Drop by around 8:15 AM Central for the Case-Shiller Housing report update.

The balance of this week is full of “surprise risk” for markets. Housing today, a Fed rate hike tomorrow afternoon, and a GDP report for Q2 Thursday that could indicate the nation is already in Recession.

The Calendar Matters

The one data point most people (including a lot of market players) will underweight in their research is the Fed’s H.6 Money Stocks measure. Because when a countries National Debt to the Penny is up running in the area of $30,529,873,257,653.04, something is bound to break, sooner or later.

The Fed meeting – gaveling in today – will be looking at a lot of data. Some of it is real while some is delusional.

On the Real side:

- The Cost of Living continues to soar as Around half of older Americans can’t afford essential expenses: report.

- Not only that, but when you don’t have enough money, guess what happens? Difficulty Paying Bills Tops Pandemic High in US Census Survey..

- The coping tool is changing of habits – and this is set to go pin-balling through the economy like a steamroller. (Huh?) More Signs Emerge That Inflation Is Altering Shopping Habits.

This was fairly predictable – as the Fed faced a terrible choice: Do they unload the balance sheet (between financial storms) realizing they might cause the next one in the process? Indeed, if they had not raised and trimmed the balance sheet, the Fed could go bust, in a sense, if they were already carrying too much paper.

This sets up the first part of the vicious cycle. Seasoned economists are not surprised in the least. Like we’ve been telling you for more than six months, plan on a minimum of a Depression Lite (which Biden could screw up and turn into Depression Hard and Deep) in 2023. Sounds like a precursor to Shallow Recession Calls Are ‘Totally Delusional,’ Roubini Warns.

What few people realize is that we may be in recession right freakin now and we could go over the edge this fall.

Cause and Effect Economics

When the bio war broke out in 2020, the Fed was handed a gift – a scapegoat. Part of the economy could be burned out (old assets destroyed creating fertile ground for redevelopment and growth) when Covid lockdowns came along.

Of course, no one could admit that, so instead we suffered through pointless deaths due to the government practicing medicine. Eventually, the disease weapon worked its way through the population and people began to unmask and rethink.

About here, it became important for the Fed to allow prices to go up. See, in long wave economics, when prices are falling, people hold their cash and stop spending. Reason is there is an expectation that lower prices will be along soon, and they can get more value.

The problem is that because of the initial drop in spending, successive waves of price collapse cycle through the eco9nmy and things just keep getting worse, prices fall, rinse and repeat. Meet the Vicious Cycle.

Inflation – like what we’re going through right now – is all part of the bankster class plan. Look what inflation has forced you into:

- You can’t save as much (if anything) because food and rent are through the roof.

- Housing – which had been the dream investment the past couple of years – has been cooling off. Remember my consigliere’s edict on this stuff. “Class C and Class B properties always fail first. The Class A office space is the last to bite the dust.”

- We are just cycling into the Class A collapse part ahead of Depression Lite (or Worse) when you read stories like Mark Zuckerberg sells San Francisco home for record $31M.

- This sets up the “normalcy bias.” Which happens because on the one hand housing sales (number of sold homes) has been dropping, but the prices keep going into overshoot territory. Wall Street Journal summed it up last week in U.S. Home Prices Hit Record of $416,000 in June as Sales Continued to Slide.

What many people fail to wrap around is that the U.S. Economy peaked in late summer of 2019. Since then, we have been in a decline if we count the absolute (ABS) number of people actually working.

Inflation perpetrates a fraud on people that few can comprehend. Best example is maybe sitting in the driveway. Your car has probably gone up in price like mad. But proportionately, the fraud is you still own the same percentage of equity. Which – if rolled over into a new hooptie – would cost at least as much – OR MORE.

Your personal balance sheet looks bigger, but your refrigerator looks more barren.

Thanks Joe.

Stocks are in Long-Term Decline

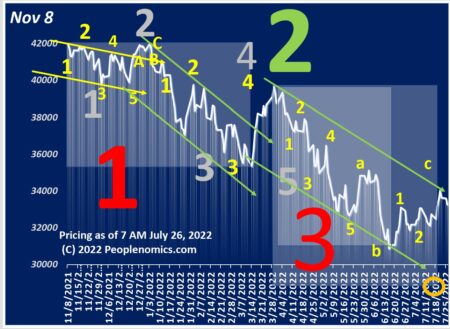

Our “truth detecting” Aggregate Index hints the all-time highs may have been notched on November 8, 2021.

