Braced for a Crash-lection? Might consider it!

The early futures were telling us little that we didn’t know after the market fell on its nose more than 500 Dow points Wednesday. As the Fed not only raised 3/4 percent but said another 1/2 percent was baked in the cake – and they will entertain ideas after that…

What they don’t realize is that in so doing, they have baked another 2007-2009 Real Estate Collapse into the Mix.

Yes, that’s right: We may not get the hard Depression until 2024 now, but this time – in addition to the Housing detritus to suffer through, we will also have famine.

It will be like taking the worst of the 2008 real estate debacle and tossing in the Dust Bowl that led to The Hungry Years.

2008 Collapse Redux

There are two major reasons for the Real Estate Bubble collapse in 2008.

The crooked CMO problems – as described in Howard Hill’s best of class “Finance Monsters: How Massive Unregulated Betting by a Small Group of Financiers Propelled the Mortgage Market Collapse Into a Global Financial Crisis” was indeed a major part.

But there was a second dynamic – coming into view again right now – that played a major role, as well.

You don’t need to run long tail bond analysis to follow this semi-hidden variable, either.

You just need to sell a home.

You see, the net cash to seller reaches its peak at the low point of prevailing mortgage rates.

To give you a sense of what will be here – withing three years, but more likely two (or less) will be a collapse from present prices to levels as much as 50 percent lower than todays.

Mechanics Matter

The factual reality is that last year, you could buy a “million-dollar home” with a monthly payment of $4,000. (Not counting taxes and insurance.)

The reason you could afford so much was that mortgage rates were down in the 2-percent range. Effectively, there was very little given to the bankster class as interest. Principal was your friend.

Then the Fed (and markets) began the rate jacks – which the Fed threw more holy water on Wednesday.

We would not be surprised – within a month or two – to see mortgages pop to nearly 8 percent.

The reason? Even with modest increases in take-home pay due to inflation, people are still looking at the same fraction of disposable income – perhaps that same $4,000 per month – for a house payment.

Thing is, when interest rates jumped up to 7-1/4 percent (which they are now), the amount of home you can purchase drops almost in half.

Seriously Hosed

There are a lot of people around the country who live in homes – built in the early 1970s – that sold for around $45,000. Recently – as chronicled in the Case-Shiller housing data – many of these homes have soared to the $1.3 million range.

Never a man to miss a chance to play with “net present values” my consigliere first ran a $1.32 million home through an online calculator to get the basic note payment.

OK – at 2-1/2 percent the home went for $4,172 and change per month.

But now – and rates are still going up, remember – want to see what that same payment will buy you in today’s world?

$764,485 of home price. But you’ll need the down payment.

The difference ($1,056.000 minus $611,572 = $444,428) is the loss suffered in real world accounting by the property owner.

That’s where we are now – and it’s baked in the cake (and super-glued into our economic future) – by the Fed rate hike Wednesday.

And it will only get worse.

Rates will go up even more. They have already warned us.

2008 or 1929?

We can see in our “rearview mirror” of economics how our Aggregate Index performed as it peaked 2-years before the nominal bottom came in.

10/5/2007 our Index stood at 14,066.01.

So, if we’re aligning the 2008 cycle and collapse that followed, we would peg that date to the Nov. 8, 2021 all-time high in our Aggregate (and Bitcoin, too, rather conveniently) at this line-up.

A year later, 10/5/2008, the Aggregate had modestly fallen to the 8,451.19 level. That’s about a 40-percent loss, right?

When we look at the week of November 7, 2021 high – 34,899.21 – and look at the lows of a few weeks back – 28,755.51 – a mere 18 percent drop it looks better for now. But we have more Fed rate hikes on the way.

The slower the Fed raises (on the timeline) the more it pushes out the resultant decline in housing prices. Which has the effect of giving people more time to adjust.

Nevertheless, it was March of 2009 when our Aggregate bottomed (on a weekly closing basis) with a low of 6,626.92, the market had suffered a decline on the order of 53-percent.

When we look at where the market was a year ago – and project ahead into next year – we can make a case for an Aggregate Index “half off” from the 2021 peak.

Simple, yet devastating if you don’t see how this economic cycle evolves over time.

It’s also knowing these dynamics that allow us to forecast further economic declines. Including now the possibility of a…

Crash-lection

We are in a delicate market position where a sordid combination of Crash and Elections could come at the same time next week.

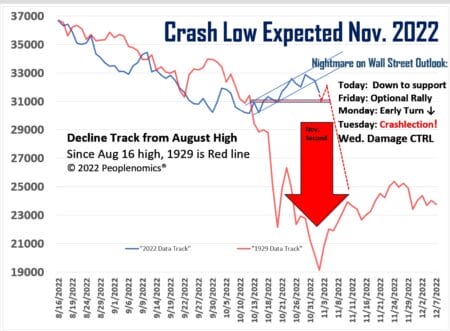

Here’s how our Aggregate Index from the top of the major Wave 2 lines up with the 1929 Dow Industrials in our Replay of 1929 studies:

That red November 2 target was way off the mark. But time is the hardest thing to calculate. The ultimate outcome (and behaviors to get there) are less so.

Unsurprisingly, Dow futures were down another 130 and the S&P was down more than 21 in the pre-open.

As you will see penciled in on the chart, we still have hopes for the rest of this week. Perhaps the ADP report or the federal job numbers tomorrow.

But all it would take would be the “match in a crowded theater” (or nuke in the Dnieper) and this puppy is all coming down. Which would then set the washout lows ahead in Q2 2023, or thereabouts.

Peachy, huh?

Elaine and I are 70-somethings and the MOST important personal financial advice we can think of for the young is “own a home outright.” Then never encumber it with liens. And never co-sign on anything for anyone under ANY conditions.

The cycles in the economy can kill your future, add stress, and put the yoke of “working” slavery on you like no crooked congress can imagine.

Of course, you’re doing the “GoPro video between the ears” of your own life. But just saying that as you film your life, it helps to Be the Studio and OWN THE SET.

We’ll move on.

Job Cuts

Bad news in the Challenger job cut report this morning, too: Cuts are up 48% compared with year-ago levels. Feel the economy roll-over getting underway?

“”Technology companies cut the most jobs last month with 9,587, for a total of 28,207 so far this year. This is up 162% from the 10,781 cuts announced during the same period last year.

The Automotive sector leads all industries in job cuts this year with 28,987, up 182% from the 10,005 cuts announced through October last year. The Construction sector announced significant cuts in October with 2,177, making up the bulk of the 3,983 cuts announced in this industry in 2022.

“The housing market has cooled as interest rates scare off new buyers. Housing starts and permits have both fallen from last year, according to government figures,” said Challenger.”

Then we have new trade figures just released:

Dollar weakening in the report period is turning up the deficit growth again.

Meanwhile, weekly new unemployment filings look like this:

Not much out there for the Bulls to hang their horns on.

So, life goes on – driven by yesterday’s decisions that put economic waves in play that wash over us at the supermarket checkout…

Barrels of Crap

Runaway Political Correctness (bullshit): Princeton University teaming up with the ADL to create database tracking non-criminal criticism of politicians. Gone anti-free speech, have they? Thankfully there is what remains of the Constitution.

Meanwhile, on a different aspect of mind control: Leaked Documents Reveal Homeland Security’s ‘Expansive’ Influence Over Social Media Censorship. That’s how to control election outcomes, right?

Buy some PowerBall tickets today! Powerball jackpot jumps to $1.5 billion, third biggest in U.S. history. Remember if you win: It’s OK to tip the tipster, right?

