TL;DR: A new paper redefining what Crypto means has just been published, with staggering implications for siloed economic thinking. Among them: local “Truth” in economics may drive cyclicity. Philly Fed numbers and Unemployment filings are out, and while not 3I/ATLAS, October still looks set to “rock” the world.

Crypto & Investing in the Post-Truth World

[I apologize for the Peoplenomics length and depth of what follows. But it’s information of a general research nature that could be important to a lot of people in the future. ]

From the beginning, if we may? (Yes, could be a riff on Clif High’s Sci-Fi world arriving…sci-fi and post-truth sharing linguistic commonalities, see?)

Hard as it is for people to believe it, at my core, I’m a data-driven guy. As part of that, I track the best and brightest brains I can find in order not to be “follow the money” but rather a “follow the Future” kind of writer. Now, toward this end, there’s a professor emeritus at the University of Minnesota, who I have followed for years. Best of class thinker. He has a new paper out and this one is a dilly. Hang on, this is the kind of “big gulp” we usually do on the Peoplenomics side. But in mid “blow-off” it’s good to look out the windows in mid launch, once in a while. Get an eye on early trajectory and begin to guess at down-range impact. In 3-2-1…

Cryptocurrencies have long been sold as technological marvels—Bitcoin, blockchain, NFTs, and the rest all touted as breakthroughs that would liberate finance from bureaucrats and central banks. Yet Andrew Odlyzko’s new essay on point (just out) takes a sharply different tack. He argues that the real story isn’t about technology at all, but about what the crypto mania reveals about us. The central lesson is how trust, herd psychology, and the human appetite for illusion are reshaping society into a “post-truth” world.

In this framing, Bitcoin is not the revolution it pretends to be. It is instead a vivid case study in how collective imagination, inertia, and influencer-driven trust can create alternate realities—realities with market valuations, political impacts, and global consequences. The fact that nearly all of the core technical ingredients of Bitcoin were available decades earlier only sharpens the point: the technology waited in the wings until the crowd was ready.

This perspective shifts the debate. Whether cryptocurrencies succeed or fail on their own merits is almost secondary. What matters is that they demonstrate how easily faith can be redirected away from institutions and into fragile, unverified claims—often in defiance of evidence or common sense. Odlyzko’s analysis ties this to broader patterns: the rise of disinformation, the spread of deepfakes, and the seductive “hallucinations” of AI.

Abstract. Cryptocurrencies have given rise to extreme excitement and controversy. There is a continuing debate on whether they will flourish or disappear. This essay argues that an even more interesting and important issue involves the implications of the cryptocurrency mania for the evolution of our society. What matters about cryptocurrencies and related subjects, such as blockchain, are not really their technology. That technology is neither novel nor revolutionary. The key factors are trust and crowd psychology, and those are driving us towards

the post-truth world, in which groupthink helps create “alternate realities.” The cryptocurrency scene provides insight into these developments, which are consistent with those in many related areas, such as growth of disinformation, of deepfakes, and of AI. (The complete paper is at cryptomania.pdf. Highly recommended._ This essay will appear in ACM Ubiquity.)

What does this mean in real time? It means the same forces that once inflated tulips, railroads, and dot-coms are alive in today’s markets—only faster and even more contagious. In a post-truth investosphere, October won’t just be about earnings or Fed policy; it will be about which narrative the herd believes in most. That’s the fuel for blow-offs, and why watching the topology of “truth” is now just as important as watching the charts.

In other words, cryptocurrencies are not an isolated oddity of financial history. They are a marker of the age we are moving into: a time when the psychology of trust and the manufacturing of belief systems may matter more than any technical achievement. The implications ripple far beyond markets and money.

From the standpoint of LRP (long-range planning) and preservation of generational wealth, the identification and operationalizing of Post Truth Investment strategies becomes a real issue. As we have written before: crypto is nothing but a single (complicated) made-up “secret number.” It holds no intrinsic value. But, to Odlyzko’s point: Doesn’t matter if you’re trading in the “Emperor’s New Clothes World” does it?

Investing in the Post-Truth World

The paradox for investors is that in a post-truth investosphere, reality and return have parted company. The traditional calculus—anchoring decisions on earnings, assets, or productivity—has given way to a new game where narrative momentum outweighs balance sheets. In such a climate, the real skill is not discovering value, but forecasting belief. Markets reward those who can sense where the herd will move next, even if that movement is divorced from fundamentals.

