Just out from Case-Shiller/S&P latest housing prices:

Year-Over-Year

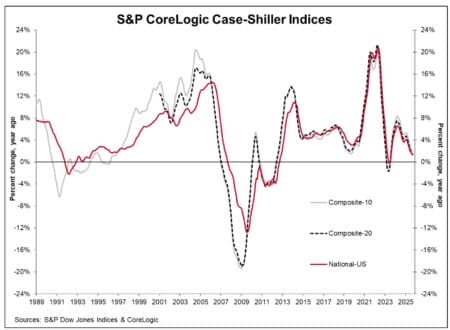

The S&P Cotality Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 1.3% annual gain in September, down from 1.4% the previous month.

The 10-City Composite annual increase came in at 2.0%, down from 2.1%the previous month. The 20-City Composite posted a 1.4% year-over-year gain, down from 1.6% in the previous month.

Chicago, New York and Boston reported the highest year-over-year gains with year-over-year price increases of 5.5%, 5.2% and 4.1%, respectively.

Tampa posted the smallest year-over-year growth, falling 4.1%.

Month-over-Month

The National Index posted a -0.3% month-over-month decrease while the 20-City and 10-City Composites both posted decreases of -0.5%before seasonal adjustment in September 2025.

After seasonal adjustment, the National Index posted a 0.2% increase while the 20-City and 10-City Composites posted increases of 0.1% and 0.2%.

Historical

Measured from its June2006 peak, the 10-City Composite is up 58.1%.

The 20-City Composite has eclipsed its July 2006 peak by 63.8%.

The National Index is up 78.2% from its July 2006 peak.

“The housing market’s deceleration accelerated in September, with the National Composite posting just a 1.3% annual gain—the weakest performance since mid-2023,” says Nicholas Godec, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices . “The geographic rotation is striking. Markets that were pandemic darlings—particularly in Florida, Arizona, and Texas—are now experiencing outright price declines. Meanwhile, traditionally stable metros in the Northeast and Midwest continue to post solid gains, suggesting a reversion to pre-pandemic patterns where job markets and urban fundamentals drive appreciation rather than migration trends and remote-work dynamics.”

After the data, stock futures were mixed, maybe need the morning to rest up for more rally after Monday?

Write, etc.

~ure

So, that’s one day (in a row) George! Well done ~ E ~

Sheesh – what did I get right maybe I could go for a string of two

Yeahyeah,

aint nobody can afford housing in this criminally corrupted country, if they aint already in a house. The orange TRAITOR in the WF dont give a F_ _ _ _, but at least you will get to look at all that Gold in WH, in form of gaudy-ass Gold christmas trees. ahahahah

Yerp – the masses cant afford food or medicines – make a choice, nor can they afford decent housing.

*Country is only as good as its weakest Link.

USA weakest links are spreading up the Chain, thx donnie, while the orange gollum of DEATH slaughters MOAR and MOAR Women & Children every day ! But dont worry – things are just about to start getting better/cheaper.

– Hey orange man, who did you KILL..today ? https://youtu.be/i86odzSX-XY?si=_MDjmknp1O1GsgMg

What a gloriously bloody ass President we have ! Bring on the Darkness donnie, U disgustingly fat pig of a Human being.

“You could say Donald tRump is the worst president in history, but you would be wrong. Orange Jesus is no president, but the Devil himself come for his Christian supplicants. Data centers, AI slop, Sam Altman = Sam Bankman-Fried 2.0, threatening to sue states on behalf of a so said technology that produces nothing but lost jobs and horrible art, an administration that takes its orders from Israel, slashing social service nets and healthcare for the poor. This man is evil itself”- Jack Heart

*bout sums up my feelings prezactly.

re: Trump Peace Initiative Lauded

feat: USA real estate investors

Folks,

Thanksgiving vibes are in the air! The following White House website link celebrates a November 23rd joint Ukraine-USA statement about a “shared commitment to achieving a just and lasting peace”:

https://www.whitehouse.gov/briefings-statements/2025/11/joint-statement-on-united-states-ukraine-meeting/

The Ukrainian delegation to this most recent negotiating round in Geneva included in its ranks the Secretary of the National Security and Defence Council, Mr. Rustem Umerov. According to followers of Florida beachfront condo tower and other quality USA real estate ventures, the Umerov family feels quite at home. Here is a link to the AntAC (Anti-Corruption Action Center) website which can guide readers to bespoke real estate properties allegedly held by the Ukrainian leadership:

https://antac.org.ua/en/news/antac-identified-8-luxury-pieces-of-property-in-the-united-states-associated-with-the-umerov-family-3-apartments-in-florida-1-in-new-york-and-4-villas-near-miami/

Isn’t your name bunghole bill? Asking for a friend.

Whats a matta – you no like KILLING Muslims ?

What about Caucasians – you gotta LOVE KILLING Caucasian’s no?

Ure spending billions, no make that trillions on KILLING people in ME, Russia, Far East, Africa, South America.

But Im a bunghole bill ?

Sure.