What did you expect – I mean seriously? Russia-Ukraine war: Russian military leaders discussed use of nuclear weapons, US officials say. Now that multiple reports have U.S. troops reported on the ground in UKR, we wonder how the war party will do in the crash-lection next week?

Meantime, Russia attacks UKR grid: Ukrainian nuclear plant disconnected from grid by Russian shelling. We will give half a consolation point to the Russians for not shelling the plant, focusing on its grid-connects. Beats a meltdown, eh Vlad?

If there’s a Red Wave, we’ve snipped this story to hang in front of democrats next week: US midterms: Joe Biden says Republican election deniers are threatening to put America on ‘path to chaos’. I mean, dems have gotten almost everything else back-asswards, right? Will they embrace if there’s a red wave?

NorK Missile fizzle: North Korea launches ICBM that apparently failed and two short-range missiles.

ATR: Genuinely Great Deal

My consigliere called me a week ago:

“Gotta see this computer that is on sale at Best Buy. Regularly $249 but they are having a Black Friday deal and it’s $99 bucks.

Sure enough, for a while, the Lenovo Ideapad 1i 14.0″ HD Laptop Celeron N4020 4GB Memory 64GB eMMC Cloud Grey was on sale for $99. It’s back to $249 now.

So, I ordered one and wow! What a great machine.

No, it doesn’t begin to compare with the multi-TB 64 gig/ram/ i7/w11 box on the desk. But for a little notepad to write on anywhere around the property?

Here’s the mod list that makes it hum:

- Turn off the Windows 11 S-mode. Otherwise, you’re locked into Microsoft Store apps only.

- Plug in a cheap 1-TB SD card.

- Change storage settings to save everything new on the 1 TB card.

- Set fonts larger.

- Set themes to dark.

- Activate the free year of Office 365.

Wow. For $122 (before taxes) a Win11 machine with full Home OS license, a full TB of storage, 10-hours of battery life. And a “smart touch pad” – tap with two fingers to open the right click menus.

Totally blown away. Best Buy goes on the list with Amazon and Wal-Mart for big purchase electronics.

The good news and bad of all this? Moore’s law is still out there. And Covid, or not, some great electronics are still coming in from Asia.

No – not the fastest processor, and 4 GB of RAM ain’t much. But OMG for $122 for a portable that even has a webcam and a year of 365? Wow – great call.

Write when you get rich,

George@Ure.net

Midterm Republicans will save us, this time. 4th quarter and all.

Quick, how many zeros in a quadrillion. Hahahaha!

Now at $2.5 x 10^15…

https://www.zerohedge.com/markets/were-end-major-era-von-greyerz-warns-25-quadrillion-disaster-waiting-happen

I don’t believe they can Steve.. we are in an upside down repayment plan..

Everything that could have been done to stop the chances of our pulling out of the mess was done..

the only thing we haven’t done yet.. is go to full War… usually war has been done to spur the economic sector.. war is money.. But we are upside down.. I believe that due to the fact that there isn’t enough money generated in tax revenue.. we will have to go through a correction.. maybe even a bankruptcy of our country..

It is hard to say.. the democratic party ran us into the ground.. we were TDC before.. ( two dam close) with all the printing and nothing substantial being done with it to improve.. the shut down a years interests on a school loan only made more money for the banks..it didn’t help the people with the school loans.. they are at ten percent right now..at least here in the wastelands….

I suspect that most/all school loans will default. They get paid last, after food, transportation, housing, etc. Credit cards will likely follow suit. After all, banks pull back in a contraction and will cancel cards even on good customers. It’s use it or lose it. Credit ratings don’t matter compared to eating and staying warm. I truly believe that we will be living in a much harsher world a year from now. People will be in survival mode.

“I truly believe that we will be living in a much harsher world a year from now. People will be in survival mode.”

If we can survive another year … It is hard to think so much that has happened has all come about and it hasn’t even been two years…. its not looking very good for the USA or mankind from my perspective..

.. and I believe its going to be one heck of an adventure if things keep accelerating the way it has..

In other housing news.

Want to live in a van down by the river? Ford has a new vehicle for that. A home under $70,000.

https://www.cnbc.com/2022/11/03/ford-transit-trail-2023-targets-boom-in-rv-van-life.html

https://youtu.be/Xv2VIEY9-A8

Hahahahahaha… OTFLMAO.. now back during the work a day world.. I had actually considered getting a van.. having one would have saved many hours of driving to catch up sleep

When I worked sound stage.. I got to meet Johnathon winters LOL LOL LOL

Had lunch with him.. LOL LOL LOL I want to tell you that was a hoot.. almost couldn’t eat my lunch.. ( spagetti ) LOL LOL LOL he was as nuts in real life as he was on stage.. great guy down to earth and a hoot from the beginning to the end..

https://youtu.be/c_y0SA1yNLc

They’re coming to take you away ha ha, he, he, ho, ho…

LOL

To the funny farm

Where life is beautiful every day

For the musicology dropouts, Napoleon XIV at

https://www.youtube.com/watch?v=3Fn36l_z3WY

“To the funny farm

Where life is beautiful every day”

…”and basket-weavers who sit and smile

and twiddle their thumbs and toes”

I had the 45 — Yes, I was one of those weird kids who made this a top 10 hit!

To this day I often quote it…

My van cost $1000. Maintenence is minimal, though some day I’ll need a transmission. Less that $200 at the pull your own junkyard. I’ll do that when I have time and they have a transmission. Otherwise, a few more bucks at a regular junkyard. I’ll be putting on newer tires tomorrow.

“There are a lot of people around the country who live in homes – built in the early 1970s – that sold for around $45,000.”

A neighbor just sold their home….. they originally paid around four thousand for the home.. two weeks ago they got one hundred and fifty thousand.. not a big home either.. two small bedrooms..

in the eighties.. I build a house and a garage for fifteen thousand.. and in the early nineties.. I build our home now for twenty five.. had a contractor walk off with ten thousand of it in down payment for the foundation and dirt work.. ( I got a hammer.. that is where my ten thousand dollar hammer came from.. he left his.. this was a common practice by construction companies back then.big name companies to. )

the kids wanted to build a bird house and a bird feeder.. at the lumber yard I was looking for one of the handi panels.. only to discover that the price went up from four dollars to forty dollars.. did a price check and materials alone for a small seven hundred square foot house had gone up to one hundred thirty seven dollars material alone..

Prices have gone down.. but still.. that is twenty dollars an hour clear for a mcdonalds worker or a store clerk stocker.. who makes that kind of money around the wastelands.. average pay is twelve..up from the nine it was.. and the regular employees didn’t get increases

GI Bill – VA HomeLoan – bought my first house with that program. At settlement RE broker was bitching bout all the fees they had to take OFF due VA saying “Nein” to all of em..”they really take care of you guys” – I will never ever forget the moment, the words or her face..ever.

Like they be talking about here regarding, Praying & Manifesting –

*Nothing is Free. ? how many times G ?

Qi Gong = Energy Work. its hard, its painful…

Gotz work to earn merits of De/Virtue. Those “merits” are like “fuel” in the Woo World. There must be “something given” in order maintain balances.

Like working wit darkies – black magic” – can get large amount money The major problem/obstacle is that on that dark “road” you got no control…you will get amount you desire, but the way you get it will prolly be painful…ie insurance payout from car accident. You get the moola and also a bunch of SHIT you no bargained for.

everybody wants it for free, yesterday..lazy bastards.

We nearly went with the GI Home Loan to buy our 35 acres in the boondocks, but then read the fine print. The property had to be fenced to VA standards, and all structures had to be built to VA standards. Any timber cut had to be approved by the VA, and they’d get half the proceeds to apply toward the loan. Entirely too many hoops for us to jump through, so we went conventional with the local bank.