For long-range planners, that makes the challenge doubly hard. Generational wealth prefers ballast and continuity, yet post-truth markets thrive on illusion and volatility. The guidance here is not to chase every mirage, but to recognize that alternate realities can sustain price and confidence far longer than logic suggests. The prudent course is to hedge exposure, participate cautiously when the crowd’s imagination runs hot, and always keep a tether to assets that remain real no matter what narrative bubble bursts next.

The Role of Truth in Previous Bubbles

What Odlyzko is really pointing toward is that bubbles spread not just by greed but by infection of flawed “truth assumptions.” Once accepted, they replicate across markets and generations like a communicable disease. A few examples stand out:

Tulipmania (1630s): the “truth assumption” was that rare tulip bulbs were inherently scarce stores of wealth, worth more than gold. The distortion collapsed when the assumption met reality—bulbs could be grown and propagated.

South Sea Bubble (1720s): investors assumed government charters guaranteed prosperity, mistaking political favor for economic substance. The “truth” snapped back when trade revenues never materialized.

Railway Mania (1840s Britain): the belief was that every mile of track equaled certain riches. The asymptote broke when many routes proved uneconomic, leaving steel and sleepers but no sustainable profit.

Florida Land Boom (1920s): the assumption was that American migration south was endless, so land prices could only rise. Hurricanes and recession corrected the delusion brutally.

Dot-Com Bubble (1990s): “eyeballs equal earnings” was the new math. Growth in website visits was treated as interchangeable with revenue, until the asymptote of cash flow reasserted itself.

Housing/CMO Crisis (2008): the most poisonous assumption of all—that “home prices never fall.” Leveraged across derivatives, it metastasized globally, and when truth reasserted itself, the financial system nearly failed.

Crypto/Stablecoin Boom (2010s–2020s): the current presumption is that digital scarcity alone creates durable value. Yet as Odlyzko notes, this is just another “truth assumption”—a fragile consensus, not an economic foundation.

Each episode shows how seductive false truths become contagious local/mass “truths.” Once embedded, they override caution, spread through networks of trust, and leave wreckage when the topology -eventually – snaps back. The investor’s paradox is to recognize that these anomalies feel real while they last—yet are ultimately viral distortions of the truth baseline.

In an odd twist of events, Wednesday marked the (Peoplenomics) pre-publication of the first section of my new book “Mind Amplifiers” Human Use of Cognitive Prosthetics.”

Taken together, Odlyzko’s insights on the changing Topology of Truth – and our own focus on how these may also relate to shifts in cognitive prosthetics, and you begin to sketch out (at least in theory) a schema where Truth is only a consensus and where cognition is blooming toward an under-appreciated end. (Spoiler alert: We are all World Observers and – as such – part of the emerging central nervous system of all Creation…)

About here you should realize that we will be doing additional research on Durability of Truth and sizing of Persuasion Blocks as an additional metrics behind “fundamental economic analysis.” Do investors need a “Truth Index?”

Ah…Enough! Maybe too much theory. Let’s check how our predicted Blow-Off is rolling in the pre-open, shall we?

By the way, the reference paper (Youseffmir, et al) is MATLAB graph. See page 17. In particular, you will want to consider in your news-readings how the “placement of what we can now behold as truth-adjustments impacts ultimate bubble form. Which may, or may not, provide avenues of predictive utility.

Simplified for Life Indexers (not us Mass Indexers): Read the news – spot events that will change the topology of local Truth going forward. Adjust plans, accordingly.

Economic cycle derivation work (my recent decomposition of cycles) extracted this which was shared with Peoplenomics subscribers last weekend.

This gives you a pretty clear sense of the gap between “Cyclical Truth” and the rolling impact of current/local Truth topology delta, doesn’t it? Notwithstanding, is there a correlation between radicalization and “loss of truth” in economics? Wow, huh?

Meanwhile, back on Earth: Economic Data Streams are buzzing…

Two On the Cash Balances Screen

Philly Fed Manufacturing report:

“The diffusion index for current general activity rose 24 points to 23.2 in September, its highest reading since January (see Chart 1). Almost 40 percent of the firms reported increases in general activity this month (up from 30 percent last month), while 17 percent reported decreases (down from 30 percent); 43 percent reported no change (up from 36 percent). The new orders index rose 14 points to 12.4 this month, and the shipments index rose 22 points to 26.1.”

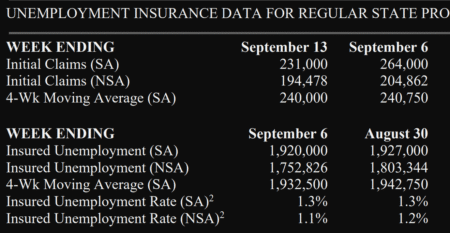

And two graphics lay out new current Unemployment filings.