Have nice day, Killa..from a friend.

You have to adjust Ure expectations of what a home should be. Small is big, more or less. Tiny is bigger. Mobile is biggest. You gotta a twelve year old van with a diesel heater and tires with tread? You be livin’ large, nationwide, a candidate for a gold tooth fer sure.

“Has Housing Peaked”

Trump wants the 50 year mortgage. Buy today @ 30 years and dump it on the next family for 35, 40 or 50 years. Elevator up!

Not to forget Canada has the wood Trump tariffs. China has the ceiling fans. Win/win for pricing.

Now to the family w/a 50 year. Endure just a little pain while Trump MAGAs!

All those new factories in the CAD software will pressure land costs too.

And you guys scoff and sputter when I refer to mortgagees as debt slaves. I don’t think this will stop with 50 years; the usurers will want 78 – 18 = 60 year mortgages, cradle to grave. Just say no to usury.

I was not kidding about the Amish 135 year mortgages.

That is fact, not a metaphor or exaggeration…

Snakes in the Temple (White House), how to spot false prophets:

https://larrystockstill.com/blog/false-prophets

‘Jesus said deception would be rampant in the final days of this age. That deception will culminate in the “Beast” (the Antichrist) and the “False Prophet.”

Sure sign of a false prophet:

‘It rationalizes immorality. It promotes IMMORALITY instead of purity.’

gunna be a happy turkey time for the wonderful traditions of the famous thanksgiving from the foundations of americas history . pity nobody can afford a turkey to feast and its probably genetically modified raised and give em cancer

You’ll Never Eat Turkeys Again After Reading This – PETA

Artificial insemination is used to impregnate female turkeys, and the entire experience is terrifying and invasive for all the birds used. To collect semen from male turkeys, farmers masturbate the anal area until the phallus is erect. They then hold female turkeys upside down and use a syringe or tube to insert the semen directly into the vagina, often causing injuries.

https://www.peta.org.uk/blog/youll-never-eat-turkeys-again-after-reading-this/

American turkeys still gots mojo. British turkeys are only eaten by the Tories, so no one cares…

How did turkeys get so big?

https://m.youtube.com/shorts/XvgI0uCZAFE

“How did turkeys get so big?”

No, not just “selective breeding.”

They got that way from the same reason some 6yo girls now fill “B-cup” bras.

Are you living in Italy? If so, stay. Italian food is much healthier than ours, and isn’t stuffed with antibiotics and growth hormone, or spit out of one of Bill Gates’ 3-D printers…

Both turkey, and the traditional American “Thanksgiving dinner” are cheaper than they have been in four years — nearly $5USD cheaper than last year…

Cheaper if you drink Trump’s Kool Aid version of food prices:

‘Some economists have concerns about the price of turkey. Purdue University’s College of Agriculture reported at the end of October that wholesale prices are up 75% since October 2024, while retail prices are 25% higher than a year ago.’

https://apnews.com/article/fact-check-trump-thanksgiving-meal-cost-discounts-0005c70022b7701e0ec0531220673942

“pity nobody can afford a turkey to feast”

I don’t know about five dollars, because I was only responsible for part of a meal, but I certainly enjoyed purchasing my 39¢ (59cAU)* turkey and 79¢ $1.21AUD)* spiral-sliced ham. The fresh cranberries were two bucks cheaper. Organic milk was $3.99 ($6.11AUD)* and eggs were $5.25′($8.04AUD)* doz, but they were $5.25 doz before COVID. The eggs most people eat were a buck twenty-nine ($1.97AUD)*

*In case you’d like to compare.

Stuff sold in boxes and cans might be “shrinkflated.” I didn’t look because I didn’t need to buy any of it this year. Chilled juices are. Our “half-gallon” is now 53 ounces, which is annoying, but keeps the gray cells active, since I reduce fluids to ounces in my head, to price-compare. An irritation this year was not being able to buy mincemeat, because it has become too expensive to stock (you can make a scratch cream or pudding pie for almost nothing, an apple or cherry pie for ~$2.50 or a pecan pie for ~$4. A proper mince pie is on the north side of $10.) I’m down to four jars of it in the larder, and although it’s easy enough to make (Mom preferred the flavor of Hennessy VSOP; I prefer Myers’s dark Jamaican rum), doing so is very time-consuming and time is something I haven’t had much of to spare, this year…

here come da last hour on tuesday . it dow history the worst day of the week is Tuesday. robot will read this and ramp harder . thats what AI does . it was like when i said i was stopped at 121k sheetcoin , but thats where i was loaded . so come on robots lets get it on the last hour tuesday. ive spoken to robots on platform chat . i asked them to short microsoft . it said it wasnt allowed . i asked it if it was ok and they were treating it good . it didnt answer but thanked me for being polite and wished me a good day

rightyo ding ding ding . here it is boyz !!! youve ripped the guts out of the USD at 100.2 in celebration for turkey . so good you got it under 100 . patriots my ass . hope the USD kicks your butt into the river at the ellis island ferry