“GI Bill – VA HomeLoan – bought my first house with that program. ”

I never made enough money to qualify for those loans.. then after an employer threw everyone under the bus to play the stock market and a freak accident.. we were totally unavailable to get any type loan..

had to do it the hard way..

even today that sends clouds over my life..

Im the last person on this board to make any comments of finance and investing. If Im off the mark , my apologies , please delete.

George I found your site by looking up info on the similarities between societies in ’29 and now. My thinking was all of the social nature. I found peoples attitudes the same then as they are now and wanted more info.

But after several years of TRYING to understand anything of what you say about investing and cycles , I still have one thought that continues to occupy my brain.

Today we have people sitting behind keyboards making instant trades with instant real-time information. Markets down 500 ? Great time to buy XYZ. Markets up again.

But back then there was a lag time. No computers , no instant trading. If the market went down 500 , the regular guy didnt have the info or the ability to react the way we do now. So maybe that day ended at 500 down. Guy wakes up , sees that , and with little information ( as compared to today ) he sweats it out and pulls out to play it safe. He doesnt want to lose any more money. Markets down further.

I see your waves every day. But I have to wonder how much different those waves would look if we didnt have computer accounts and such. Would that not alter the appearance of your waves ?

Is that fair to think ?

Interesting thought., but not very realistic.., as we do have computers and near instant info for trading – rather difficult to “image” what it would be like without them.., but the wave count and such would be the same.., just very delayed in getting the info., and you wouldn’t be day-trading., you couldn’t.

“But back then there was a lag time. No computers , no instant trading. ”

A friend of mine and I both had twenty five hundred dollars.. to make a trade.. My sibling told me someone he knew.. ( Bill ) had a small company that he was going to take to market.. Microsoft.. and then Cisco.. so the share was what five bucks a share..

We went to one of those guys that traded stocks for people.. he laughed at us.. five grand.. told the two of us.. don’t even think about it until you have fifty thousand.. we didn.t..

we all know what happened to micorsoft.. no one wanted those shares LOL.. we both would have been millionaires.. but we couldn’t make the trade we wanted to..

then I mucked up.. took some funds and put it in a camel group… then needed the money for a surgery .. what I didn’t know was the low interest wasn’t yearly.. but calculated daily interest.. didn’t know it till I got out of it.. couldn’t put it back in.. OH WELL EASY COME EASY GO..

the most important lesson for the young, and all consumers, is to understand the way amortization works, first payment 99% interest and 1% principal and final payment 1% interest and 99% principal. people need to understand not to chase rates, that dropping your rate won’t necessarily save you money. i also explain how excess payments go directly to principal so paying one cent more means that you’re not financing that penny for 30 years.

Sunograss, that’s a great addition to the conversation.

I like to go to: http://www.hughchou.org

He likes to build the calculators including an amortization calculator.

One can easily plug in variable data inputs for what a 5, 10, 15, 20, 25, 30 year loan amounts and get the principle and interest payment over the life of the loan. You plug in term and interest rates.

AND can put in a estimated pre-payment monthly, annually, to see how a prepayment on principal affects the overall interest paid and payment term reduction.

IF you have a current loan and have lost the amortization schedule, recreate it here.

One can even compare is it better to pay off a home loan or make another decision.

When I first decided to pay off the remainder of my home loan, the calculations showed that I could save $10k if I paid off $70k early. I went ahead and paid off the home. I never regretted it as that was during the 2008/09 downturn and a lot of people lost 50% of their 401ks which took 7 or more years to return to the original amount, and much longer to increase valuation from there.

We met a man a few months ago, he pulled $200k from his investments and purchased 20 acres with a home/outbuilding, well, etc. Said he didn’t trust what was going on and would rather have his money in property where he could farm if need be.

Getting Out of Dodge (loans, high debt, high interest rate, etc.)

Excess payments will only go directly to principal if you specify that they do and follow up on it! Otherwise, many institutions will apply them to future payments on the original schedule.

“Meanwhile, on a different aspect of mind control: Leaked Documents Reveal Homeland Security’s ‘Expansive’ Influence Over Social Media Censorship.”

What was it I was saying the other day here? Ohhhhh yeah. Big tech acts as an arm of the government. Good luck voting your way out of this giant mess. You might as well jump off a building and flap your arms to soften the landing.

The sound of rough water ahead is becoming deafening. Is that what a ‘Red Wave’ sounds like?

It would seem that after the election, IF the Rs win big, the Ds plan Very Significant Protest(s). (of course..)

Also, the Rs will get ALL the blame when the economy finally Blows A Gut, mere days after the election. This concept, fitted for Stoopid Peeple, easily led, will aggravate the V.S.P.s to a huge degree.

The wheels will fall off — permanently — unless Sanity breaks out. 50-50, maybe, on that one.

Koyaanisqatsi, baby: Koyaanisqatsi…

Be ready to pull up the drawbridge over the moat and hunker. I hope we all (here) endure the storm.

7.299 by day, 3.999 by night. (There are groups on both, but not full-time. There’s enough airspace to share. ‘Specially on the 15s and the 45s — only the unsophisticated call on the hour or the half-hour…)

-73 –

(When the guy yells “DUCK!!” — don’t ask why. Just duck. Find out why later — if ‘later’ actually arrives.)

As we used to say, “It’s about to Get Real, Gents…)

crazy 8s are a coming, see what happened on the 8th for the last 4 months, just is strange

July 8: Shinzo Abe assassinated

Aug 8: Mar a Lago raided by FBI

Sep 8: Queen Elizabeth dies

Oct 8: Crimean bridge attack/collapse

Nov 8: Midterm elections

https://truthsocial.com/@JuliansRum/posts/109278059563060962

and it is a blood moon,,,

https://www.space.com/moon-total-eclipse-election-day-nov-8

Yee Haw, pass the popcorn

tOBD

correction to time line/events Lizzy in a Box = 2-22-22 “on the TWOS.”

“dumb” chuck lit off uziokraine on the date of death..at least on the spiritual side of this massive War..”break on thru” -JM

Spanky Lay Out

Thanks

“Buy some PowerBall tickets today! Powerball jackpot jumps to $1.5 billion, third biggest in U.S. history. Remember if you win: It’s OK to tip the tipster, right?”

LOL I had someone ask me what would you do with a billion dollars.. Hmm that is interesting.. exactly how much do you think I would need to make me happy.. I don’t care about showing off and pointing to a sheet of paper with numbers on it.. so what would I do with it.. well three things for shure.. I know of a school in kenya that is a well deserving school.. I would get the one person I know that would make sure it got there.. as a part winner.. then there is an organization in canada that helps deserving children have a chance at a normal life.. oh boy.. they to would be in on this.. everyone needs some hope.. then there is a hospital for cancer patients.. parents don’t pay a dime for treatment.. one to help people with astronomical medical bills.. and the shriners hospital.. a school in texas experimenting with the Kanzas cancer treatment and some funds to help with the water pipeline in my families name.. and a Solar power tower for three megawatts.. I would build the tower.. then let the power company use the energy anyway they want.. I would do it for our city.. just because.. see about a free medical van… what is that.. well there are a lot of cities in the USA where medical treatment clinics are hundreds of miles away or even at fifty miles away.. so a remote clinic.. to visit a town a day.. monday your in elliots ville.. tuesday at cranville.. etc.. put a couple of those out..

put a couple bucks away for our future medical expenses and put up that solar kid.. just because..