So…er…like we were saying…notice how UI filings were already going down before the Fed bent to Trump and lowered a quarter? Again, look for a “slow drip of C-4” (an explosive…)

The rest will be along when it will be along. Though in the ChartPack on the PN side this week, we will take a stab at “top of bubble estimation” although the “density of delusion” is a factorial hemorrhoid. How to assign numbers to crazy?

Pressing Ahead Backwards

Pressing Ahead Backwards

Let’s look in on the ICU (internet consuming users) ward and see how Truth is holding up, shall we?

Notice how the media battle (ongoing_) is a good indicator of the Post-Truth status of the country. Some examples? Media tries to protect Antifa with tired al-Qaeda talking points | Blaze Media. In fact, we happen to agree with TRUMP DESIGNATES ANTIFA TERRORIST ORGANIZATION. Across the aisle? WGA Rips ABC for Pulling ‘Jimmy Kimmel Live!’ From Air.

Ever read the book Commanding the Heights? Not old enough? So here’s how it laid out back in 2002: Daniel Yergin’s Commanding Heights (2002, with Joseph Stanislaw) traced the 20th-century struggle between government control and market liberalization, showing how nations repeatedly swung between state-driven economies and free-market reforms. The book’s insight for today lies in its recognition that the “commanding heights” are never just factories, oil fields, or finance—they are also the levers of narrative. As production globalized and deregulation spread, media itself became a strategic high ground: shaping investor sentiment, legitimizing policies, and mobilizing public consent. In this sense, Yergin’s framework foreshadowed modern media warfare, where control over perception and storylines often determined outcomes as decisively as control over tanks or pipelines.

After Yergin’s Commanding Heights set the stage for how power shifted between governments and markets, the natural progression into the realm of media warfare is David Patrikarakos’s War in 140 Characters (2017). Where Yergin showed how economic control defined the 20th century, Patrikarakos showed how social media and narrative control define the 21st. It documents how tweets, memes, and online personas became weapons as real as tanks or tariffs, making the battlefield as much about perception as about territory.

From there, the trajectory continues through works on economic statecraft and chokepoints, but War in 140 Characters is the pivot point — the book that turns Yergin’s story of global economic liberalization into today’s Age of Narrative and media conflict.

Hard to make a tradeable pendulum out of Truth balance. However, here’s one more swinging indicator to consider: Students are TURNING on their violent leftist teachers!!

Our Big Bottom Line? The Post-Truth investosphere has been seeded and in the making for more than 20-years. As much as anything, simple tabulations of media acceptance of radicalism (BLM/Antifa) may be useful indicators of media credulity. Which, in turn, could be a useful metric when making portfolio allocations….

Noticed in Passing

Social tensions on boil: 3 police officers shot dead, 2 wounded in Pennsylvania; suspect killed.

Come to America then bitch about it? Um…no… US judge orders deportation of Palestinian activist Mahmoud Khalil

You do realize 100-years ago, virtually no childhood vaccines were administered, right? Ousted CDC director says RFK Jr. will change vaccine schedule. Coming up on 100-years from? 1920s–1930s: The diphtheria toxoid vaccine is rolled out on a larger scale, becoming one of the first true “childhood” vaccines to see routine use. And yet, humans somehow lived…

Economically, here’s another one to ponder: What happens to the Pharma and cancer treatment centers around the country if this story has legs and isn’t just propagandized bullshit? Russia Rolling Out “Free” 100% Effective Cancer Vaccine? Moreover – inquiring minds out here in the woods are asking – why isn’t CDC telling us the “what’s real” behind this? I have an answer which no one will like, so best keep it close to the vest. (But bet you can guess. Here’s a hint: $$$)

Around the Ranch: Rocktober Fest Landings?

One of the smartest of my long-term strategic planning and look ahead cadre shared a what amounts to a “colleagues” note Wednesday. To his (expert/SME) eyes, 3I/ATLAS may not be an issue…but…

“…there is a very good chance that this October we will be seeing an unusually large number of meteorites. As in really unusually large number. All the regulars, plus…

In early October 2025, Earth will pass through the debris trail of the newly discovered interstellar comet C/2025 R2 (SWAN), which may result in a new meteor shower

. Scientists also predict two established meteor showers for October, along with possible fireball activity from the Taurid swarm.

