) trade with never so much as a second thought, then your “hold on money” (fear of loss, or lack of practice) likely means you should use a financial advisor.

That said, demand to see documentation of their entire client list performance compared with the S&P 500 or the Russell 2,000 for the past five years. Be prepared for disappointment. Sorry to report, metrics and benchmarks are what we live by around here.

That said, IF the market closes below the early futures, then we put on the Karnak hat and begin to sense “slaughter of the elves” as the devil tries to kill Christmas this year.

Given events in the world, that would hardly be surprising.

Long Wave Econ Data

Sunday, December 7, 1941 was 81-years ago. We mention this because in the study of longwave econ, figures like Nikolai Kondratieff (Kondratiev, but we roll with the American Economic Society’s 1933 spelling). Yet two-bit pipsqueaks, like my friend Ehor, who worked with me on the 83-year currency cycle back in 2001, get little due.

Same with people from the University of Colorado Long Waves group days. Folks like Tony Plummer whose books are even today pertinent in the study of moods and markets are overlooked in the mainstream.

World War 1 started about 104 years ago. The modern analog (Ukraine) is a nicely (close to two Kondratieff’s cycles) rhyming event.

Which tells us there may be two Kondratieff cycles in play. One was the 52-years from 1914 to the ramp-up in Vietnam in 1966. While another might be seen in the 1941 to 1990 (50-years) between the Japanese attack on Pearl and the launch of the Gulf War in 1990.

In fairness to Kondratieff fans (of which I am one) the K-wave as it’s called can run from 48- on the low side to 56, or so, on the high end.

Notwithstanding, 2024 will put us 51-years, more than close enough in our work, to be a bull’s eye K-wave count from the 1973 Yom Kippur War:

“The Yom Kippur War, also known as the Ramadan War, the October War,[60] the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from 6 to 25 October 1973, between Israel and a coalition of Arab states led by Egypt and Syria.”

Thus, a modern analog may be seen blossoming – and in fact it’s doing so right now. Thanks to modern technology, though, we’re thinking this will be more Kippurs and bits, which the news drones on about.

Back At Reality

So, how is that Challenger Job cuts report, anyway?

“U.S.-based employers announced 45,510 cuts in November, a 24% increase from the 36,836 cuts announced one month prior. It is 41% lower than the 76,835 cuts announced in the same month in 2022, and marks the first-time cuts were lower than the corresponding month a year ago since July, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

So far this year, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period last year. It is the highest January-November total since 2020, when 2,227,725 cuts were recorded.”

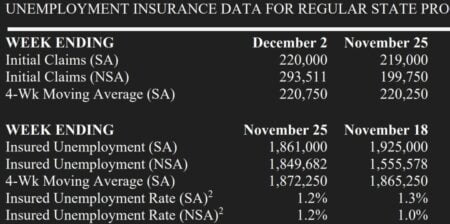

There is also fresh data on new unemployment claims.

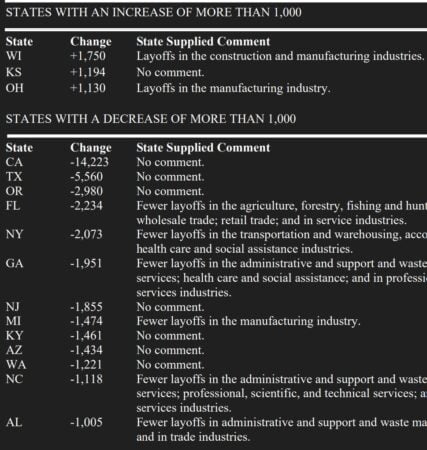

And with this, how various states were feeling the pain:

From here, we’re set to dial-up the outlook for one week from tomorrow which is? Options expiration. Early this month.

Last month, our Aggregate was 38,691 and pocket change. Today (early futures) the Aggregate prices around 39,180. The useful question to be asked is “Are things 1.26385 percent better than they were last month?

(Surely, you don’t need a lot of coaching on this, because that infers an annual rate of, um, 16.2 percent!

Just a dirty little fact (besides Gaza and losing in Ukraine) that could begin to rot the minds of bullish hypsters. After the jobs data from the feds tomorrow, or will it wait?