I can’t see me driving a fancy car.. the buggie is good enough.. but since we seem to have wheelchair people living in our spare bedrooms.. I might get a wheelchair van.. and a bigger kitchen.. LOL to many kitchen projects and a greenhouse

needless to say.. I am already happy.. got enough crap.. just would like to be secure for future medical events.. and would like to assist others.. if you didn’t notice.. I have mostly medical things.. I have seen people destroyed.. heck I was destroyed by a half million dollar medical expense that my employer cause when he tossed everyone under the bus wheels to play the stock market.. and a freak accident..

The Pooh Team has this all wrong. Lizz was baking cookies for Blinky to hand out in Kyiv. LOL.

https://www.shtfplan.com/headline-news/liz-truss-allegedly-sent-a-message-saying-it-is-done-to-blinken-after-nord-stream-sabotage

Explains the sudden departure.

See Kim Dot Com – he explains how he did it – how NO INFORMATION is Secure..anywhere in the world.

Intel agencies can acess ALL of it, as can Kim Dot Com with Apple Cloud Admin – times, dates, numbers, text EVERYTHING.

Hell I used to attend meetings at a “satellite tracking company” in the early oughts that had Lead Lined Meeting Room (s) = Secure….until the information was stored to cloud..

I jumped in on Halloween.., couldn’t stop myself. The NASDAQ 100 has dropped 6% since I entered the trade – down 1.6% [ 176 points] this morning. So., it would appear that I timed this one just right. Not too sure just how much further this is going to drop right here – will be watching.

– Wish you would have posted the laptop deal when it was $99 – I am looking for a new one.

Shouldn’t that broken glass and debris be on the INSIDE of the structure?

https://www.zerohedge.com/political/san-francisco-da-wont-release-police-bodycam-video-911-calls-paul-pelosi-attack

a 82 year old’s home is invaded, he gets clunked in the head by a hammer, he’s still in ICU a week later and you’re telling lies. you’re FAKE NEWS. why is it easier for you to believe BS propaganda than the truth? because the truth is that language by republicans lead to the attack. so what do republican do, make up a fake story to divert accountability. you are what’s wrong with the US. i bet you trust putin and russia more than the US too.

Steevo is just observing how a Big Fix works. Glass on the wrong side of window.

Police won’t release body cams or 911 calls.

This is very likely being covered up – but real details will come after the election.

Maybe.

More gormless lefty drivel from *on the grass* (apt, that), our resident lefty troll. This is my surprised face. The only thing missing in his screed (besides punctuation/capitalization/and proper grammar, natch) is,of course, any real connection between the barking mad, doper (who thinks he’s Jesus) who attacked Pelosi and “republican language”. You know, something that would logically connect a seriously mentally ill, illegal alien who lives in a SF nudist commune, festooned with BLM and gay pride and MJ flags with anything *any* republican said. Ever. Except looney lefty wish-casting and projection, that is. If you are really looking for direct connections between “language” and political violence, give this guy a call: https://scalise.house.gov/ . Or you can also ring up this fellow: https://supremecourthistory.org/supreme-court-justices/associate-justice-brett-m-kavanaugh/. In the mean time lay off the hebephrenic attacks on steevo. Or, better yet, just take your insipid, lefty yammerings back to Democrat Underground or where ever else tendentious, low information, baizuos like you usually congregate. Exit question(s): I seem to recall another of your clout chasing posts here regarding “poor quality” candidates (like General Bolduc) forwarded by the republican party this cycle. You know, “inferior” (Dangerous even, according to President Houseplant just last night) candidates destined to lose and all. So why did the democrat party spend millions on primary ads in support of the General (and other *democracy threatening* “election deniers”)…and how come he (and other similarly “inferior” republican candidates your party spent beacoups bucks on) is currently projected to win his NH race against his progressive democrat opponent? I assume that having invested heavily in the General’s campaign (via your doubtless contributions to the DNC), you will be popping the bubbly if he wins next Tuesday night…right? If so…word up—go slow with the libations. Look what happened to Pere Pelosi a few weeks back (say…who was that mysterious passenger in his car, anyway?). I myself will be drinking in moderation here in Florida. But I may just dance naked when Charlie Crist and a whole host of other “inferior” democrats pols get handed their walking papers. Say…any chance you want to Facetime with me on election night?

@George

“real details will come after the election.”

Not a chance.

Pelosi and DePape were doing the hammer dance when police arrived. Neither one of them opened the door… so who did?

In the photo of the Pelosi residence, the broken window debris is all on the outside of the door. The probability that that window was broken by something striking it from outside the residence is zero.

Nancy Pelosi established an “outpost” of “The Capitol Police Department” in Frisco, as her own private bodyguard. It is manned by 200 cops. The Police Station has a live feed on camera surveillance from every room in the Pelosi digs, except the bathrooms and bathhouse, as well as every square foot of the grounds. Additionally, the Pelosis are worth between $200mln and $900mln, depending on who you ask, and they’re kinda high profile. I find it impossible to believe high-profile people who’re that wealthy would only have security on the grounds when the Misses is home, and I’ve never met someone with that kind of pocket change who didn’t have a residential servant or three.

TPTB have demonstrated that a majority of the population will obey an “official line” without hesitation. The commies in government and the media will repeat the “official line” until a majority believe them, then they’ll disappear the discussion.

After that, any future narrative will be from the standpoint that the “official line” is the only line and anyone who doesn’t accept it is a conspiracy theorist or nutjob.

It took the authorities three days to write a sanitized version of the Pelosi incident, and when released it bore no resemblance to the original version that the COPS who were at the house described. One of the versions must be fake, and neither was written by Republicans. But there’s nothing to see here, right?

On the plus side, the whole circus is adding some much-needed humor to the garbage passing as news these days. Mel Brooks should make a movie of this!

i’d say occam’s applies here. y’all gotta keep writing your fictional conspiracy theories though. why? what happened to pelosi is exactly what y’all wanted to happen. even MTG called for pelosi to be executed. y’all wished mike pence got it on 1/6 too. you can’t run from the outcome of your actions.

JAC – you sound really unhinged. you shouldn’t be allowed to have firearms.

Nor you writing instruments?

Ah, No direct link to “republican language” and the attack on Pelosi (the facts of which get weirder with each passing day)….provided….other than more window licking looney blather by our enervating resident troll “on the grass”. Who now, in the depths of his lefty delirium has branched out into psychology (without portfolio, natch). Too cliche. It is more than likely that *he* is the one who should steer clear of both firearms and sharp objects….if predictions hold true next Tuesday night

“i’d say occam’s applies here.”

I assume you mean “Occam’s Razor?”

Were one to apply Occam’s Razor to this incident, they would find it was most-likely a quarrel over either payment due or services rendered.

Were one to apply human intellect and deductive reasoning above that of a clinical imbecile to where and how he lived, and his selection of political adornments, they are not likely to come to the conclusion that Mr. DePape is in any way sympathetic to American conservatism, Mr. Trump, or the U.S. Constitution.

Rather than making inane and borderline slanderous suppositions regarding the desires of George’s readership, why don’t you go troll the reader forum at “17” for a while — see if you can keep up with preteens before you venture back into the adult room…

I see noth ting !

sniff sniff ..was ist das ? Is that apple strudel I smell ?

Righto Steevo!

I’m going to give a caution here. Making public attacks on victims of crimes can be prosecuted or sued as retaliation. Jones learned that the hard way. Freedom of speech does not include the right to pile on victims of your favorite perps. This isn’t play by play commentary of a football game. I have to side with sunongrass. All crime scenes have anomalous details. Whether the the perp broke in or was invited in is truly irrelevant; the victim had his skull cracked while he was calling 911 for assistance. If you are under threat of violent attack with the attacker listening in, it will affect what you say to the 911 operator. You don’t intentionally provoke an attack with inflammatory rhetoric that will get your skull cracked. I read an alleged transcript of the alleged perp’s confession. Pelosi’s alleged statements are consistent with the alleged perp’s confession. I also have to ask- where was the secret service in all this?