As may be seen, things are conflicted for now and the count can be argued a couple of different ways. Which is a Peoplenomics topic tomorrow.

For now, just realize that when the stock market is down in Bear country6, real estate has peaked (on a unit volume basis) and while prices are holding in class A properties, the bottom is already falling out down under.

Just a matter of time before things to get worse. Which will likely dispel the useless democrat control of Washington before (properly named this year?) Thanksgiving Day!

Things to Notice

This is a great time to chase the bag (of money) and stay your personal course undeterred by media bullshit stories that sound urgent and yet they are not actionable. Some notes on what’s crap and what’s keepers:

Keeper: Got your mega ticket? Mega Millions odds: With jackpot at $810 million, is it worth shelling out $2 for a ticket?

Filler: Testimony to start in Alex Jones’ Sandy Hook damages lawsuit.

Robots are out to get us, dept. Chess-playing robot breaks 7-year-old boy’s finger during match in Russia.

Crap: How long have we told you social media is a marketing con game designed to piss away your life into a screen? A few are waking up: Customer Satisfaction With Social Media Platforms Is Slumping | PCMag

Keeper: Questions are being raised about whether beta-amyloid plaques really cause Alzheimer’s: Potential fabrication in research images threatens key theory of Alzheimer’s disease. We continue to recommend doctor Dale Bredesen’s work because his work shows Alz to be a kind of “type three” diabetes which can be largely treated by diet.

Biden Crap: FBI, DOJ accused of downplaying Hunter Biden dirt. Even more outrageous is US Sold Nearly 6 Million Barrels of Oil Reserves to China, Records Show. Looks to us like the Bidens are in China’s pocket.

More tea and then a housing update.

With an hour to the open stock futures are down 4-10ths of a percent on the S&P.

Write when you get rich,

George@Ure.net

“The Class A office space”

Jump out of a plane with no parachute & you’ll smack Earth. CMBS will get bailouts.

Eddie handed PBGC the Sears pension plan without any push back. He’s smart enough to get his mall properties bailed out.

In Detroit the billionaire inked a deal to build a building. Tax credits, grants and everything. Construction started and the building is going up. Now the billionaire is coming back to the city demanding $60,000,000 in more tax credits or the project can’t be completed.

Only one city council person is standing in the way. Everyone else is on the take.

General Motors want’s out of the Renaissance Center. They’re thinking about building a new, smaller headquarters if they can get free riverfront land and tax credits.

Detroit is a smaller version of China. Instead of ghost cities ghost buildings. A mirage of growth based on financial wizardry. Most cities are the same.

Detroit is a classic example of what happens to a city when you let CRIME and VIOLENCE get out of control, FORCE the school district to lower it’s standards such that the Middle Class has no confidence that their kids can succeed in life if they remain in that school district, and raise taxes to astronomical heights at the same time local industry is downsizing and not as profitable as it once was.

Portland is in the running to be a smaller CLONE of Detroit, as is San Francisco and Los Angeles. Chicago is already well down that “proven path” of self destruction.

The new mayor of NY is trying his best to stop NY from going down that same path, a direction that was INTENTIONALLY begun with the last mayor, but it remains to be seen if he can manage that try as he might. At least the new mayor of NY is trying and has the support of the local community … I don’t see that happening in Portland /LA /San Francisco (and a number of other cities around the US)

The city of Detroit itself is STILL a total basket case even though a SMALL part of downtown has been redeveloped. An amazing feat of SELF DESTRUCTION by the people who lived there and the politicians who catered to their Entitlement Mindsets.

AMEN @Stephen 2 AMEN

defund the only protection that the already vulnerable have..

I have family in portland.. well did.. they moved away the crime was out of hand and the police were neutered by BLM and Antifa..

the same in Minneapolis.. the area there is so dangerous that the odds are you would be shot driving through it..

