Busy as hell around here (though I know it has been coming). Spring is in the air and for one old man, two deck plans and a generator shed plus greenhouse repairs, plus… well, to the column, huh?

VIX, Volatility, and CFNAI

We figure another hard down (or blow-off rally) will happen this week. Because of bank settlement day Wednesday. Which you don’t read much about – because when I put it to AI, what I got was an admission that there’s not too much written about it:

“There is some evidence suggesting that institutional timing—like bank settlement days—can affect market liquidity and trading behavior, which in turn may influence volatility around those days. In some markets where settlements occur on alternating Wednesdays, researchers have noted that trading patterns (and hence volatility) may be somewhat different just before or after settlement days. For example, liquidity adjustments (as banks mobilize or absorb funds for settlements) might cause a temporary spike or dip in trading activity, which can be reflected in volatility a day or two either side.

However, the research is not entirely conclusive. While studies on day?of?the?week effects sometimes point to midweek anomalies that could be partly driven by settlement procedures, other analyses find that once you control for other factors (like information releases or general liquidity cycles), the specific impact of settlement days is less clear. In short, although a correlation is plausible in some settings, it does not appear uniformly across all markets or time periods.

Further, the magnitude and even the direction of such an effect can depend on the details of the settlement system and the overall market structure. More targeted research with high-frequency data would be needed to isolate the impact of bank settlement days from other calendar effects.”

Still, you can step back a ways and see that when changes of macro trends are in the air, there are lumps and bumps over a top which are useful to study. Some – arguably like Warren Buffett – will see the trend early and will jump ship before sinking. Warren Buffett Defends His Growing Cash Pile – WSJ is mostly on point.

And one key trend we will learn a lot more about this week is the future of AI. I’m betting on the software side of things, but we will know more about hardware – like all those high-end repurposed GPU designs when Nvidia earnings live: what to expect as the AI semiconductor giant announces results. I may have a lift to lead, so watching is not high on my priority list, but let’s go over to our Ebbinghaus model and see what future may portend.

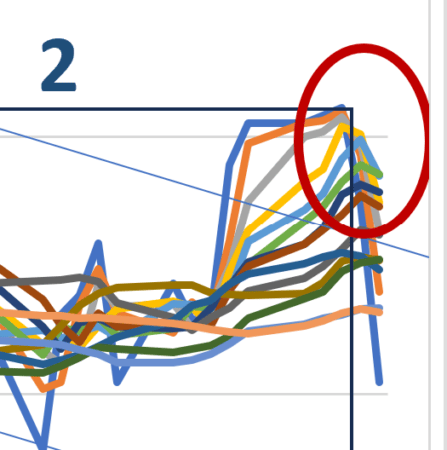

Here’s is the zoom-in based on our Ebbinghaus-Ure model as of the close of the NASDAQ last week. The current closing number is the medium blue line that fell off a cliff Friday. Notice how it even goes below the lowest orange line?

The red circled area is what I was yelling about how we should be “Looking out Below” and then, well, you see what happened…above.

Now, here’s the point: The lowest trend line (pieced by the light blue) is a kind of puke-orange-salmon color. (Not our pallet, but whatever…) This is known around here as “Sheet!NX60” and specifically Series 14.

Which could be anything, but it’s not. It’s our half-cycle indicator, a 42/43 day moving average of the tech market. But my point is simply this: We have seen in other market moves how the Aggregate Index comes down to the 85 DMA and gets a rally going. We’re almost there, so bounces are possible.

We also know that when we had a little nosebleed like Friday, the Thanksgiving break, the decline did not go below the 43 Day. It hit just below the 20 day moving average but then stayed above that moving average until December 18th. We will talk more about Ebbinghaus on Peoplenomics Wednesday.

For now, the least surprising future based on trading in Europe and such would be an “inside day ” today, not going above Friday or lower. Then, with the VIX (volatility index) coming down, the Bulls ought to put on a “buy the rumor” ahead of Nvidia earnings.

Then we will be in position to break again. (We don’t know IF we will, but weakness going into NVIDIA might be taken as potential good news coming. Or the reverse if we rally. Because somewhere, someone, already knows and will set the stage to stack a little cash.

To Hold GOLD???

OK, the OTHER big mover this week *(outside Ukraine and Hamas being pricks again) is 400 tonnes of gold reserves at Fort Knox: US President Donald Trump to ‘find out’ how safe the repository is… IF we get a tour and IF it’s live (as Musk has mentioned) THEN we could see an explosive more up (or down) from around present levels.