Earth encounters Comet C/2025 R2 (SWAN) debris

Source comet: The interstellar comet C/2025 R2 (SWAN), spotted by an amateur astronomer in September 2025, has an unusual trajectory from outside our solar system. It passed closest to the sun on September 12, leaving behind a debris trail.

Peak date: Earth is predicted to cross the comet’s orbital plane around October 5, 2025. (Tatman: That’s AI speak for we will be passing *thru* the debris trail. As this is a probable first solar encounter for C/2025 R2 (SWAN), it should be a hefty debris trail.)

Potential display: While comets are unpredictable, skygazers will be watching to see if this crossing creates a new meteor shower, with some estimating the possibility of a visible show. (Tatman: Or worse. The global impact episode of 12,800 some years ago set fire to the Northern Hemisphere from Syria to Alaska. Well, the parts of the hemisphere which weren’t ice covered. Whilst the SWAN debris will likely not be that bad, it could be ugly, with a number of impacting and/or atmospherically exploding meteorites. We’ll see.)

READER NOTE: SWAN is NOT 31/ATLAS. Atlas will be passing Mars around 3 October. Earth will not go thru any ATLAS debris trail. (Well, if it has one. So far, it doesn’t seem to have a tail, it has a crown, facing towards the sun, not away from it, and the emissions given off have recently been changing color, from red to greenish. I keep waiting for an announcement that it is slowing down. If it slows down, it *is* a spacecraft. If it doesn’t slow down, it only *might* be a spacecraft. I guess we’ll see.)”

If someone shows up around Thanksgiving and says they’re “Here to serve man” be suspicious. And ask yourself “Would I ‘pair well’ with cranberry sauce?”

We now return you to your regularly schemed programming. Good luck, Jim.

Write when you get rich,

George@Ure.net

Pressing Ahead Backwards

Pressing Ahead Backwards

re: American Waltz

feat: right – left – right

Folks,

The early am show with DJ George is always a treat. Nothing beats a finely tuned Lawrence Welk bubble machine topped off with some hard rock tracks.

Last night’s UK State Dinner for the US First Couple apparently featured menus in French perhaps out of deference to the King’s Norman roots. One might have expected a themed mocktail in honour of the teetotaler guest. However a Johnnie Walker concoction rolled out in the form of a “Transatlantic Whisky Sour”. Pheasant crumble pie was nowhere to be seen. Therefore guests settled for mains of “organic Norfolk chicken ballotine wrapped in courgettes with a thyme and savoury infused jus”.

Apple’s head sat beside President Trump’s daughter. Forlorn ChatGPT fans saw their leader paired with the leader of the UK opposition Conservative Party. Meanwhile the UK PM Sir Keir landed beside the Blackstone ceo. Perhaps the latter shared a name for the new man-made lake which has appeared on his Wiltshire estate. Of course, President Trump enjoyed place of honour between the King and the Princess of Wales.

The Duchess of Edinburgh, currently on a royal visit to Japan, is understood to have left no stone unturned constructing a setlist for the Windsor Castle merry musical ensemble agreeable to their esteemed guest. Thus did a Rolling Stones anthem “You Can’t Always Get What You Want” echo about St. George’s Hall. Those longing for the good old days happily made do with “Nessun Dorma” (None Shall Sleep) lifted from Puccini’s opera “Turandot” set in China. Answer three riddles and gain a damsel’s hand in marriage. Fail and the axe shall fall Tower of London style.

re: peak drama

feat: director’s cut

Folks,

Extra Cuvée de Réserve, 1998 served last night at the Windsor Castle shindig is sourced from a favorite champagne house of Winston Churchill, Pol Roger, according to “Wine Upon a Time”. Apparently the brew also starred at the wedding of Prince Harry to Ms. Markle lately of Montecito. Pol Roger is situated by the Marne River in France which last week celebrated the 111th anniversary since a failed German attempt to complete WW1 in 40 days with the First Battle of the Marne. It seems the region’s Montagne de Reims became nicknamed “Hill of the Coronation” at the end of the 5th century ad. Prior to Roman conquest, the ancient Remi tribe had known it as Door of Cortoro. Does that translate as Door of Cutting or Door of Otherworld?

Speaking of ending wars in otherworlds, the President of Ukraine has posted a photo op of his visits to the front along with the Commander-in-Chief of the Armed Forces of Ukraine. Brigades of the Ukrainian Assault Forces are visited who boast a motto “Always First”, and have St. Michael as their patron. “Wikipedia” describes them as “the elite of the Ukrainian armed forces”. No one smiles for the camera. The President does not appear to have arrived with tables of fresh food on display as like earlier in the war, only water in small plastic bottles. Dour looks seem legion. Happily one is informed that 100 Russian prisoners are taken!