Indeed we are in the crack up phases heading to the boom.

https://www.zerohedge.com/geopolitical/erdogan-demands-us-troops-leave-syria-vows-he-wont-back-down-new-cross-border

I don’t know @Steevo maybe that article is false and it won’t happen.. I personally believed that we were at the point where we either had to commit completely go all the way.. and go for it.. or drop back a week ago and let ukraine go.. and so far.. it looks like we are backing down and NATO is not advancing like they were either…. which I believe is a good thing and thankful that it is turning that direction I am beginning to feel like we could have a future again….unless of course they are being sneaky about it. but so far all the news overseas is pointing to the us and Nato de-escalating and letting ukraine go..I believe that this whole mess could have been avoided in the first place..

The real question is what will that do to our position as the one to look up to..for their security..

“a Blue theory, the United States may be inefficient and/or ineffective at mobilizing competitive responses to multi-domain strategic competition in a multipolar security environment. And fourth, without such a Blue theory, leaders in allied countries could choose independence and proliferation rather than continued reliance on the United States as guarantor of their security. ”

https://cgsr.llnl.gov/content/assets/docs/DEWT_Workshop_Summary.pdf

in a way I see that as both bad and good.. why should we be the worlds police force.. maybe the puppeteers will quit making us dance to their tune and pick on another country for a change..

Now that the nothing usable backs the $, collapse should be arriving right along the 2023 CBDC glide path.

https://www.zerohedge.com/energy/david-stockman-all-out-commitment-destroy-fossil-fuels-will-it-succeed

Hey Mr. G,

Did/Do you see i”t”? have you “looked” at any of the JamesWebb telescope photos? https://youtu.be/_L9zpD8ZDig

The “spot” is in the Jupiter photos – and it is not a dust mote. Check those photos Out! they gotz a TON of Information “contained” in them..

Usually dont see “them” as they typically hidden behind a holograph in side of a deep crater..hello Luna, a backside phenom. https://youtu.be/dk4WRhPQuyo

* whispers in the “aether” – nasty is toast, inside trader included in the package deal.

more whisperZ not to visit Lithuania, dont even touch it with a ten “Pole’ or any other “Pole” for that matter..

LOLz Just like the last setup (Oct ’29) the Fed will be hiking rates into this. Makes for one helluva profit opportunity on paper in the STRIPped securities market.

https://www.zerohedge.com/markets/no-recession-all-sudden-yield-spreads-are-collapsing

https://www.reuters.com/markets/europe/fed-lift-rates-by-75-basis-points-july-50-bps-september-2022-06-22/

“The Cost of Living continues to soar as Around half of older Americans can’t afford essential expenses: report.”

there are people that are only on retirement… and rent is more than what they get.. but their retirement is more that what would get allow them to get into the good samaritan programs..

the one gent.. his rent alone is two hundred more than what he gets a month.. and then there are utilities.. we here are insurance poor.. this month the company that is our source of income reduced hourly workers hours .. the covered shifts droped to four shifts for the whole month of august and the same in september.. earnings wouldn’t even cover the car insurance.. much less taxes food utilities etc..

it is what it is.. luckily.. one of the salaried workers was sick of having to work so many hours that they gave us some of theirs..

and medicare costs coming up..

go to any meals on wheels dinner and you will get an earfull..

Immoral economics.

Yesterday I posted a link explaining Flint, MI got a $170,000,000 bailout for their pensions. Not a complete bailout, just enough to make payments until the next bailout.

Flint started their pension schemes around 1908 when GM was opening new factories. Those factories have been gone for 50 years. GM went BK 20 years ago, but all the liabilities live on for us.

When Flint is ‘bailed’ the ‘bail’ comes at a cost to all citizens – but especially seniors who don’t get pension.

We need a new, New Deal. There’s no way the unbailed can compete against the bailed. Save up a million and purchasing power gets reduced by 40%. Whoever got bailed took our purchasing power.

Theft.

Need some ground camel?

https://www.youtube.com/watch?v=FmMXi3nLVkQ

Augason #10 cans are on sale. Some for about $10. Some for up to 64% off. Cheap enough to not feel bad about making biscuits when you can’t find flour this fall. Check them out on Ama$$n. Bread mix, biscuit mix, powered peanut butter, powdered milk, powdered butter, potato flakes, peas, banana slices.

Good tip – thank you! We just did some topping off

Thanks !

Cricket farms are going up everywhere. When the famine reaches the screens we’ll be told cricket harvests are about 60 days out, eat them or starve. Cricket will be renamed…. and used as a filler of course, “Tekcirc protein substitute” or something.