As one reader noted, there are lots of claims about how much gold is “paper” and how much is physical. So we put the question to our (ChatGPT) AI pal:

“• For gold, the universe of paper instruments (futures, options, ETFs, and other derivatives that “represent” gold) is often estimated to be roughly an order of magnitude—or around 10 times—as large as the available physical bullion. In other words, for every ounce of gold sitting in vaults or held by central banks and private investors, there might be claims on roughly 10 ounces of gold traded on paper markets.

• For silver the discrepancy is even greater. Because the physical silver market is much smaller relative to the explosion in derivative trading, some estimates suggest that paper silver may be anywhere from 30 to 50 times (or even more) the physical silver available.

It’s important to note that these figures depend on how one defines “paper” (which instruments are counted and how they’re converted into a physical-equivalent weight) and that market conditions and reporting methods change over time. In short, while no single authoritative ratio exists, a commonly encountered ballpark is around 1:10 for gold and perhaps 1:30–1:50 for silver.

Still, if you round off a bit, gold at $3,000 times 10 could be around $30,000 an ounce. Silver could be (even at 1:30) $990 – call it $1,000. At 1:50 it’d be around $1,650.

Of course, if that happens, the Ures will take a few days off to move to a huge compound on a lake somewhere. But, likely not.

See, there’s a trick to this paper gold thing most people don’t think about. The FedGov has historically valued the gold at $40/ounce. Does this mean there could be paper leases on America’s Gold? Well, sure. All the Audits of Ft. Knox (and don’t leave out the NY Depository!!!) wouldn’t resolve the truth of that. UNLESS Trump were to compel the Fed to release ALL LEASING ACTIVITIES AROUND GOLD.

Bet there’d be some hand-wringing and bed-wetting on that prospect, huh?

OK Eventually we get to…

CFNAI

A tad weaker:

“The Chicago Fed National Activity Index (CFNAI) decreased to –0.03 in January from +0.18 in December. Two of the four broad categories of indicators used to construct the index decreased from December, and one category made a negative contribution in January. The index’s three-month moving average, CFNAI-MA3, increased to +0.03 in January from –0.13 in December.

The CFNAI Diffusion Index, which is also a three-month moving average, increased to +0.10 in January from –0.07 in December. Thirty-nine of the 85 individual indicators made positive contributions to the CFNAI in January, while 46 made negative contributions. Thirty-four indicators improved from December to January, while 50 indicators deteriorated and one was unchanged. Of the indicators that improved, 10 made negative contributions.”

Stock futures remained pointing for a hard bounce up at the open.

Sorry for Our Prescience

(again)

Let’s go back to our Valentine’s Day column on the 14th. Where I wrote “… Say, you don’t think the movie Conclave was a message in advance, do you?”

We have movement on both the movie and the Papal front. Pope first (we go by seniority around here. He’s looking at possible early signs of kidney failure. But the prayers and happy-talk continue: Pope Francis, in Critical Condition, Is ‘Resting’ in Hospital, Vatican Says – The New York Times

Now, on the movie, Conclave, cast and crew won for ensemble at the (assuming you remember SAG is the Screen Actors Guild) SAG Awards Winners List 2025: See Who Takes Home The Trophies.

Scrolly Rollers

In other Holy Scrollers! today:

The Ukraine War cha-cha continues to entertain: Foreign leaders visit Ukraine to show support on war’s 3rd anniversary. We don’t see it as anything other than a management tool of the global elite to keep making up jobs to make more useless shit (to put in storage units) as I outlined in my book The 100-year Toaster. Which continues to be one of the least-read books on Amazon, lol. Point of that book is that planned obsolescence has been a dandy escape from genuine human spiritual advancement. But, not like we need any more, right?

We continue in awe of the Trump H.R. picks. It just keeps getting better and better: Who Is Dan Bongino? Right-Wing Commentator And Ex-Secret Service Agent Named FBI Deputy Director. We’re just guessing Senator Schumer won’t be thrilled…but only Monday morning spidey-sense.

Except for the “trade dress” issues, we’d do a Good Housekeeping award for: The Trump administration is putting USAID staffers on leave worldwide and firing at least 1,600.

Germany conned again. (Why can’t these people do better picking leaders?) German election victor Merz plans pivot from US as coalition talks loom. Plans pivot from suckling us and Ft. Knox? Naw..all for show. Same leach class, new marketing campaign.