The President took selfies beside the crest and emblem of the Assault Forces. They show the flaming sword and wings of St. Michael. An open, non-golden parachute dome also features.

Presently the official White House schedule reflects that the First Couple have departed Europe. Meanwhile sinking Dolphins travel to Buffalo in hopes of collecting on some bills at a stadium named after a non-profit health insurer.

Per the US’s National Public Radio (NPR) a couple of weeks ago Ukrainian deaths in the War are under 100,000 whereas Russia’s death numbers are already at nearly a million. With a 10:1 ratio in death rates in this War obviously Ukraine in winning.

At that ratio of deaths Russia will soon be bled white with not nearly enough men to continue with their campaign while Ukraine will still have at least a couple of million men, maybe 4 million, to continue to fight with.

No need for dour looks by the Ukrainian leadership!! VICTORY is right around the bend!

I was visiting with a woman from ukraine..she was showing me photos of her best friends yard and home..absolutely beautiful..the yard would put down any horticultural center in the usa..absolutely beautiful..videos of her friend sculpt bring trees and shrubs.. the family enjoying meals .. the garden .. a wall around the yard..the family happy and enjoying each others company..the she showed me photos of the town..totally destroyed..friends and neighbors that were killed devistation beyond appearance.. the only structure and family that wasn’t destroyed..was her best friends home and yard..

the biggest issue for their living in the usa wastelands is..they can’t believe how much it costs for the average family here..how the people are reduced to being considered disposable.. the fear that they will have to return.. and the rumors that the Ukraine azov army is sending in children and girls from what I overheard in a chat they had..its true.. not some rumor..

Oh, yes…Highmark Stadium…

This is not investment advice.

“collective imagination, inertia, and influencer-driven trust can create alternate realities—realities with market valuations, political impacts, and global consequences”

Sounds like the starting of a religion!

Groupthink!

Oh boy, it’s all fun, fun, fun, until Daddy takes The T-Bird away…

“The paradox for investors is that in a post-truth investosphere, reality and return have parted company. The traditional calculus—anchoring decisions on earnings, assets, or productivity—has given way to a new game where narrative momentum outweighs balance sheets. In such a climate, the real skill is not discovering value, but forecasting belief. Markets reward those who can sense where the herd will move next, even if that movement is divorced from fundamentals.”

Danielle Park: Investors have a strange relationship with risk. On the one hand, they want it: Risk brings reward when it works out. On the other hand, unrewarded risk is the very last thing anyone wants.

The result is the all-too-familiar swing between fear and greed, boom and bust, as investors switch from loving risk to fleeing it. This is relevant to today’s stock market because the market is riskier than it used to be on three important metrics:

First, it is much more concentrated in a handful of stocks than in modern times. That means investors who simply track the market are taking much more single-stock risk than in the past.

Second, the stocks that dominate the market are heavily exposed to one big bet, on generative artificial intelligence, into which they are expected to pour almost $400 billion this year.

And third, everyone agrees that those stocks are phenomenal and bound to go up, creating a form of groupthink vulnerable to a sudden reverse on any setbacks.

https://www.howestreet.com/2025/09/stock-owners-have-learned-to-love-the-bomb/

““childhood” vaccines to see routine use. And yet, humans somehow lived…”

People pick and choose.

A lot of the under 25 crowd think malls are fake. Driving to central shopping zones is beyond them. Some folks think the Holocaust is fake – generally all direct observers are dead. Was Polio fake?

Which was fake Smallpox or the Smallpox Vaxx?

Back there Governor Rick Perry made a HPV vaccine mandate. One or the other is fake.

’round and ’round.

“Back there Governor Rick Perry made a HPV vaccine mandate. One or the other is fake.”

Which, if I recall, he quickly rescinded when the backlash hit.

That circles back to “People pick and choose.”

He thought forced Vaxxing was a good idea. Activist courts overturned his mandate.

“Rick Perry did not rescind his HPV vaccine executive order, but rather it was overturned by the Texas Legislature in 2007, days after he issued it. Perry issued an executive order mandating the HPV vaccine for young girls in Texas, which was met with strong opposition and concerns about his ties to the vaccine’s manufacturer. The order was quickly overturned by lawmakers, and Perry later admitted he made a mistake in how he handled the issue, though he continued to defend the decision as being about saving lives.”

Have you ever noticed people make things up?