“Commonly, the life span of the cricket is very short, reaching from 60 to 70 days and the average egg production lies within the range of 200–1,500 eggs/female. The female can mate with many males and can produce more fertile eggs. The body composition of an adult cricket on analysis showed that it contains dry matter 33.30%, crude protein 63.30%,…”

I really don’t know how Snowden is still getting fresh info, but he’s as fresh as a cricket.

Edward Snowden Says We Are All Going To Eat Crickets

“They’re gonna put em in Hot Pockets. your kids are gonna be like ‘mom! i want the pizza crickets!’”

https://www.benzinga.com/news/22/07/28109474/edward-snowden-says-to-fussy-eaters-youre-gonna-eat-crickets

Soylent brown yeum

Any other good reasons to ‘grow your own’ garden? Papa here spent his free days fishing the shoreline. He always had a freezer full of fish. You can keep your processed crickets. I’ll have the fresh fish dinner, thank you.

Crickets sound probably OK. When I was in Africa I ate (not regularly!) de-winged fried termites. Not a delicacy, but entirely edible. Better than Soylent Green.

Yeaaaaahh, right. I can see the entire First World munching down on BBQ’d crickets, Teriyaki crickets, salted crunchy, munchy ones … NOT. We’ll happily deep fry the people trying to feed us that crap and feed them to the pigs out here in Texas. It’s called meat laundering. Fattens them up and tastes like it always did.

Out of Work Steve,

Mr. Snowden’s last update on his Substack blog as far as I can see was “Everything Going Great” published on Dec. 23, 2021. Paying subscribers surely must be chirping by now because since then what have the rubes been hearing?

Crickets

Pardon me. There was a Vimeo presentation back in April. A secret ceremony participant in the creative alchemy of a new cryptocurrency under the pseudonym John Dobbertin (hopefully not the same as one allegedly having a FINRA investigation) was said to be Edward Snowden in a Forbes report. It’s quite the achievement how a new crypto can launch with a couple $billion start-up capital having been spun off as a subsidiary of a tiny LA film producer run by a former dancer. Maybe her old dance instructor haeiled from the pre-amalgamation Germany as perhaps did Mrs. Snowden’s troupe kommandent of Honolulu? I don’t know. Sounds like someone is out fishing and stuck the Snowden bait on their hook in hopes of landing bigger sucker fish?

“Cheap enough to not feel bad about making biscuits when you can’t find flour this fall.”

Guy at the elevator just asked me if I wanted more wheat…he suggested I get some..I do need a couple hundred pounds of rice and will pick up another couple hundred of wheat..he was saying things aren’t looking to good..lots of notices of product shortages..

Crypto:

As I noted a week or two ago my belief is that based upon PAST BUBBLE dynamics that Crypto which peaked in value at somewhat over $3 Trillion Dollars, and is now down to the $1 Trillion Dollar range, would at least HALF AGAIN before the sell off was complete, or AT LEAST an 85%+- haircut from the top. (it could decline even further)

Some may have thought I was picking on Crypto with that comment, but in the history of bubbles that has been a very typical DROP FROM THE TOP, from a very hyped financial emotional high, time after time. That was what happened to Silver after the 1980 Hunt Bros debacle, that is what happened to Oil, that is what happened to Gold, that is what happened to the high tech bubble of 1999/2000. That level of haircuts is NORMAL!! (and sometimes the haircut from the top is 90% to 93%).

Well yesterday one of the established players in the field of Crypto Land, probably the biggest player, Coin Base, got hit with an SEC investigation … ie: MORE troubles in Crypto Land. Not surprising since Crypto Land was filled to the gills with SCAMS and HYPE, so much so it makes the old Vancouver “Penny Stock” Exchange look like a place that was populated with people who were paragons of virtue who were honest as all get out!

As the economy continues to decline average Joe will have LESS money to invest in Crypto AND those most inclined to invest in that “new” financial product will be the ones who invested in it in the past!! … but ALL of those types are already sitting on large embedded losses from their previous foray into that corner of the financial world. In addition there is STILL LOTS of leverage left to be unwound in that entire arena.

Sell offs from Emotional Bubble Highs in the financial world are NOT generally complete until most of the leverage is squeezed out of the product that went through the bubble … and I have yet to see being the case in Crypto Land

MORE scams to come to light.