BTC unable to break over $97,000 for the weekend. US Bitcoin ETFs lose $1.14B in two weeks amid US-China trade tensions. Well, that and and a hack, right? But hype springs Eternal in the wallets of humanity: Montana House Rejects Bold Bitcoin Reserve Bill: A Missed Opportunity? We were looking for Montana ranchers to start raising “virtual cattle” if this had passed…

OK, some Actual thoughtful perspective now: Designing For Gen Z And Alpha: 5 Insights From The Next Generation Of Innovators.

And to wrap the headline scan, since I have a daughter with peanut allergies, this is of keen interest: Peanut Allergies: The Hidden Environmental Factors.

Around the Ranch: Rural Fiber Fairytales

Let me say up front that this is a rant about media impact on du jure segregation. Where (if you cut Latin ) “De jure segregation is the legal separation of people based on characteristics like race, religion, gender, or age. It’s enforced by laws and government policies. ”

This frenzy of ADHD-crazed thinking was touched off by my remarks about the virtues of “two or more remotes” for every electronic device. Which was in the ShopTalk Sunday column here.

See, when I was growing up (on the side of Beacon Hill in Seattle), my pal of 73 years, the Major, lived up the hill from us by a hundred feet of elevation, or so. But small as that may seem, it meant that he had great television reception on some channels that didn’t even show up on our screens.

You see, in the early days of television, the amazingly high towers for transmitter antennas were not around. As a result, since V and UHF TV travels like a light beam, only the highest income parts of town got good TV. Stations went where the money was.

Now, in Seattle (the ghetto) part of town (always reverently The Central Area) had some pretty-well shadowed signal areas. As a result, the backside of Capitol Hill was always “in the dark” so to speak. One of the slowest areas in town to benefit from housing inflation.

Now walk with me out to the power pole in the front yard, where about 30-feet of fiber is neatly aging in place. We were supposed to have Rural Fiber in here at least a year ago. Nope.

One excuse was an industrial accident (a fatality) so work stopped for months while lawyerization moved along. Then, the money hasn’t gotten from Spectrum to the system builder year (goes the story, anyway) so work is stalled “We have to finish the first section near Athens (texas) before we can run your fiber…” went the conversation with one supervisor.

But now, we get to the “social engineering aspects” of not getting Rural Fiber finished: We think that the Universe is arranging for as many City Hostages as possible. Yep. Keep ’em in the mid-rise buildings and not building deer stands…I can visualize the greedsters planning your 250-square foot future now.

“Hey, if we sell them an 8K VR headset so everywhere in their 250-feet of living space can pretend to be somewhere else, hey wouldn’t that ought to keep them happy, huh?”

We haven’t drunk the Kool-Aid yet.

But behind the headlines, we can hear the tinkle of the ice in the glass pitcher being stirred. And that face in the frost on the pitcher…wait, wasn’t he a news anchor back when we had local news on teevee?

How digital paywalls are quietly reshaping (and reducing) local news coverage.

So are inexcusable delays finishing Rural Fiber. There may be Trump. But we still have bullshit bureaucracies. Useful to keep housing segregated, ain’t it?

Write when you get rich,

George@ure.net

the bigger the boat,,, the longer the turn radius,,,

this ship of state is a big one,,, Capt Trump is turning as fast as conditions allow,,, while fighting the pirates of the bureaucracies.

pirates and GOLD,,, hummm

Did you know back in the day, Women in British Honduras/Belize today used to dribble RUM on their Breasts to sooth teething Babies? The Pirates around here called Belizean Rum “titty rum”, thus the Historical proof needed to get Big Titty Rum name all official and what not.

In case anyone wondering, Yes I have been passive aggressively accused of Sexualizing big titties by a more than one “Karen”, while out and about walking my pair of Jacks while wearing a Big Titty Rum T-Shirt, one time with my Wife standing right next to me. The accusers are NEVER attractive, always “fugsters” with dyed strand of hair amongst their otherwise conservative hairdo’s. Aa pattern has emerged..

Anyway the owner, Frank, is a real Swell Guy – https://www.bigtittyrum.com/

“Untile George has to ban him, again.” There fixed that for you.

That by far is the clearest easiest post to read of yours to date !!!

I even scrolled back to the top of the post to make sure it was YOU !

Gold –

“how much gold is “paper” ”

.gov can own all the gold and still paper trade. .gov has the power to bust the trade. Look at what .gov did with GM and everybody went along. That’s the way it works. Or .gov calls it. Pound sand and have a nice day.

Fractional Reserve Gold?

…as long as you have enough actal physical material to meet any redemption demands..