Anything and EVERYTHING that is claimed to “Save The Children” is good!!

Didn’t you get the memo? All the “Big Government Is Good” people did.

Crypto

Regarding Russia, Trump says he will weaponize crypto.

And non-U.S. banks, and market exchanges.

Does that notion fit with Ure’s crypto thinking? That can happen?

George –

Your comment that 3i/Atlas has a ‘crown’ — why did you write that?

I have been watching for the second great sign in heaven mentioned in chapter 12 of Revelation verse 3:

“And there appeared another wonder in heaven; and behold a great red dragon having seven heads and ten horns, and seven crowns upon his heads.”

The first sign mentioned in Rev 12 appeared 9/23/2017.

We are entering a high watch period for the rapture (yes, I am one of those people), so when I read your description of 3i/Atlas having a crown, it set off alarms.

God stated the purpose of creating the Sun, Moon, and stars (Gen 1:14):

“And God said, Let there be lights in the firmament of the heaven to divide the day from the night; and let them be for signs, and for seasons, and for days, and years.” Note that the first purpose is for signs.

Brenda Weltner who has spent countless hours studying the book of Revelation put out a video about comets and 3i/Atlas:

https://www.youtube.com/watch?v=oBwYnRhSOzk

I had a dream last night that was a new post at The Age of Desolation site…

G.A. STEWART: I know that the world is diving toward chaos and destruction, hence the name of this website.

It has been a dark week for humanity, the social engineers have decided to destroy Western civilization. Their implementation of some grand design reminds me of the hubris of today’s genetic engineers experimenting with nature at a foundational level and toying with the building blocks of life. Once Humpty Dumpty falls off the wall, all the king’s horses and all the king’s men will not be able to put Humpty Dumpty back together again.

When they get the world they want, it will not be pretty.

https://theageofdesolation.com/nostradamus/2025/09/17/pseudoscience-and-chatgpt/

TL DR Mr. Ure,

“The fact that nearly all of the core technical ingredients of Bitcoin were available decades earlier only sharpens the point: the technology waited in the wings until the crowd was ready. “

I like to travel down to the docks where the bankers go to buy their green bananas that arrive into port. The banker will tell the public that they don’t need green bananas. Green bananas are early and will make you sick if consumed. And that is why they are so cheap, no one wants them. Be the banker buy the green bananas and HODL.

https://archive.org/details/reminiscencesofs0000edwi

Of tulips:

https://archive.org/details/maniaspanicscras0000alib

I believe it was the invention of the bond circa 1694 by the Bank of England that later came to be the basis of new Fiat creation, the bonds backing the notes being printed out of thin air.

https://moneyweek.com/402300/27-july-1694-the-bank-of-england-is-created-by-royal-charter

The next financial asset class to be “created” into the banking system and the modern monetary system is… Blockchain. Been about 400 years…..

that may be why the concept of a new financial asset class seems foreign to so many.

So, all those years accumulating green bananas, perhaps that’s why the message from British HODL was so important.”get to one Bitcoin”.

https://m.youtube.com/watch?v=tPcpaoDHJDY&pp=ygUiYmxhY2tyb2NrIGV0ZiBiaXRjb2luIGJyaXRpc2ggaG9kbA%3D%3D

The magic (to your point), this has all been noodled out back as far as 1988. We were waiting for Moores law to catch up.

https://www.reddit.com/media?url=https%3A%2F%2Fexternal-preview.redd.it%2F57eqA-RiCHkD2-X3R1J7oJH63nFgswC4i40TiJ5cm7c.jpg%3Fwidth%3D320%26crop%3Dsmart%26auto%3Dwebp%26s%3D91636ede9f26fe2f4c8ca18742463b4a31db59a4

Now, what is the future complexion of “the dollar” ?

Now on the concept of payments: Blockchain most closely resembles a modern spin on the travelers check, which has arguably been around since the Crusaders were using coded paper chits redeemable in gold on deposit when presented to the international money lender. The money lender would verify the cypher as genuine and decode same to determine the amount of money owed to the recipient.

https://financefacts101.com/travelers-checks-a-historical-overview-and-comparison-with-modern-payment-methods/

Enter Web 3.0:

A world where everything will be hypothecated into the blockchain.

https://en.m.wikipedia.org/wiki/Digital_twin

What is the digital twin of paper and metal money homegamers?