Short Snorts

Ah, to the SSDD part of the morning.

Houseplant by the nuts? Following the republicans doing the right thing (No UKR of Israel money until the US Border is fixed, which we’ve been saying for how long?) Republicans block bill to send billions of dollars of aid to Ukraine and Israel comes word that Biden willing to ‘compromise’ on US border policy as Senate Republicans block Ukraine aid.

We trust Joe Biden as much as we trust George Santos. Speaking of which: Candidate for George Santos’ Old Seat Convicted.

White replacement is still going full-steam in the UK: Rishi Sunak Government Crisis: Backlash Over Rwanda Plan | TIME.

Another “convenient” mass shooting. Yep, as the demonscraps make more moves on guns, another mass shooting to whip the public into support and forgetting of the Constitution. UNLV shooting: Gunman was a professor who sought job at school, sources say – NBC Connecticut. We’re wondering if he was a democrat, though.

The Global Wars drag on:

- Israel, Hamas Engage in Fierce Battles in Gaza City, Khan Younis (voanews.com)

- Russians take Sinkovka and advance into northeastern Kharkiv – Russian sources: “7,000 Ukrainians will be eliminated”

- Seems almost like Gulf of Tonkin II is being set up as we read How the US is protecting Red Sea shipping lanes as Israel-Hamas war continues.

Now Let’s Talk Solutions

Let’s spend money we don’t have for a problem that is largely made up and call it good, shall we? US pledges climate aid for cities, more private sector finance | Africanews

Then, if anyone questions simply “making up money” let’s turn the press on them to smear their position. Binance CEO Challenges Dimon’s Anti-Crypto Stance in Senate Hearing.

And if that’s not enough, here comes more math horsepower to fuel your AI replacement: Quantum computer sets record on path towards error-free calculations | New Scientist.

There…three solutions. Don’t anyone call us doom porn merchants. We’re here to help.

ATR: The “Do Quotient” Problem

One of the problems with computational life is that we have far more capacity to think about problems now, than actual DO something to revise or implement solutions.

Noticed this the other day when I was taking a “beat break.” Which is when I turn away from the computers and look out at the forest and ask “So, asshole, what are you really doing right now?”

(My self-talk is pretty brutal, but given I’m sort of loutish, it makes sense that strong language would be necessary.)

As the screaming match between my ears faded down a bit, I came up with a new way of evaluating my Life Performance.

Say I have spent an enjoyable morning surfing the web. Nominally, I’m “day trading” (Doing, work) but since the market moves a glacial speed and I need only a few seconds to pop off a trade, that leaves a ton of time to “do nothing”. Knowing (*protestant work ethic guilt) that I don’t deserve to really rest until dead, I convince myself that designing new ham antennas, working on an ebook, or just eyeing new eBay listings is somehow “Doing” something.

However, the far side yells back “If it doesn’t result in a worthwhile deliverable, it’s not DOING anything. Only count DOIING when you are on a task that is on a list. Otherwise your DO QUOTIENT is zero.

My what?

Working on deliverables is DOING.

Futzing around in TinkerCad on a non-specific Incredible Jaagub or better, my [Tinker this] Neat Vihelmo-Lahdi is NOT DOING.

Out came the stopwatch again.

(Gulp!) As I feared, my actual DO QUOTIENT Wednesday had dropped to just under 50%. Sure, a few things got done, like burning leaves, opening mail, planning today’s grocery run, and working on some server-side issues. But overall? It was a screw-around day.

The Other/Auditor in my head called me out on it.

If you ever get to feeling like your Life is not improving as fast as it should, take the time to run a DO QUOTIENT check.

A highly productive day can still be fun. BUT if the DO percentage of your time is under 80 percent, or so, harden up on yourself. Goggin’s yourself a bit. Focus on deliverables. On time, under budget.

Which is why today’s column might make sense. What a change, huh?

Fake out Dow drop early, then higher is our guess. Buy the rumor ahead of the Federal jobs report tomorrow, anyone?

Write when the screaming between the ears stops,

George@Ure.net

Eyes so BULLISH hear,

that I need a whole herd of Moosies for Mating, right now!