“Aye! There’s the Rub!!”

Had to laugh about the Outhouse and lack of inside water comments yesterday. Know the Frostbite Cheeks sitting in the outhouse well. Taking a bath in the water tub placed in the kitchen as the wood stove was there.

Just remember all of that was our White Privilege!

Mom picked cotton also but how many pictures to you see of whites picking cotton?

Cheers – Another day and another disaster.

I have to add my Dad and I (at 8yrs) had to walk 1/4 mile to get buckets of creek water for mortar for the cinder blocks he was building our basement with.

Mom grew up in Upper Michigan. She said they hung a toilet seat indoors near the back door where it kept warm. In the winter you took the warm seat out to the outhouse with you to sit on. That worked for the first 30 seconds or so when it was below zero. Then you sit on your hands. Watching Alaska real estate shows of ‘dry cabins’, it seems now that the preferred outhouse seat is well carved blue insulation foam.

Large compound on a Lake somewhere ?

How does 150 acres in Winnsboro Lake area strike Ure fancy ? Can be Ures for the right price..BTC or Gold/Silver. No Funny money! There is another 150 acres adjacent – mineral rights are intact. Youse want them – youse got to Pay up, but Always willing to listen. Weyerhaeuser is currently managing the Trees..Loblolly Pines(SouthernYellowPine). Got folks interested in hunting compound..cabins and what not – we shall see.

In other news – held SHORT over weekend – QQQ & SPY …too many moving parts right now to be comfortable – ahhh but at least BRK-B is hitting ATNH’s ..”steady eddy”. Also still playing with Dividend Paying PM companies – do Ure own research…Shark infested, Algo/Ai infested waters require extreme caution..like having to fight entire gang of yakuza…Kill Bill splatter scenes- https://youtu.be/GkLbzkFM4B0?si=LpL_isqq9Q9KGQwl

..Dont be a victim, everyone knows that Sharks will rip Ure Arm off, well some of em..whoopwhoopwhoop-https://youtu.be/RnXgEuH2XRU?si=vReUSQVmCm3mNkBs

lol lol lol

I heard a story.. an increase in multiple flights inbound to Fort knox!!!

dam that’s funny … all before theres a possible inspection of the vaults.. lol

what would I do if I was Trump.. people have questioned what our reserves have been for decades..when there should be an audit every few years..

I think they are playing a shell game..hide the pea so flying in gold for the inspection…

lol lol then as soon as they do..drop the oligarchs..you know sleazy sneezey Dumbo and jackle.then go on the gold standard..redo the dollar..

MARTIN ARMSTRONG: In both world World Wars, capital fled Europe for the US, strengthening the dollar and driving up gold demand as a hedge against uncertainty. Gold doesn’t necessarily move with inflation but reacts to geopolitical instability and loss of trust in institutions. If conflict escalates in Europe, capital outflows could once again drive gold higher, similar to historical patterns. There is a reason we are witnessing a mass exodus of gold into the US.

As far as a matter of confidence is concerned, DOGE’s search into Fort Knox could have many questioning if gold is indeed safe in the US. We are certainly living in a time of mass political uncertainty.

https://www.armstrongeconomics.com/markets-by-sector/precious-metals/gold/london-offloading-gold-to-new-york/

Guitarist Bill Frisell performs ‘Goldfinger’.

https://www.youtube.com/watch?v=J1meUGGtYzo

Nice.

..but did you know the “Beast” of revelations was good guy ?

Did the orange gullum of greatness not survive a Head wound ??

Is he not now making PEACE around the world ???

hmmmmmm

G wrote:

“… “Hey, if we sell them an 8K VR headset so everywhere in their 250-feet of living space can pretend to be somewhere else, hey wouldn’t that ought to keep them happy, huh?” …”

Hey … I resemble that remark!! (mid 80 inch 4k tv)

This past weekend I traveled to Sicily and found it enchanting with NO demanding of my money from the mob

I also revisited some of my favorite places in Switzerland … fabulous visit

My Rome visit allowed me to visit a few places I hadn’t yet been to so it was wonderful too

Still looking to again visit the Hofbräuhaus but without all the extra noise of the crowd and seeing the female beer servers wearing bustiers that comes from being there in person I am not sure it would be a good visit. Think I’ll hold off on that one.

If you haven’t tried traveling the world in 4k while sitting on your couch you need to try it!! No street crime, no overpriced trinkets, no bad hotel room, no stress about making your plane or train on time.