Blockchain is money’s digital twin”

So unlike the longevity and use case of tulips as a store of value and currency in Web 3.0. The Blockchain technology arriving today and being pressed into production service around the globe as digitized assets has a use case (many).

http://www.reesonomics.eu/themes/Keynes/Keynes_Bancor_ICU.pdf

https://www.taxresearch.org.uk/Blog/2025/04/05/is-it-time-for-the-bancor/

Eyes on the prize:

https://custommapposter.com/article/which-banks-use-ripple-xrp-and-why/1781

https://apnews.com/article/britain-trump-state-visit-king-charles-9e888f6d58da8765ab7e0775d11fb350

Not Advice. Do your own homework. Mic drop.

London Calling:( watch what they do(signal) not what they say(noise).

https://m.youtube.com/watch?v=EfK-WX2pa8c&pp=0gcJCRsBo7VqN5tD

G if it doesnt collapse now at these top rails ,your aggregate system is kapput a waste of time . every metric every parameter is crash

market greed never changes ….. thoughout history tons of examples … time to dust the cover off and read again … good luck

Extraordinary Popular Delusions and the Madness of Crowds: All Volumes, Complete and Unabridged

https://www.amazon.com/dp/B09WZ75FF8?ref_=ppx_hzsearch_conn_dt_b_fed_asin_title_1

good book that . read it a couple of times

wow president trump is going after the zorro gang !! good on yah mr president take those commies in and there yourow. i aint paying 30 USD for mickey dees or KFC in europe .cant make an omelet without breaking eggs . slow cook it . maybe 6 to 8 months mr president

From 2 years ago.

What time frame are they talking about that’s forthcoming? That would be NOW.

Pay attention home gamers.

https://youtu.be/cF_sfbcmFJk

Pele’s pot is boiling again. Imminent eruption predicted.

https://www.youtube.com/watch?v=tk0tfYDxrUA

Hmm… instead of popcorn for the big show.. why not stuffed marshmallows.. like chocolate fluff ..

first you need to make the marshmallow..

3 envelopes unflavored gelatin (about 2½ tablespoons)

½ cup cold water (for blooming gelatin)

¾ cup water (for syrup)

2 cups granulated sugar

¾ cup light corn syrup (or honey/maple for legacy variation)

¼ tsp salt

1 tbsp vanilla extract (or rosewater, almond, etc.)

Bloom the gelatin In a half cup of cold water..

In a saucepan, combine sugar, ¾ cup water, corn syrup, and salt.

Heat to 240°F (soft-ball stage) without stirring. Use a candy thermometer.

Powdered sugar + cornstarch (for dusting)

Slowly pour hot syrup into the bloomed gelatin while mixing on low.

Increase speed and whip it real good for 10–15 minutes until thick, glossy, and tripled in volume. then pour into a pan or mold

https://www.amazon.com/Marshmallow-Silicone-cavities-Realistic-2pcs/dp/B0CM3HLF13/ref=sr_1_15?

let it sit for six hours or overnight to set up then dust with powdered sugar or corn starch..

Now..the barefoot Contessa that suggests coating the pan with powdered sugar..or cornstarch.. that’s what they do with gummy worms and bears so rather than spray coating the pan..I would go with the barefoot contessa.

https://youtu.be/WAFPqiFZe30?si=fZu_A8GVRPxtsHNh

Something that not a lot of people know except for my mini me and family..is I love marshmallow peeps.. you can get just about any silicone mold ever..

Amazon has a fabulous assortment of great molds..

Oh… to get home made chocolate to resemble store bought smooth.. you may need to conch it..

1/2 cup of shredded coco butter

1/3 cup powdered whole milk

1/3 cup powdered sugar sifted

1/4 cup of cocoa

heat the coco butter on a double boiler then add one at a time the dry ingredients..

1 tbsp of vanilla to if you want or other flavorings..

then after you’ve mixed it all together you put it in your wet grinder and let it run..just like making nut butters…

https://youtu.be/j9bihBJ9WMA?si=gPSc4JF7onBrPWvj

I haven’t used my wet grinder in a while now..

Here’s a video showing how to make it without any special tools

Cosmic Mind Amplifier on October 30th, 2025, Massive Cosmic Event,

https://x.com/TheKaterPotater/status/1968122613550682423

The ->Math<-checks out.

schumann resonance + the "strange attractor" = the Maximum Novelty experience?

the thing is that is the same night i experianced the ~ Eric Church ~ Miracle. same image in the cd i found 10 months prior to the minute.

when i returned to that spot after being in idaho and wyoming, i found a bunch of baseball cards. all heavy hitters. same exact spot i found the eric church Cd.

the date of that event, includes Atlas, 10/30/2025.