…”mooove over honey, gotz a wide turning radius on this “badboy, thats it, a lil farther forward” mmmmmmMMM!” -https://youtu.be/aYM8Yb14cew?si=UdOstNDDKwh5TDWx

Have you seen the DAX? The German economy is in the shitter, swirling in da bowl as I type, and DAX be rocking to new heights – G musta been reborn..again, sucka

Going higher into totally ridiculous levels -https://youtu.be/tQ0PSpHFV_s?si=Zl0w-ootFnyEGNCi

* sighted in new “scope/rifle combo” – going for a new record Confirmed Killz this year – “Elves”

How many “elves” do you home gamers plan on bagging this year..dont forget – Plan Ure Work and Work Ure Plan .

Hey George, want to do something with a deliverable? Finish up The One-Hundred Year Toaster!

Check your email for a review copy

Here we are again TEF – global crash tomorrow……..

not to worry, yet another update pushing out the crash date again and again, is in the works ……

“if you hear any noise, its just me and the boys”

Yeah – thats what tends to happen (getting fractilized) when you get close to the business end of a “hose”.

They have a whole category on that exact thing, over at pornhub – for anyone interested in that kinda Do Quotient activity.

https://youtu.be/GT3ecv01xDE?si=3nbhGJfRr7l6R0Lz

P-Funk -can youse feel it ?

I read somewhere that the feds have the bois at finance by the balls . Seems that the Fed bois are asking for past information on crypto use.Seems like they want some tax money. What do all the smart people say , the government doesn’t know how cryptos are spent. They will now

Damn spellcheck , “binance”.

George

Ya oughta get retard before ya git too tard to do. Do-ing is over rated. Done is how i like to see it. Then do-ing don’t git inna way.

I’m still voting for floating as the new way. Forty two feet and a water world.

Gotta love the new hydroponic stuff. Fresh green a thousand miles offshore… it’s a brave new world.

Stiks

“Deadly Downside”

https://youtube.com/shorts/Pa3SC9TJ5Ck?si=GI5z5B7v9rF8ty7m

We seem to be – or are – most of the world’s bomb makers. When you have reasonable balance of favorable global opinion of what or who is bombed and can protect yourself, that’s generally seen as a “good thing”. But when you’ve passed out munitions to Ukraine like candy at a parade and now to kill civilians, the balance of popular opinion changes dramatically and becomes a very “bad thing” and our national security has become extremely questionable,- because of economics and general integrity, also.

That, is a very dangerous position to be in. Scripted or not.

I think, in the future, what was once Global Warming as a “cause” – Global Waring is going to be the next thing the global population fights.

Protesters have already tried to stop munition shipments. I fear, that could escalate and morph into something worse.

I was digging in the dumpster for scratch offs, Jerusalem REITs.

The ETF DB lists four ETFs that are mostly Israeli tech.

Israel ETF List

https://etfdb.com/etfs/country/israel/

Then there is a real Israeli REIT – RIT1 and would be an awesome short into atomic oblivion.

https://finance.yahoo.com/quote/RIT1.TA?p=RIT1.TA

The First Real Estate Investment Trust in Israel

REIT1 is leading the REIT sector in Israel with a diversified portfolio of premier assets

REIT1 is a TASE listed stock (TASE:RIT1) and is a TA-125 constituent

https://www.reit1.co.il

I think five of their buildings including the commercial property and commercial parking lot are in Jerusalem, half their portfolio.

“Where will you go, if it all goes wrong?”

“Jerusalem!”

https://youtu.be/yNYLzVc53vs?si=Gouk82v-HYzliBAG

(Black Sabbath)

I told my grand daughter she should check out a colony.. its giving up almost all modern luxuries.. but its a place to grow.. build your home and live a much simpler life..

I was invited but seriously I am to old

there baaaack..

thats right Yanks, I introduce to Ure & Company – SMERSH 2.0

Ure Christians In Action be beyond toast now..”we have ways of making you talk, comrade”

Yeah I know – prolly rooting for their success in the field..if not, you should be, they are Hunting for OUR benefit.