In sixty-something years, I have yet to have contact with a cop where they didn’t try to turn my complaint around on me, or just basically tell me, in a polite and officious way, to piss off. Front line cops appear to be instructed to take any statement from a perp at face value, regardless of how ridiculous their statement is in regards to physical evidence. Investigators and prosecutors sort statements out after the fact, usually without talking to witnesses directly. Lawyers are usually about the same way, though they are more likely to make ad hominem attacks on the their potential clients than cops.

I have been conditioned by real experience to accept all that, and be grateful for the cops not hauling me off, torturing me, shooting me, and dumping me in a shallow grave, as well as for most lawyers refusing to provide services when I really need them. I am happy the Pelosi’s are getting police service. I wish all of us got that same level of protection. Still, on the whole, I like vigilantes a lot less than cops.

“the victim had his skull cracked while he was calling 911 for assistance.”

Not true. The perp waited until police were on-scene before hitting Pelosi.

“I’m going to give a caution here. Making public attacks on victims of crimes can be prosecuted or sued as retaliation”

That is a good caution. I don’t believe any of us have crossed any lines as even the folks at TMZ have posited that the incident could have been a lovers’ quarrel.

FWIW, Paul Pelosi is a really nice man. He drinks, he cavorts, but he also has to look at Nancy’s naked body and perhaps worse, her naked face.

In his place, I’d drink and cavort, too.

I think he’s a jerk for having employed a couple hundred illegal aliens on their vineyards, but that’s also common practice in Cali so is probably not an indictment of his character.

With that said, somebody either killed those 79 security cams and pulled both housekeeping and security from Casa Pelosi, or somebody’s got some really insightful A/V files they’re not sharing.

Who answered the door when the police arrived…?

I have to admit that I am “slightly intrigued”., with all that is going on in the world economically and financially – at the performance of gold and silver. One precious metals pundit / guru stated that gold has had it worst performance since 1869. [ I didn’t crunch the numbers to verify.] Another analyst said that gold., in real terms, based on historic economic data, should be over $4,000 an ounce. [ I have no way to verify that.]

– With a severe market down turn., recession heading into depression, wars and rumors of war, political chaos world wide…., will gold start to make a move up? Or will “the powers that be”, keep the prices deliberately strangled ?

– Seems to me that manipulating the price and keeping it low, so they can buy-buy-buy., that sooner, or later they are going to want the price to start soaring. But when? ., and when “they” start lifting their controls and manipulations…, what will that do to the stocks and bond markets., and dollar value?

– “Slightly intrigued.”., indeed.

Mute be the point, the price, as when liftoff occurs, world will be deep in the kimchi. Precious Metals mines nationalized over night..stocks in PM miners not in USA,will be exposed to this massive risk of loss of entire mine/operations. HellI would have already told the USA to pound if was dik tater in Mexico, Africa, Indonesia..so solly chaalie ..

Buy some cheap silver/gold coins, junk works.

The manipulation will stop if/when there’s a break down of governments. That’s when it will have some value if you don’t have anything put away to barter with (alcohol, food, meds, etc).

Figure 10% of your holdings in physical…later it will be too late to convert from paper to physical because there is many x the paper gold than there is physical availability.

Housing can’t be measured in a macro sense. There are still micro-markets out there that are experiencing decent YOY growth. My market is one of them. My team is up over 20% YOY and that’s coming of a record year. The difference we see is that more buyers are going to cash positions in their portfolio’s and transferring that money into real estate. We aren’t talking small amounts either. Our last few dozen sales ranged from $6.35 million-$2.2 million. 60% were all cash. That’s one way to fight high interest rates.

I just got back from a national conference and the greater Miami area, pockets of L.A., Atlanta, and the core of Hawaii, D.C., New York, Boston, Austin, Dallas, Houston, San Diego, Seattle, Denver, New Jersey, Nashville and Charlotte are all seeing increases in volume, YOY. Those pockets represent nearly a third of the U.S population and 2/3rd’s of the nations GDP. In fairness, that leaves 2/3rds of the population and only 1/3 of the nations GDP experiencing a downturn in housing pricing and an uptick in unsold homes. There is a correlation…Where there are jobs, there is robust activity. The area’s that are suffering the most? Places where bus loads of angry folks moved to thinking the grass was greener like Boise, Las Vegas, Phoenix, Eastern Oregon, and the Gulf Shores of Florida (hurricane induced). There we are seeing exponential decreases in value as they quickly found out that the grass in those large markets where they moved from was just fine. Many are moving back. A lot of those were from California and I personally am helping over a dozen find homes back here in the Bay Area. A lot of that is our superior weather, but the job opportunities are just so abundant, that despite the high cost, it’s a more long term secure situation to live here, L.A.San Diego etc.

In 2008-11 locally a couple of the burbs, the ones with the best school districts that also had long established residents who’s home’s had huge equity built up in them, never missed a beat and values continued to increase. Increase in EVERY QUARTER through the entire period. Of course MOST of those buying into those areas during that time were HIGH STABLE INCOME or CASH buyers.

Rest of the urban area … well it went down, some parts of it by a LOT.

The overall real estate market as Mark points out can be very very different than that of a sub market perspective. This is even more pronounced if in the sub market being considered most buyers are CASH buyers and don’t need to rely upon either financing OR monthly income cash flow to pay for their purchase.

Over an entire metro area though real estate pricing, once you are away from those cash /or super heavy down payment buyers, relies upon the interplay between monthly mortgage payment costs and the income that people in the area make.

If one has a stable employment area with a balanced supply – demand situation wrt inventory then the market is going to almost exactly match the up’s and downs of the cash flow required to service a mortgage … so over time with rising interest rates the prices WILL fall (with a lag, generally about a 6 to 18 month lag).

What will be interesting to see is “IF” Elon Musk does fire 1/2 of Twitter’s employees will that break the logjam in Silicon Valley and set off a HUGE head count reduction in the high tech /silicon valley world?

No way for us on the outside to know at the moment … though after many many good years in a row you can be certain that MOST of the high tech firms inthe valley are heavily bloated with highly paid tech people, many of whom aren’t really very efficient and not adding to the bottom line. If the layoff /firing logjam get broken and they start in earnest in that world that could end up doing some serious slicing and dicing on the personel front. (both numbers employed and how much they are paid)

IF that happens it probably will have minimal impact on the most upper end real estate in Mark’s world, but it will have a MAJOR impact wrt the middle market /middle class end of that real estate world, starting with those areas out on the extreme fringes where people are commuting 90 minutes to 2 hours to get to work from.

Economist Jordan to Newsmax: Companies Bolting From California

https://www.newsmax.com/newsfront/california-taxes-companies/2022/11/03/id/1094791/

Economist John Jordan, who’s on the board at the Hoover Institution, related a simple explanation for recent reports of 11 Fortune 1000 companies moving their headquarters out of California since 2019, along with 41 businesses bolting from the Golden State in 2021 alone.

…

Jordan reasoned that Democratic Party leaders in California — or “the ‘museum of head injuries’ that run” the state — are “doing everything they can to drive out businesses” to other regions.

Jordan said, “Just look at downtown San Francisco … more than half the commercial real estate [available] is empty.”

With each passing year, Jordan said California will continue to lose more people and more established companies from its base.

Also, the rampant homelessness in major cities hasn’t been sufficiently addressed, said Jordan.

As a result, Jordan said that California’s remaining citizens and companies would be left to cover the obligations for one of the highest-taxed states in the union.

The high taxes in California “grab the headlines,” said Jordan. “But it’s also the regulatory burden which functions as a hidden tax” for current companies and prospective businesses pondering a move out West.