Now to find some Door Dash Food that matches up to the locations I am visiting so I can sit on the beautiful terrace overlooking the bay at Santorini while having a wonderful Greek Dinner and gazing down at the cruise ships floating on the sea below. Already have some Greek Wine in the stash ready to open!

(youtube is where you find the 4k, and even 8k, travel visits)

You HAVE heard that Santorini is earthquake rattlin’ and fixing to blow, right?

No problem!

It is NOT blowing up on my mid 80 inch 4k TV as I sit having a wonderful Greek Dinner with Greek Wine while sitting high above the bay looking down at the sight of those “miniature” cruise ships that are anchored way down there in that former caldera of a huge volcano.

Ah … I feel like I am there!

But you missed the cavity search and toupe slicer for aisle 2…

I believe it was Helen Keller that said something like this: “The good ole days? When you get up at three in the morning in a cold dark room and look out the window to two feet of freshly fallen snow and the outhouse is ten feet in back of the chicken coop. It wasn’t so great.”

I “see” what you did with your post.

Alexander Graham Bell her lifelong sponsor would ether chuckle, roll his eyes, or make some very fast hand gestures!

Grok 3 [xAI Chatbox ] predicts Bitcoin will dominate in 2025 with a year-end price of $180,000.

– Grok 3 is the latest release of Elon Musk’s xAI chatbox. Which he proclaimed is the smartest AI in the world. [ well.., you didn’t actually think he would call it the dumbest., did you? ]

Microsoft’s AI Chatbox ‘CoPilot’ answer to the same question:

“Some forecasts suggest that Bitcoin could reach around $160,000 by the end of 2025, driven by factors such as institutional adoption, favorable regulatory environments, and increasing corporate investments. Others believe that Bitcoin’s price could hit a maximum of $170,000 in 2025.”

What used to be venus seems brighter now.

https://a2.beforeitsnews.com/spirit/2025/02/nibiru-dr-sam-hercolubus-the-modeler-of-the-earth-given-february-20th-2025-2524569.html

“There is nothing in the Constitution that says ordinary citizens have the right to see what we spent our tax dollars on!”

Elizabeth Warren – January 30th 2025 [ yelling at the press.]

.

.., and there-in lies the main problem with career criminals. The “ordinary citizens” are no more than fodder. We simply do not count as long as they count our votes.

A senator who thinks that way ought to be put out to pasture. Soonest.

“A senator who thinks that way ought to be put out to pasture. Soonest.”

Only if that pasture is inside Leavenworth.

You have to give people who are Indians, even if fake, and an ex Harvard Professor who got their job legitimately, by an early version of DEI since otherwise unqualified, some slack.

She occupies the same Senate Seat that Ted Kennedy occupied and everyone should have learned a few decades back even MURDER does not disqualify a person from being a US Senator from Massachusetts as long as they have strong ties to Harvard.

I sit in awe of your “chappy” memory for detail

The hell of it is, not a single one of these fools believes the money they so-cavalierly piss away is ours, not theirs.

BTW (and Attn: LOOB) (Senate majority leader John) Thune is requiring the Senate to be in session on Fridays, and all Senators to be present.

If’fn y’all think the deadbeat bureaucrats are hollering about having to come back to work, you should hear some of the Dems in the Senate…

U.S. Constitution, Section 9:

No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.

Seems pretty clear to me, Lizzy.

That’s how sghe got to be Poke-and-taunt-Us

y’all would rather believe obvious lies because it aligns with your preconceived opinions than the truth. the pathetic thing is you all keep going back to the same liars and believing more lies, like you’re unable to learn. not a good survival strategy.

https://www.snopes.com/fact-check/elizabeth-warren-tax-dollars-quote/

https://www.politifact.com/factchecks/2025/feb/11/instagram-posts/no-warren-didnt-say-citizens-dont-have-the-right-t/

https://www.usatoday.com/story/news/factcheck/2025/02/17/quote-elizabeth-warren-tax-dollars-fact-check/78966887007/

https://www.reuters.com/fact-check/false-quote-public-spending-transparency-attributed-elizabeth-warren-2025-02-17/

what do ya know? even a blind hog finds an acorn, once in a while.

the factcheckers sure jumped on this fast, kind like it was planted, just to be exposed as a lie from the right side, when it appears to be a deep state plant, as mis-info, that they can they use, to support their crack check propaganda.