No matta the splatta – we got that covered 2 -https://www.theinteldrop.org/2023/12/07/russia-deploys-new-avangard-hypersonic-missiles-in-silos/

Raising the questions about – WHAT EXACTLY have the .Mils provided to Pentagon lately ? Not much, cept pod stolom (underthetable) $$$$ for the revolving door candy wrapper types.

Not like they are missing 3 TRILLION DOLLARS again this year – having FAILED yet another Audit.

* They have never passed an AUDIT since bushtheVile sr was Dir of Pedophilcia.

gives me, Boris, goosebumps thinking about Ure spies being hunted down in ukraine/eastern europe.

The Snow Tygers come..

“Natasha , we must stop the human traffickers- christians in action!”

I think very few people can make good decisions in an instant, regardless of whether it’s 10K or just a single dollar. I think twice before buying a tool at Harbor Freight, and it’s rare that I see a deal so good that I just grab it. Low inhibition is a skill that can probably be honed to some degree, but for many of us, a “financial advisor” might be helpful, or even just an algorithm that says buy, sell or hold. Of course, the advisor costs money and can rarely be trusted. At least the algorithm is deterministic(until AI)! Some of us should trade, and others of us should probably just work to improve the value of what we already have. I don’t have an advisor because I’ve never found one that I could trust, and don’t have an algorithm either.

I do find that avoiding spending money is generally a good thing, and fixing what you already have is of great value. I never bought crypto because it seemed too ephemeral, and back in the good old days of under $100/BTC, it was really hard to find a source. Mining would have worked back then, but again, getting enough good info on setting up was a major time and energy consumer. Many of us have other priorities.

In life, I invested in education(not always formal), materials, and tools. Also, anything else where I can park value for decades at a time without constant monitoring. I have no regrets about those choices. Unfortunately, the intangibles that make life worthwhile can’t be bought with money.

Dec. 7 is a somber day in Hawaii as we remember Pearl Harbor. 103 year old Ira Schab has returned to honor his friends, “I owe them”.

https://www.kbtx.com/2023/12/07/i-owe-them-103-pearl-harbor-survivor-returns-honor-comrades-lost-attack/

Soon it will be January twentieth.. the day that JRB was signed into office..

Loob, soon Trump could be behind bars, Georgia’s got a lot on it’s mind:

https://www.theguardian.com/us-news/2023/dec/07/georgia-fani-willis-donald-trump-election-trial-prison-sentence

Deep in the heart of TX (gunman kills 6):

https://www.nbcnews.com/news/us-news/shooting-spree-texas-austin-san-antonio-rcna128283

U.S. has the highest gun ownership rate in the world:

https://www.bbc.com/news/world-us-canada-41488081

“Loob, soon Trump could be behind bars, Georgia’s got a lot on it’s mind:”

Possible history is full of examples of civilization that have put political opponents in prison..

https://theconversation.com/lessons-from-ancient-athens-the-art-of-exiling-your-enemies-68983

but we should learn from histories pasts.. which is filled with political opponents being exiled and imprisoned….

From what I have read Even if Joe doesn’t go.. the kid and the siblings should have been put there long ago its so big and vast and way way worse from what I have seen. and the average guy or girl on the street knows it.

GUN’s Now I don’t know about the promised land.. but in the wastelands.. Gun purchases went up after the hateful destruction, the violence and the raping and pillaging done from those terrorist activities of BLM and Antifa.. when people realized they are not to be protected by the very agencies they depended on for protection.. then watching the heads of these very same agencies sitting in front of a hearling and lying to congress it appears as if they have been accomplices and part of a vast network of political corruption.. all this did is convence them that if they want to stay safe they needed to seek out their own protection many of those neighborhoods are now ten times more dangerous than they once were people are buying guns faster than ever and if they can’t buy them then they get them on the streets .. I am am a DEMOCRAT and it shocks the shit out of me.. Cities that have strict gun laws.. are the worst to.. this isn’t something that isn’t noticed. if only the police and the bad guys have guns and you take away the police protection they were even lacking before the terrorist activities..

https://www.theguardian.com/us-news/2023/dec/08/gun-violence-gentrification-study

https://www.foxnews.com/media/levin-blm-and-antifa-are-the-militia-wing-of-the-democrat-party

https://news.northwestern.edu/stories/2021/02/gun-sales-spiked-in-2020-amid-pandemic-social-justice-protests/

https://www.washingtonpost.com/national/record-gun-sales-us-2020/2021/01/18/d25e8616-55a9-11eb-a931-5b162d0d033d_story.html

EVEN Democrat liberal msm brought that up.. the terrorist activities.. people killed.. and raped with billions of dollars worth of damage to neighborhoods that were already in heavy decay.. and not one has gone to jail or seen a courtroom.. cities that reduced their police protection.. are now so bad that people are fleeing them..