MORE thefts of coins by the firms that were holding them to come to light

MORE losses by crypto firms to be recognized as clients are unable to pay back the loans they took out, which will bankrupt MORE cryto firms

Interesting to watch unfold … from the sidelines.

“Keeper: Got your mega ticket? Mega Millions odds: With jackpot at $810 million, is it worth shelling out $2 for a ticket?”

Hmm what would I do with that much money…

The first thing I think of.. is let’s splurge and fill the tank on the buggy…

Take the boss out to eat

Build a solar tower..

Help out cancer patients

That’s $10 million. What about the remaining $800 million?

If you take the annuity option to maximize the payout,

$810M x .65 (taxes) / 30 years / 12 months = $1,463,000 per month for 30 years. Again, PER MONTH after taxes.

We all can make a short list, but 360 of them? For perspective, the Maryland Food Bank commits $68 million per year on food collection and distribution (source Charity Navigator.org).

Good luck to all!

You may have some competition. The owner of a chicken franchise here bought 50,000 tickets – one ticket for every employee. If any one of them hit he’ll split it between his employees.

Wonder if it’s too late to apply for employment there?

For some time I’m getting these personalized emails about life insurance: 250 K for 15 per month with no examination and no questions asked.

a) How do they make money?

b) If illegit why isn’t this being taken care of?

The insurance is “level term.”

There’s a two year buffer between when you start paying and when your heirs are eligible for a payout.

“Shares” are $15/mo. You must buy a number of shares to yield a $250k payout. The number of shares you must buy to net that $250k payout is variable, and increases from “one” if you buy in when you are young, to probably 1000 shares at your age (94?).

It is the “Colonial Penn” scam — perfectly legal and completely immoral, or it is a Nigerian scam, designed to run in the real world for 2-3 weeks, and then the perps disappear with however-many $15 payments they’ve pulled out of the anonymous P.O. Box they set up, in that time.

TNSTAAFL!

(Also, caveat emptor…)

Welp, they did it again. Big come-from-behind victory thanks to “the machines” for Colorado’s Secretary of State race. Just like Slo-Joe’s victory.

“On Tuesday, June 28, a no-name political operative who sits on the Board of Directors for Mark Zuckerberg’s private election mafia the Center for Tech and Civic Life (CTCL) won the Republican primary Secretary of State race in Colorado.

Popular conservative and MAGA candidate Tina Peters was leading in the polls and had a 15 point lead on her closest competitor Pam Anderson before the votes were counted.

But Pam Anderson from Zuckerberg’s CTCL had the night of her life and defeated Peters by 20 points.”

https://www.thegatewaypundit.com/2022/07/will-bring-evil-empire-huge-update-candidate-tine-peters-raises-funds-recount-stolen-colorado-primary-race-incredible-achievement/

But Ms. Peters had NO problem raising the money for a recount for such an obvious fraud. People are fed up with The Steal! Now all she has to do it work through the political machine that keeps the criminals in office to get a fair hearing.

Bill, havent you heard,

Dems giving MAGA candidates $$, making the MAGA Republican candidate easier to defeat than a non-MAGA in Nov.:

https://www.newsweek.com/democrats-have-spent-20m-trying-help-trump-loving-gop-candidates-win-1716353

Now that’s full on delusional – at best! That would be like saying U.S. industrialists funneled support to Hitler in order to insure there would be a global war that we could win and then enjoy a period of global dominance.

Oh…wait….

Democrats already have a bill to lower drug prices:

https://khn.org/news/article/medicare-drug-price-negotiation-senate-democrats-legislation/

It’s your Repugnantlicans (McConnell) who are opposing lowering drug prices (G, quit making Biden your scapegoat, it’s a boring uninformed and lame way of covering up the inflation machine of the Republicans!:

https://www.durbin.senate.gov/newsroom/press-releases/durbin-if-republicans-really-care-about-inflation-why-are-they-opposing-plans-to-lower-prescription-drug-prices

“Toto, there’s no place like home!”

Thanks for the link to the story of the San Fran house sale by the CZI LLC to a Delaware LLC. The latter shows registered two months ago in New Castle, De. In other New Castle neighborhood news, the President remained at the White House last weekend rather than returning home according to the public schedule due to his covid-19 diagnosis.