Let US know when ya track down the original source, instead of just saying,,”look , they are posting lies”,,, who started the story?

smells like a trojan horse,

she still is a fake indian, lies she told, so why defend her?

she is in trouble, and needs a little help from the propaganda team,,, so why not start the lie themselves ,,, then come to the rescue, and factcheck it

I asked google and it did not have a source

https://search.brave.com/search?q=who+first+posted+%22++%2C+Warren++say+citizens+don%E2%80%99t+have+the+right+to+know+what+the+government+spends+money+on%22&source=web&summary=1&conversation=6c3ed6fad65c628e830a0b

but lizabitch did say

“Here’s something President Donald Trump, Elon Musk, and I agree on: the federal government throws away trillions of dollars on wasteful spending. I have spent years trying to squeeze government waste out of our budget, and I’m ready to work with Musk to make government more efficient and save taxpayers money. But here’s the thing: we need to focus in the right place. Instead of cutting help for people who rely on Medicare, Social Security and the VA, let’s focus on the billionaires and billionaire corporations who are feasting off the American taxpayer.”

https://www.warren.senate.gov/newsroom/op-eds/sen-elizabeth-warren-trump-musk-and-i-agree-on-something-important-and-ive-got-30-ways-to-get-it-done

if she really want to attack billionares and save our tax dollars

why o why, has she not stop the USAID funding that goes to sorass and the open society?

years she said, but Elon and the DOGE have found it in under a month

But , you liddle truth, keep on posting for me, thank you

tobD

The U.S. Trade Representative’s office has proposed charging up to $1.5 million for Chinese-built vessels entering U.S. ports as part of its investigation into China’s growing domination of the global shipbuilding, maritime and logistics sectors.

USTR said in a January 16 report on a probe that China increased its share of global shipbuilding tonnage from 5% in 1999 to over 50% in 2023 because of massive state subsidies and preferential treatment for state-owned enterprises that are squeezing out private-sector international competitors. The agency said that U.S. shipyards were building 70 ships in 1975, but just five annually today.

So.., let’s all gather around the docks, hold hands, sing patriotic songs and then punish China for foreseeing what was going to happen.

.., and what will they do in response ??

“punish China for foreseeing what was going to happen.”

That’s not why we’re surcharging them…

“We continue in awe of the Trump H.R. picks. It just keeps getting better and better: Who Is Dan Bongino? Right-Wing Commentator And Ex-Secret Service Agent Named FBI Deputy Director.”

Ex New York City cop and Secret Service agent…

I was seriously hoping Mr. Trump would pick up Dan Bongino. Actually, I was hoping he’d make Dan head of the Secret Service, but I’m okay with this, too…

BTW:

NBC News: FBI agents express shock and dismay over naming of right-wing podcaster to No. 2 post

USA Today: Who is Dan Bongino? Trump announces podcaster as FBI deputy director

Newsweek: Stephen King Deletes Social Media Posts Attacking Dan Bongino

Etc, etc. Note, the low-information / low-intelligence crowd is being fed the line that Bongino is a “podcaster.” I doubt a one will mention that he served on Obama’s personal detail…

My negotiation service now has my ISP down to $50 a month and pocket change. Magic Jack is still less than $4 a month for the VOIP. Unlimited 5G (35 GB) cell is $26 a month. Given that I am telecommuting, and move significant data daily, and stream a lot of media content after work, I figure I have pretty quick ROI on the comms I have, such as they are. I can handle work data, comms and meetings; I can stream without interruption.

Maybe one of you comm and/or media experts can convince me as to what I am missing by not having VR capability ?

I don’t see any ROI for incremental additional service opportunities that VR provides that I am not already getting with a big 4K monitor. Not a gamer. Convince me of what I am missing, and what it will do to enrich me. Looks like a time waster.

Talk to us about your negotiation service?

It’s part of the Experian credit monitoring package. They have a list of outfits they negotiate with routinely. It is mostly comms and alarms. They also have some services for finding less expensive insurance, but to date, I have not gotten anything out of those. The basic credit monitoring, credit lock, dark web monitoring and identity theft insurance are included. I have used other services that were cheaper, but the Experian is solid, and I have used it longer than the Others. I would call it a love/hate relationship deal. They screw me over, I complain to no avail, and a couple of weeks later it gets fixed by magic. My leading question to them when my credit rating dives for no good reason is “Is someone gaslighting me for retaliation, AGAIN ? My credit rating over a period of years has taken on the appearance of an Aussie bush saw blade.

According to the Federal Reserve., the current home owner insurance crisis could make it impossible for some areas of the country to obtain a mortgage for many years.