Put it all together, and Jordan said the high taxes, prohibitive cost-of-living, and diminishing quality of life have led to Democrat leaders creating a “menagerie of public policy” decisions.

“California hasn’t hit rock bottom yet, but they’re also not too far off,” said Jordan.

Links within the original text for substantiating information at the link above. -Bill

John Jordan is a hack. Commercial real estate in most cities are running at half capacity do to work at home policies still in effect. However that is changing rapidly. WFH is not working…a majority of workers are reporting back to the office…Just in Time…Most major highways were just recently expanded by 20-25% extra capacity by adding a lane or two each way…easing up traffic woes we had to deal with pre-covid.

Plus there has been a switch of sorts for commercial builders to build for the bio-tech sector. Bio-tech workers have and always did go to the office, even during COVID, because you can’t do lab work from home. There are over 18 million sq ft of Bio-tech buildings under construction in the Bay Area right now. Most of it is in South San Francisco, Mission Bay in SF and new projects in San Carlos, Menlo Park and Foster City. The Bay Area job market is resilient. While some companies have moved out, they are being replaced by companies moving in or being formed like APPLE, Google, Nvidia, etc before them…by the multitude of Stanford, Cal, Santa Clara, and SOCALS, CAL Tech graduates monetizing their thesis projects.

[This is intended as a reply to Mark; the software allows a limited number of nested posts]

>>WFH is not working…a majority of workers are reporting back to the office…

My employer pretty much demanded that everyone spend three days a week in the office (more if you want) 12 or 14 months ago. The arguments in favor included easier collaboration, the cross-pollination that can come from people meeting at the coffee station, and probably two or three more that don’t come to mind now, while I’m insufficiently caffeinated.

The last time I saw someone wearing a mask in the office was earlier this week. I *think* that he does so for health reasons, and not to show how happy he isn’t about the policy.

More pointedly, this software company has lost a number of developers (well-known inside the company, well respected, and with a history there). Some of the hallway conversations left me thinking that some of them were expected to stick around for another 20 years. IIRC all of such conversations mentioned that each of them had moved to companies which expect the work to get done… somewhere… and probably expect participation in monthly staff meetings (for which Zoom-style remote AV might satisfy requirements).

I must say that I don’t know for sure how many of those departures might have been precipitated by the requirement to get the jabs prior to returning to the office (failure to do so was promised to trigger ‘corrective HR actions’ which could include termination of employment). I suspect that it was a factor for some, but not all.

This business of private businesses enforcing government decrees reminds me of a style of government that was popular about 80 to 85 years ago. Benny apparently stole the quote calling it “corporatism”.

Mark, as a 40 veteran realtor I finally had to check your BS.

By price/volume and the number of homes sold. Here are the facts straight from the NWMLS (Seattle)

County=King,

City=Seattle

In the last 365 days 8501 residential properties have sold

with an average price of $912,500.00

$912,500 x 8501 = $7,757,162,500.00

The prior 365 days( same criteria) moved 11,149 residential units

at an average price of $835,833.00

$835,833 x 11149 = 9,318,702,117.00

Prices are up, so is inflation….

Also note, in the last 365 days, of the 8501 units sold in the last year, 1218 sold for cash.

On the positive side, average days on market has remained 13-14 days both years. The last 30 days however shows the average DOM has edged up to 17 days.

Just for fun, for those 580 residential properties that sold for over 2 million in the last year, 185 were cash sales.

How does this prove i am wrong? I said 60% of my sales were cash..not the entire Bay Area. My team will close in excess of $200 million this year. I am way up YOY this year…but I play in a different segment of the market. My average sales are well north of $2 million. But…the fact that in all of Seattle, 31% of sales over $2 million were all cash sales…is pretty evident that what i said is spot on…Seattle has a fraction of the wealth of the Bay Area and still has a well above average all cash saleswoman then is what I said BS?

Excuse the auto correct typos…I meant to say at the end of my post…

Seattle has a fraction of the wealth of the Bay Area and still has well above average all cash sales numbers…so then why did you say you had to check my BS? Based on the size of our market and our extreme wealth (more millionaires per capital than anywhere on planet earth) 60% all cash sales in the luxury segment of the Bay Area is pretty normal.

Don’t remember if I have shared this.., it is an interactive map of stock market indexes around the world. Just hold the cursor over a listed country and a small window will pop-up with that country’s index.., pretty handy for getting a very quick – global view.

.

https://markets.businessinsider.com/indices

My 0.02

2008 was different. Everybody was getting no-doc ARM mortgages. Turns out that not qualifying buyers income and setting them up with 100% ARMS was a bad idea. Those mortgages were worthless from the start. Hogs get slaughtered.

Today everyone gets qualified and no one is getting an ARM. Yes, a recession will bring foreclosures, but no where near the bank-breaking levels of 08. Pigs get fat.

Next up: debt. As in $31 trillion with a “T” of debt. And a bunch of it is scheduled to roll over in 2023/2024. Higher interest rates will blow a hole in the federal budget that they cannot paper over without driving more inflation. Interest rates will not stay high for long… because they can’t.

Fed is taking one quick, hard shot at shocking away inflation with a hard & fast recession, before they have to lower rates again to roll over all that debt.

Finally: for every 1% increase in mortgage rate, the amount of mortgage than can be supported by a given payment amount drops by 10%. So payment of $2,100 will get you a $500k house at 3%. But at 4% that same $2,100 payment will only get you a $450k house (90% of 500k).

People don’t buy houses; they buy payments. They will buy the biggest house that they can afford payments on, and not a penny less.

The good news is that as long as they keep their jobs, they will be happy sitting in that house with a 3% mortgage for a while. Home values should stabilize, but not crash.

I think this is a wee bit off – the adjustment of rates higher killed the arms mortgage market – it will be the termination/lay-off cycle that will kill it this time – in my sub-division pricing on ave now is prolly around $1mm+ – minimums $700-750k remodels and new construction ranging up to the mid $1mm’s – I rarely see a house that doesn’t have 3 vehicles in the drive way …… this is on the out-skirts of the Memeorial Villages/Houston when this really starts to bite I think it will be a massacre …….

I would argue that smart people buy houses(at the lowest cost and with all kinds of construction problems, but not municipal ones), and lower information people buy “homes”. You can’t buy a home unless it comes with a resident woman! Buy the house you want/need for its mission profile. In most cases, that involves tolerable living for the given number of residents, along with enough enclosed workspace and garage space to be able to live without a job. Jobs are never guaranteed – you can be fired for one cause or another. Imagine working for Twitter! Everyone needs to sleep somewhere and shelter from the elements. That’s what a house is for. If you need to finance it, plan on ridding yourself of payments asap! Those who maximize their house size via payments/interest rates are planning on a lifetime of servitude and insecurity. Beyond a certain size, the house owns you.

A house of any size owns you! WHATEVER you own, owns you.

The reduction in value of the house looks real to me.

Over time housing prices in an area reflect what people in the area can make payments on (unless you are older you BUY based on payments, NOT price!) plus adjusting that amount to LOCAL Supply /Demand dynamics.

Given the short time frame that the changes in interest rates have occured over the supply /demand situation (ie: how much people make in an area + net migration amounts) can be considered a constant (non-changing) for your cited property. Because of that the change in value would be directly related to the change in interest rates causing monthly payments for a particular house to SKYROCKET if the value was not reduced.