“Lets remember pearl harbor..’

Used to sing song at specialist post on Philly Options trading floor, whenever Nip vip’s visited the trading floor..

https://youtu.be/DkDlTRFv0P0?si=cALP0cs3XhBL7q61

My great uncle was a Warrant Ofc 2 Seabee stationed on Pearl Harbor-he was there.

..was forever telling me WW2 Seabees were the OG SEALs – funny guy Uncle Jr. MIT grad who refused officer rank – instead took Warrant Ofc – he worked with and was real big on supporting the “worker bees”.

When I visited the Battle ship Arizona memorial (80’s)- I was outnumbered by “Nips” 7 to 1 easy – I was disgusted by the spectacle, and left with a very sour taste in mouth..

..took about 5 Mai-Tais at Benihanas(next to HaleKoa) that evening to wash it away.

Have they taken over Hawaii yet ? https://www.statista.com/statistics/1025523/hawaii-population-distribution-ethnicity-race/

My, my. Now there’s a racist attitude! Old warriors are sometimes never able to give up the ‘hate the enemy’ attitude after the war is over.

Over 90% of the Japanese you meet in Hawaii are local born AMERICANS. Some local Japanese AMERICANS even fought the Germans in Europe alongside the US.

I have a Macy’s AmEx issued by Department Stores National Bank, an affiliate of Citibank.

They sent me an interest rate notification which I glanced at and noticed the APR for purchases and cash advances is an annual 31.99%.

31.99% was probably fair before computers because the CC companies had all those accountants keeping tabs on the tabs but today 31.99% seems criminal when a server is doing most of the work and we’re doing the processing work if paying online, etc.

while we point fingers and yell and scream at each other over BS the bankers and money changers rake it in.

How Citibank Made South Dakota the Top State in the U.S. for Business

Little South Dakota (pop. 833,000) holds $2.5 trillion in bank assets — more than any other state. Here’s why.

https://www.theatlantic.com/business/archive/2013/07/how-citibank-made-south-dakota-the-top-state-in-the-us-for-business/425661/

Sounds like the average staking yield in select Crypto NFT’s.

Got blockchain?

Everybody is always talking about a civil war but all they have to do is stop paying their credit card bills and let them throw them all in prison.

I doubt most CC companies and banks would bother with less than five figures

worth of CC debt. I think it gets charged off after six months of no payment. They’d try to collect, and harass you with phone calls and threatening letters, but they’d probably not bother with a judgement. Of course, holders in due course might, but then it’s only a judgement that they’d have to execute on if there are assets. The only causes for prison or jail time might be fraud on the consumer end or a contempt of court ruling for failure to appear or answer. After a few years, the debt becomes subject to a statute of limitations unless you pay something – it could be only a few cents, and that restarts the statute.

Of course, you’ll have no credit rating worth admitting to, FWIW.

CC’s are UNSECURED Debt.

-backed only by faith that You will pay off the balance..

no prison, no fines, just a shitty credit report to follow you around for years.

oh my… can you imagine what a catastrophic event that would be..if everyone just did a Biden and just didn’t pay or claim any of their income at all..now that would be a nightmare.

the people I know are all using plastic to keep their quality of life now ..

https://www.msn.com/en-us/news/politics/biden-impeachment-vote-announced-by-house-speaker-mike-johnson/ar-AA1la6Ap?ocid=msedgntp&cvid=7275e1669cde49db8ed41f84ae295205&ei=9

Now that is confusing.. can the white house ignore turning over evidence.. that just paints the whole situation that much darker.. then to tell people called to testify that they don’t have to go.. can they do that????