Agreed. And in those areas what will be the numbers for new housing permits & completions ? How many “areas” ? [ The Fed didn’t say.., but implied it was big.]

Could this significantly affect / impact the total numbers on new housing starts and completions ? Would any developer / builder actually build a new ‘house’ when they know it can’t sell due to no insurance available ??

MSDNC cancels Joy Reid…

https://www.cnn.com/2025/02/24/media/msnbc-lineup-schedule-reid/index.html

______

The New York Times: Associated Press Sues Trump Officials Over White House Ban 3 days ago

The New York Times: Judge Declines to Intervene in AP Lawsuit Over Trump Access 23 minutes ago

“We’re going to keep them out until such time as they agree that it’s the Gulf of America.” trump

clear cut viewpoint discrimination. government can’t force people to say something or not say something. be careful what you wish for unless you approve of government dictating speech.

“[Judge McFadden] urged the Trump administration to reconsider its two-week-old ban, saying that case law “is uniformly unhelpful to the White House.” “It seems pretty clearly viewpoint discrimination,” McFadden told Brian Hudak, a government attorney. “The White House has accepted the correspondents’ association to be the referee here, and has just discriminated against one organization. That does seem problematic,”

I missed the part of the Constitution where view point discrimination is illegal? Can you redirect please?

they really need to start teaching basic US civics in schools again. i’m gobsmacked that kids can graduate high school without ever having covered constitutional law.

ok, the first step to understand is that the US has two systems of law running concurrently. there is a civil system and a criminal system. you characterized what is an alleged violation of AP’s first amendment right to speech and fifth amendment right to equal protection as being potentially illegal. that’s your first error. there is nothing illegal about the government violating someone’s first amendment rights. the AP v. trump is a civil matter.

next up sources of american law. the jurisprudence of american law comes from the US constitution, statutes, regulations and case law.

although the constitution doesn’t mention viewpoint discrimination the doctrine has existed for hundreds of years. an example may help, let’s say that some high school allows student groups to meet after school in empty classrooms. everyone gets to meet no matter the club’s purpose. administrators really don’t review the club’s purpose. then one day a group comes along that wants to save squirrels. the principal hates squirrels so forbids this particular group from meeting. that’s viewpoint discrimination, government treating different speakers differently depending on the content of their message.

if you’re an originalist maybe you can point to wherein the constitution it says you get to marry the person of your choice? or point to the constitution where it says you have a right to privacy? or to vote?

here’s a case about a flag flying over boston that the city didn’t like the content of and tried to prevent. that’s viewpoint discrimination. https://harvardlawreview.org/print/vol-136/shurtleff-v-boston/

Doctrine and case law is why the first victim of any courtroom proceeding now is a travesty of justice.

The court systems exit but their asdministration has gone to shit. Privvy’ed women can get away with shit that would land a man in jail in some states,….and perfectly (more) competence people are advanced on racist grounds.

Nope – go spew erlserwhere. a AP has its recent head up its butt trying to “steer the heard” rather than be a reporting media of record. See everything since the floyd case and if you can’t spot woke, you’re dumber’n shit. And we don’t run daycare here.

i don’t doubt in your mind GU that white christian males are the victims of women and BIPOCs. evidently you feel it’s a good idea for the government to force the media to use specific words, terms, phrases and language. careful what you support. and that the AP is on some sort of woke campaign.

i disagree on both.

btw the AP is an international organization. it would probably create problems if the AP started referring to the gulf by a name that the other 194 countries on the planet don’t use. what was trump’s purpose/goal in renaming it?

Actually, you failed to address two out of two.

1. Law is lopsided in America. Especially when women are give 20-years (to unlimited) time to claim assault. Men are not. That pa; is the face of inequality. Women (and POCs) still regularly get jobs where WCMs are more qualified Because when equality leaves, so does justice. Discriomination of your radical left sort arrives.

2. The AP, regardless of having never worked for/with them (I was on the board of the AP Broadcast Associationopublications Commitee in my news-chasing days) has become a woke-change-minority champion at the cost of jnournalist accuracy. Under US law, people in the country illegally are “illegal aliens” and the AP no longer accurately uses this term.

Your stance reminds me of one of Pappy’s old sayings about faux moralists (which you seem head on the path of): “He so phony he whe wouldn’t say shit, even if he had a mouth full of it.”

Now, not another word or off to the penalty box. My house, my rules.