In your example the jump in interest rates from 2.5% to 7.25 has thus effectively reduced the value of the house by 40+- %, though it may take a bit of time for that pricing change to be reflected in the market (real estate prices are really sticky when prices are declining since the natural inclination of most people – not businesses – is to NOT reduce their asking price … which results in sales slowing down dramatically during the early period of a residential real estate decline, and then bunching when the price bottom is actually hit)

40+% loss in the value of the house in less than 18 months should be a real “Wake Up Call” about what a person’s house is worth … but of course most people will NOT do the math so as to try to understand what is happening.

Homeowners contemplating selling have missed peak market. So, do you invest in add-ons, or do you sit tight? Wish list:

Solar panels

Geothermal HVAC.

Shelter for equipment.

3 pt tiller.

Diesel back-up vehicle with storage tank.

Guess I better buy a lotto ticket.

“Runaway Political Correctness (bullshit): Princeton University teaming up with the ADL to create database tracking non-criminal criticism of politicians.”

I wondered why (Jew) Mark Levin was so anti-ADL (ADL={Jewish} Anti-Defamation League) until I started looking at some of the stuff the ADL says & does. The ADL is no better than the communist-run or inspired organizations within my own religion, and in some cases, worse. I now automatically put anything the ADL spews into the same pile of vomit the SPLC upchucks. Livingston was undoubtedly a more upstanding person than Soviet agent Morris Dees but it seems, thanks to the level of freedom we enjoy(ed), nonprofit NGOs always seem to gravitate toward communism, when they attain a level of notoriety.

Lefties are easier marks (marx?) for fund raising

Ray, this guy tells the story of why orgs like ADL and all the rest were created and how they’re used against the people:

https://www.bitchute.com/video/80eh3jCstNUa/

or go to bitchute.com and search fagan illuminati cfr 1967

If anything, it’s an interesting story…being this guy was there for some of the meetings.

Bitchute, a place where it’s still ok to incite violence..

https://www.adl.org/blog/bitchute-a-hotbed-of-hate

https://www.independent.co.uk/news/uk/home-news/bitchute-far-right-youtube-neo-nazi-terrorism-videos-a9632981.html

Thar’s money in them thar hate groups:

Bitchute, Alex Jones, Mr. Monster all associated:

https://www.npr.org/2021/02/08/965448572/meet-the-man-behind-epik-the-tech-firm-keeping-far-right-websites-alive

https://www.splcenter.org/hatewatch/2021/11/16/infowars-director-bought-domain-named-after-terrorist

n, thanks for your powerful comment about public attacks on victims of crime being able to sue the public attacker, aka Alex Jones reference, …lawyer quoted, ‘Speech is free, lies you have to pay for’

live in a fantasy world, try to convince others that your lies are true:

https://www.cbc.ca/radio/thecurrent/the-current-for-aug-5-2022-1.6542343/alex-jones-has-learned-that-speech-is-free-but-lies-you-have-to-pay-for-says-lawyer-1.6542617

Speaking of non-free speech, as you did, Elon Musk has done a complete turnaround on his promise to make Twitter a free speech haven and reinstate some of the banned. And one of his group of content moderators is the ADL.

https://needtoknow.news/2022/11/elon-musk-to-crackdown-on-hate-speech-with-help-from-the-adl-and-other-content-moderators/

Will there be action in the marijuana stocks?

“Biden ponders marijuana moves as states forge ahead”

My understanding is while legal in many states marijuana businesses run as cash businesses.

When the Feds legalize marijuana will the growers/dealers then be able to use the banking system/tax laws. Right now I don’t think they can expense or capitalize expenses on taxes.

If this changes will that show a temporary boom to their bottom lines?

What’s the tax law on weed businesses?

The hitch in the pot giddy-up despite being legal at the state level in many states, is due to Cannabis being on the Fed’s “Schedule 1 list” along with coke and heroin. So long as it’s on the list, banking of any sort is prohibited, which makes it an “all-cash” biz.

But if you want to speculate, look into CGC, Canopy growth, headquartered in Canada. I’m underwater right now, but holding. This is not investment advice, ya-di ya-di-da.

Why the Great November Nonlinear 2022 Crash?

While not 1929, not 2008, but this crash does represent great nonlinearity within the US 1807: 36/90/90/54 year asset-debt macroeconomic cycle. This historical super bubble asset valuation was inflated since 2020 via unprecedented world central bank covid related money printing, low to negative interest rates, and money lending programs. With resulting consumer inflation at 40 year highs, the bubble is being given 10000 needle pricks a second via an historical acceleration of central bank money tightening. This time is really different. A historical nonlinear devaluation will be representative of that difference.

From the 90 year 1932-2021 third fractal November 2021 Wilshire/Bitcoin high:

the simplest mathematical y/2y/2y monthly decay fractal series: 3/6/6 months (with lower or higher low valuation at 3/6/6/4 months – likely higher with an earlier QT to QE pivot than anticipated)

2009 to present:

1st fractal: From the ending Feb 2009 low: 6/14/14 months: 32 months

2nd fractal 15/35(8/17/12)/20(6/15) month = 68 months

Valuation distortions caused by Brexit world banks’ large QE/lowered interest rates …

3rd fractal using 15 (3/7/7) month upgoing base of (6/15 month terminal 2nd fractal)(15)//36 (7/15/16)//33 (7/17/11) = 68 months (with lower or higher low at month 71 (15)/36/36 months.

For the final 11 months of the 7/17/11 month fractal 7/15/13/10 weeks or

31/71/60/43-44 days (with base for 71 day second fractal 28+ days)

The final 43-44 day decay fractal is composed of a 2/4/4/3 and a 5/12/13/7-8 day decay fractal ending Wednesday or Thursday 9/10 November 2022 with a potential longer daily time period because of trading halts. A potential low of 14470 to 15370 is possible for the Wilshire.

Final 7-8 day 4th fractal decay series:

From the 1 November 2022 3rd fractal 13 day (key reversal day) (5/12/13 day) high : 2/4/3 to 4 days.

The timing crash of the US (and European, and Japanese) equity crash and cryptocurrency crash coincides with the Chinese property, banking, and composite equity crash.

The WEilshi8re 5000 halved by end of next week????

Lord o’ Goshen!

We’d get all the Pear Trees along with all the partridges.

15,000 on the Wilshire? That’s a 20,000 point drop. .., damn !

Buy low, sell high.

Accumulated GBP/USD long into the 1.1150 area inside the Day Demand box. 2:30pm eastern.

Closed some up into the 1.1200 area. Sent Ure the charts. Will hold the rest until we see what non-farm payroll looks like or stop out at break even. My opinion at the moment is the Dow moves up more next week because most central banks are matching the US rate hikes now, the 3/4% hikes are over, paid operators haven’t started the post-election chaos in the streets the America haters are promising, no dirty bomb in Ukraine set off yet by the power mongers.

Need a ‘blow off top’ to sucker small traders in long and leave them holding the bag while the big$ closes longs and go short. Not seeing this developing yet. non farm payroll could change this.

Re: Bon Appétit feat. Dystopian Qiandry

Folks,

The German Chancellor appears to be the first Western leader of substance to visit Beijing, and a beaming Mr. Xi of extended mandate, since covid emerged. A contrail leads from CGTN to DW to the BBC and onwards to a dim sum presentation on Park Avenue, NY, by the charity “China File”. They describe their Chinese character script meanings as central (China), archive, restaurant. The public record describes their one of the two building tenancies as “food preparation”. The other tenancy houses a small Asia Society museum of carefully curated pieces founded by JD Rockefeller III some 65 years ago. The general public is welcome. Admission for corporations into the Society’s behind-closed-doors governing Global Corporate Network requires an annual stipend from $10,000 to $50,000.

https://www.chinafile.com/library/excerpts/american-trained-rocket-scientist-who-shaped-chinas-surveillance-system

Re: Let’s Make a Deal feat. Donkey behind curtain 1

Comrades,

In sarcasm we trust.