George what your piece misses in writing about value etc. is that the world is now awash in excess liquidity: excess Dollars, excess, Euros, excess Yen, excess Third World Currencies, and yes excess Yuan.

ALL of that liquidity is lookng for a “parking place” and just like having an apartment and also a car in New York City where there are NOT enough street parking spaces where all the cars in NYC can Park all that money liquidity it has to go somewhere to Park.

(so what happens in New York City with not enough street parking? People start paying money to park at private locations, LOTS of money. The nearer the congested parts of Manhatten one is the more and more people will pay to Park. In some areas a monthly parking spot can cost one $4000 or even $8000/mo (or more)/mo, whereas a street parking spot, if one was available near your apartment would be either free (Sundays always free) or about $50/day+- inthe cheaper parts of Manhattan (max 7 days in one location in the residential areas of Manhattan – obviously cheaper in the boroughs).

The Markets and Crypto are just like car owners in NYC who are reacting to the massive amounts of excess liquidity floating through the system and their money is just looking for a Parking Space …ANY Parking Space!!

REAL profitability of what the money is invested in is almost irrelevant for most of the excess money floating around the world as long as where it gets “Parked” meets criteria #1 … IT IS LIQUID! ie: one can get one’s money back out to redeploy very quickly. The MORE LIQUID the market that is serving as a “Parking Space” is the higher above a real investment rate of return (ie: dividens), people are wiling to pay to Park there.

UNTIL liquidity dries up the excess money is going to chase after the FEW available Parking Spaces. Particularly prized are those that “might” give one a positive rate of return!!

The key lesson being the more money floatin around and the fewer Parking Spaces … the MORE one must pay for a Parking Space! ala … the top 20 stocks in the stock market, crypto, bonds, and the now dying Real Estate Investment Trusts (dying because they were a lousy investment and were virtually guaranteed to lose money – but LOTS of profits to Wall Street to market and manage them).

“IF” there wasn’t excess liquidity then Crypto would be a nuthing burger, As it is ALL of Crypto only totals up to $4 Trillion Dollars, of which 25% to 30% is now permanently LOST (locked in long gone hard drives, etc. etc.) and thus no longer really exists … so call Crypto as having in reality $3 Tillion dollars of “current value”

Nvidia ALONE has stock that is valued at just a hair over $4 Trillion as of yesterday’s close. Nvidia alone, just going by it’s stock value, is thus worth 33% MORE than all the Cryptos ($3 Trillion) that really exist today.

NOW … talk about INFLATED ASSETS, Nvidia shows perfectly how excess liquidity can fuel Pie In The Sky valuations. Nvidia pays $.10/qtr, 40 cents per year in dividends … with a stock price that a few minutes ago was $176.00 per share, or about 2/10 of ONE percent in divedends to a shareholder. (00.2%)

WHICH is more of a bubble? Nvidia or Bitcoin?

(Intel until it’s recent price rise with the US Govt investment and Nvidia investment was valued in the stock market at $86 billion, yep NO trillions there, and they actually have some REAL manufacturing plants unlike Nvidia. (currently today it’s value is up to $139 billion after the Nvidia promised investment this week). As of today Intel with REAL manufacturign plants is only worth 3.5% of Nvidia’s value if one does the math.

If you strip out all the money liquidity floating through the system Nvidia’s valus should be 1/10 it’s current price, or MUCH lower, until they start paying reasonable dividends (FORGET repported earnings … those reported earnings are NOT cash being returned to YOUR pocket, they are just mirrors reflecting internal hamster wheels turning)

Some ridiculous percentage of the entire stock markets’ gains over the last 2 years have come from about 12 to 20 mostly highly overvalued stocks. While Nvidia is the poster child of the worst even the “best” is still overvalued, based upon it’s DIVIDENDS, on the order of 5x (maybe 10x) or more.

“Accouting Profits” have absolutely ZERO to due iwth investors getting their money back from investing in a publicly listed company.

“Accountign Profits” is all a sham for most big companies (speaking as a former Big 6 Auditor who looked under the hood a LOT back in my acounting days). EVERYTHING wrt a big company’s stock price depends upon how good of a Story Teller about Building Castles In The Sky upper management is … since they are NEVER gonig to pay out even a small percentage of those so called “Profits”, current or in the future, to the actual (stock) owners.

Bubbles everywhere … not just crypto. ALL brought about by governments everywhere pumping more and more liquidity into the system, liquidity that HAS to go somewhere to Park itself.

This gets my vote as best post of the day. Your take on what is happening matches what I have suspected.