You defilers can Run,

but ya cant Hide..https://edition.channel5belize.com/belize-detains-foreigners-wanted-for-crimes-in-guatemala/

Screaming with VENGENCE -https://youtu.be/fHHBDK-vq0E?si=YN7Ek2ks0cWgV0Xh

A new poll by Harvard CAPS-Harris reveals the majority of the country backs President Donald J. Trump and his actions to bring much-needed reforms that are making America great again.

Americans overwhelmingly support President Trump’s agenda.

81% support deporting criminal illegal immigrants.

76% support a “full-scale effort to find and eliminate fraud and waste in government.”

76% support closing the border with additional security and policies.

69% support keeping men out of women’s sports.

68% support government declaring there are only two genders.

65% support ending race-based hiring in government.

63% support “freezing and re-evaluating all foreign aid expenditures and the department that handled them.”

61% support reciprocal tariffs.

60% support direct U.S. negotiations with Russia to end the war in Ukraine.

59% support cutting government spending already approved by Congress.

57% support ending the ban on new offshore drilling.

Americans strongly support President Trump’s effort to root out waste, fraud, and abuse in government.

77% support a “full examination of all government expenditures.”

72% agree there should be a government agency “focused on efficiency.”

70% say government is “filled with waste, fraud, and inefficiency.”

Two-thirds say Congress should join the “effort to reduce government expenditures.”

Americans back President Trump’s action to protect American workers.

61% support reciprocal tariffs.

57% say tariffs are an “effective foreign and economic policy tool.”

54% say tariffs will help get “concessions from other countries.”

ICYMI: DEPARTMENTS TOUT RESULTS AFTER PRESIDENT TRUMP’S HISTORIC FIRST MONTH

https://www.whitehouse.gov/articles/2025/02/icymi-departments-tout-results-after-president-trumps-historic-first-month/

re: “media coverage and segregation”

feat: Marvel-lous?

Folks,

Tots of rum all around; welcome to the twilight zone! I checked the film listings currently playing at 24 multi-screen movie theatre’s in a 25 km. radius around Kiev, Ukraine. 22 of the 24 lead off with “Captain America: Brave New World” starring Captain America of Marvel Comics fame.

Zero screens are showing “Putin: a work of fiction based on fact” which was supposedly issued in mid-January. It’s an English language Polish production whose writer, director, and producer apparently will answer to a pseudonym of ‘Bezalel’ (from “The Bible’s” Book of Exodus?). The actor portraying Putin is allegedly AI-enhanced in the film. Here is a YouTube link to a trailer of the “Putin” movie:

https://youtu.be/k_JNwT4Td2Q

Speaking of ‘Exodus’ and President 4%, the Eastern European media offers a couple of observations from an elected deputy of the Ukrainian Rada (parliament). Earlier in February they voted to go ahead with the Ukrainian-American installation of two nuclear reactors ‘made in Russia’, and no longer required by Bulgaria. Here is the web link Turkish state-run Anadolu News Agency:

https://www.aa.com.tr/en/europe/ukrainian-parliament-votes-to-support-purchase-of-russian-made-reactors-from-bulgaria/3479155

The same Ukrainian deputy quoted in the Turkish report also appears in a Bulgarian article about a Ukrainian Rada vote today. The President has fallen 8 votes short of extending his term. Here is a link to the report from Bulgaria’s “Fakti” (which may be a subsidiary of Serbia’s “Rezon Media”?):

https://fakti.bg/en/world/952282

I strongly, strongly, STRONGLY suggest everyone invest 20 minutes to watch this clip:

What the Future Will Look Like, Predicted by Grok AI

On the one hand, we can access information, complete tasks, and solve complex problems faster than ever before. On the other hand, there’s the constant fear that it will become too smart and take over the world.

This is a legitimate concern considering that every time we turn around, a newer, smarter version of AI is being pitched to us.

Just last week, xAI, the artificial intelligence company founded by Elon Musk, launched Grok 3 — a chatbot Musk himself described as “scary smart.”

Glenn Beck, curious about this latest and greatest technology, conducted an experiment in which he asked Grok 3 about itself, artificial intelligence in general, and what the future might hold.

https://www.youtube.com/watch?v=j_Iuf-lwEpE&t=2s

“Life for the average human is going to be wild, and unrecognizable!”

Buckle up. Seats and tray tables to the full upright position. Prepare for rollover.

This is the scariest conversation I have ever heard since

“Open the bay doors Hal

I’m sorry, I can’t do that Dave”

https://youtu.be/dSIKBliboIo?feature=shared

And most won’t bother with it, because it came from Glenn Beck. They don’t realize that narrowmindedness only compounds ignorance…