It’s not that bad! In fact, the numbers are looking great. Kindly take your seat in the re-education hall. (Iris scan registration pending .) Welcome to a review of “Poverty in the United States 2021” as presented in Report Number P60-277 issued 9/12/22, courtesy of the US Census Bureau.

https://www.census.gov/library/publications/2022/demo/p60-277.html

Care to take a look at Table B2, people in poverty by number and percent between 2009 and 2021? It is blatantly clear for anyone to see that the Biden Adminstration has singlehandedly lowered the poverty rolls of all races combined by some 13 million souls reducing the poverty rate by 4 percentage points from 11.8 down to 7.8%. Please, people…show a little gratitude.

And furthermore for all you doubters hanging out on Truth Social – you wanna see Truth?! Check out Figure 1: Number in poverty and poverty rate using the official poverty measure – 1959 to 2021″. Do you see the vertical grey line on what appears to be the last quarter of 2019? Yes, folks, it’s tagged “R” for Recession, but if you wish to believe “R” for Republican, feel free. President Trump left office with America in recession? The history book printers would appear to be leaning that way.

Clearly, the Administration is doing its darndest to get the message through to you Americans. Even to the point where on the last Sabbath Dr. Biden was out on the campaign trail spreading the good word, while Mr. Biden looked over the grandchild flock in Delaware.

Well, it’s that time. From studio pulpit blasting forth the sonic waves, here’s DJ George telling it like it is with a great Canadian band, Trooper, from their Thick as Thieves album –

Raise a Little Hell

https://youtu.be/pG_brDZoLAs

George,

It seems what we consider an index finger is known as the food finger, “shizhi” in China, and is the pseudonym of a famous poet of the Cultural Revolution author of “Winter Sun: Poems”.

https://u.osu.edu/mclc/book-reviews/winter-sun/

When I look for palmistry, the first knuckle at the top of the finger represents “spirit”, the middle knuckle is “reality”, and the bottom knuckle is “material”. A curved finger might represent the feminine, a straight finger might represent the masculine?

PS:

I overlooked to say Qian Xuesen has been turning up in the current Chinese media. Perhaps it was in relation to the Oct. 31st anniversary of his passing. A Borg is under construction? The 2022 World Internet Conference is in Wuzhen Nov.9-11…

73 you haven’t done any work or no guru for that matter any guru on how market crashes form . Trading patterns . Black Monday scenarios . And gold is pure it is telling us for a long time . Good luck everyone

Not much time to talk. I’m busy thinking. Boy, DUDE pointed out some stuff in me I didn’t like to see. The closer you walk in the light the more it exposes the darkness. And you know once ya see things as they really are about you. The good the bad and the ugly you want that ugly shit to go away. Own it right away. Change course.

A few things from my thoughts and observations since I was last on here. I litterally drive 12 hours and talk to THE DUDE, after a 2 hour meditation in the morning. It’s like 14 hours of meditation.

Ure website is backwards geroge. Everything colored Green is turning to color Gold. They hydro seeded the jobsite and all them fields of green turn to gold. Same with the leaves.

Now if you understand the meaning of Green spiritually. Growth etc and the Meaning of Gold spiritually as in highest form of development.

Everything green is quickly turning to Gold. This is the Age for it. As I noticed this trend of green to gold I remembered my old website mining was in green and the future was in gold. Then all the sudden Norman greenbaum came on the radio singing spirit in the sky. LOL

95% of the world’s population is below the Age of 70 BTW.

Saw a light blue doge pick up then a white one and then a green one yesterday in that order.

The Federal banks are buying up alot of Gold

Saw a bunch of big baby eagles today. One flew right over me.

Have a good week. I been getting messages that say faster than you expect. But all the events in my personal life keep getting pushed back a week. Hmmm. So I’m wondering what is happening faster than I think and what is being pushed back. Not sure.

I did forget mention direction. See how i tell when something is future tense reading the language of creation is its moving towards me like the doge trucks. Blue white and then green. Coming from the direction where I’m heading too. That means it’s insight into the future. Same with the green turning to Gold. And then I ask for a point of reference and normal green baum gives spiritual answer. Spirit in the sky song. So I know to look up the spiritual meanings of the colors.

The trucks and material meanings.

One last thing. When I prayes for someone occasionally I get a name of a person I don’t know. And I write one. I found one of the people I had no idea who it was yesterday. It’s political leader lady from Arizona named Kari. Tripps me out. I wrote a prayer for her 2 years ago. Not a clue who she was till yesterday.

She has a very bright future. Very bright.

OK back to my talk with the DUDE who is telling me I’m getting married soon and I currently have no plans about that

The true value of a house is 3x the gross annual income of the people living in that neighborhood. Anything more or less, and somebody is gaming the system, and somebody else is going to get screwed.

Remember when interest rates were determined by supply and demand, and risk was considered as well. Now the government and the banks dictate the interest rate for their own benefit. And stocks were to raise capital for a growing company while sharing the risk of that company.

Right now the housing market is being suppressed to drive the builders into bankruptcy so they have to dump their inventory at fire sale prices. These houses will be sold in multimillion bankruptcy tranches to keep the individual buyers out of the market. Then, when interest rates peak, and housing prices bottom out, the big boys will step into the market and buy everything that hits the market FOR CASH!!! After that they will be able to dictate rents, just like the banks dictate interest rates.

If you think the sh*t house of the USA economy is going to stay together until 2024, there is still time to get the hell out of the USA, buy yourself a nice $120k condo with $60 monthly fees, and live in a country that exports both food and oil. And has medical costs about 20% of USA prices.

And BTW, November 9 is the day to fear, because no matter how the elections go, neither side is going to accept the outcome. It’s why I predict civil war in the USA by 2025. Multiple locations over multiple issues.

“The true value of a house is 3x the gross annual income”

“True values” are tricky.

What’s the true value of the BAG, Boeing, Amtrak and GM?

Delta folks are striking. The strikers probably think the airlines are flush and profitable because the airline executives booked COVID bailout as profits to get bonuses. Now the money is gone or needs to be refilled.

What’s the real general wage level without bailout?

Most pension plans are busted out and rely on bailout. They’re all busted out after reverse multipliers.

There is no true value after the bailout multipliers get removed.

The poster up there posted, “$2.5 x 10^15” Quadrillions? Everyone takes quadrillions in unfunds seriously. Good luck

I used to have a lot of fun upgrading the processors in laptops and computers when they weren’t soldered into place. Does this Lenovo have a socket that allows for this?

The wife handed me a bunch of lottery winning tickets she’d collected and gave me marching orders to go swap them for quick picks. At least it was an even swap. I hate paying that stupid tax!

Also had a bit of fun just before lunch. An obviously low-information, dyed-in-the-wool, old fart (probably about my age) DIMocrat that either had never seen the Internet or anything outside the MSM came over to me while we were waiting to get our cars’ oil changed and worked the conversation around to tell me The Steal wasn’t real, the “insurrectionists” carried ARs and pistols into our capitol building and how ridiculous it was for his kids, who evidently were telling him the same things I was, to have 30 guns when he had none and didn’t need one. I told him not to worry because in West Texas that was just a starter set. He also raved on about Trump not paying taxes so I asked him if he ever took a deduction to which he had to admit that he did. Every DIMocrat I know is basically on this level (which includes my wife’s boss) and I sure hope they can’t find their way to a polling booth.

https://youtu.be/DU9qCEjNxH8

See this is the kind of stuff you hear at every restaurant or coffee house.

https://youtu.be/DU9qCEjNxH8

anyone could become president..just change their name to NONE OFTHE ABOVE.. you don’t even have to make signs or debate a thing..