(“They’re refusing to turn over key witnesses to allow them to testify as they’ve been subpoenaed,” said Speaker Johnson about the Biden Administration.

“They’re refusing to turn over thousands of documents for the National Archives,” he continued.)

it was bad enough that the heads of agencies are telling congress to go to hell.. they don’t have to give them anything .. or they were unprepared and have no knoweledge of what in the hell is going on in their own offices.. but to tell witnesses that they are not to go..

can they do that.. ?????

this just gets weirder by the day

“Yet, the Dollar can’t fall too far – because it is supported by the Fed which we keep hearing is buying our own paper – to keep Titanic America afloat financially. ”

what is keeping America a float is selling bonds or securities to other countries..the people of the usa are using plastic..

if.. it was a closed off system without fresh revenue or numbers coming in.. the usa might make it to the Darwin awards.

like bit coin it’s only valuable as long as people see it as valuable..our support change raises its c ost on goods and services what would we have..if a dishwasher that retails in turkey for 4.50 us currency that retails in the usa for 450.00..whst happens if they let’s say raise the cost of that same dishwasher to 10 dollars us.. then transportation..instead of 3.00 a barrel us to six or ten dollars.. well you get how this could just explode..

The cell phone carrier announced they were cutting the price on unlimited service $4 a month, and raising the “unlimited” data limit to 35 gb. Sounds deflationary. Now if I could only get the ISP and the electric company to climb on the bandwagon. Gasoline is already running $2.55 a gallon locally.

It finally got to where it doesn’t take a C-note and change at Sam’s to fill the truck again. Restaurant prices are still up there and maybe climbing a bit.

I eat out less to compensate, and go on days with known specials.

Filled up for $ 2.419 / gal this afternoon.

https://www.msn.com/en-us/news/politics/new-criminal-case-filed-against-hunter-biden-report/ar-AA1laCgW?cvid=61bf73eef8264eda8f25251f8e8384fd&ocid=winp2fptaskbarhover&ei=7

https://www.dailymail.co.uk/news/us-politics/article-12839961/DOJ-files-new-criminal-charges-against-Hunter-Biden.html?ico=related-replace

Who would have ever believed any of this was even a remote possibility three years ago in their wildest fantasies… with all the ranting and raving about the last president not wanting to disclose his tax statements all while they weren’t even claiming theirs LOL.. OMG.. it just gets worse every day.. I am terrified to even make a two hundred dollar mistake on taxes and here we read about millions not even being reported..LOL LOL LOL

the issue will vanish as if it was never there or get a presidential pardon…..

https://youtu.be/Pa1fH0SvGPg?si=RW5I3eTLhirIW9We

Tucker interviews Alex. Ought to be “X” (Twitter) gold!

“Tucker Carlson broke the internet when he dropped his interview with InfoWars host Alex Jones on X.”

“Alex Jones told Tucker Carlson that Joe Biden wanders around the White House naked in the middle of the night.”

“Tucker and Alex Jones also revealed they had some drinks last night and prank-called former CNN potato Brian Stelter.” https://twitter.com/townhallcom/status/1732912062739751174

https://www.thegatewaypundit.com/2023/12/alex-jones-tucker-carlson-had-some-drinks-prank/

https://www.thegatewaypundit.com/2023/12/full-video-tucker-twitter-46-legend-alex-jones/

Full video – https://twitter.com/TuckerCarlson/status/1732897835572461582

A more reliable feed –

https://rumble.com/v406rx2-tucker-on-x-episode-46-alex-jones-tucker-carlson.html

OTFLMAO …Wandering around the Whitehouse naked now that has to be a sight lol lol but believable.. mr. president what are you doing in the dish drawers lol lol

lol !ol.. took care of a guy with dementia chewed juicy fruit gum would stick it on his urinal..went to throw it away and he’ll broke out.. leave it it keeps it moist.. he use to pee in his drawer of candy then pass it out to the nurses.. I asked them once where did you get the candy…lol lol unwritten law of healthcare don’t accept food gifts from severely demented people unless they are wrapped..

being on his security team has always been a demotion and the worst duties for security personnel..

Obviously – he was once again wandering around looking for little Boys & Girls to diddle – it is all crooked joe can remember anymore.